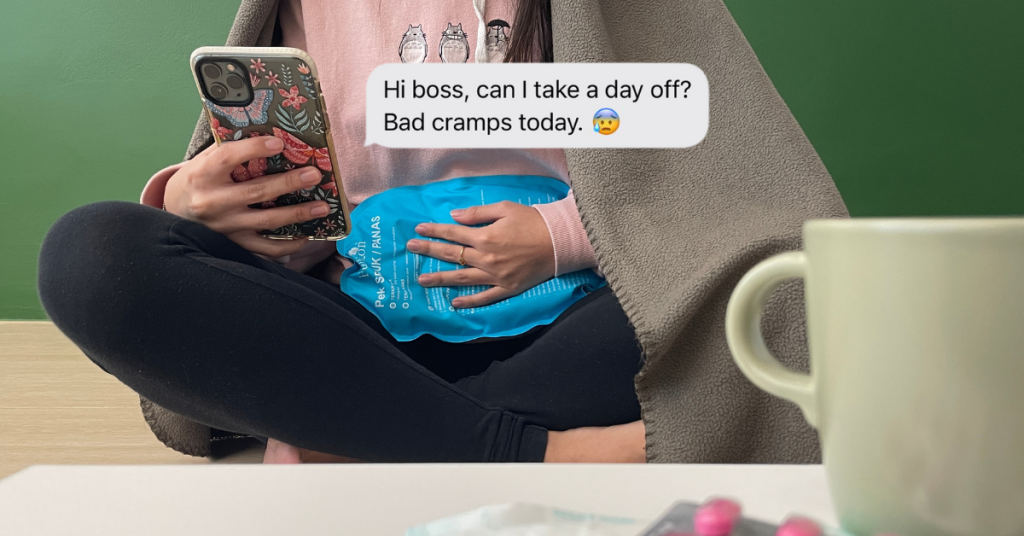

[Have Your Say] Should companies in Malaysia offer menstrual leaves and benefits?

Last month, Spain became the first European nation to legislate menstrual leaves for women in the workforce. They’re entitled to five days of paid menstrual leave every month, which will be subsidised by the government.

Globally though, the topic of companies providing menstrual benefits to its employees has been the talk of the town, especially over the past year.

These benefits include paid menstrual leaves, the option to work from home, and flexible working hours.

The rising interest in menstrual benefits also comes from an increased awareness of menstrual struggles, including period pain.

The National Health Service in the UK states that period pain (medically termed as dysmenorrhoea) is usually felt as “painful muscle cramps” in the lower abdomen which can spread to the back and thighs.

The pain varies depending on the individual. For some people, it can be mild, but for others it can be more severe.

It’s estimated that dysmenorrhoea affects 80% of women in the Malaysian workforce.

While dubbed as a common occurrence, period pain can be caused by more serious underlying conditions, such as endometriosis, fibroids, and polycystic ovary syndrome (PCOS).

A study published in 2019 found that 14% of respondents had taken time off from work or school during their periods. And despite feeling unwell, 80% of the research subjects continued studying or working, but felt that the pain made them less productive.

We want your thoughts: to provide or not to provide?

This brings us to the next query—do people in the Malaysian labour force believe that employers should have menstrual benefit policies to help ease those in pain?

It’s a tough question with many variations of answers. Maybe you think it’s a good step to take but have your own reservations. Maybe you don’t think it’s necessary and might increase the gaps in gender equality.

We at Vulcan Post would like to hear what you would have to say on this topic of companies in Malaysia providing menstrual leaves and benefits to employees, so we’ve created a survey. You can take the survey here or at the bottom of his article.

Once we’ve compiled your opinions, we’ll be writing another piece to share our findings with you.

- Share your thoughts on this in our survey here.

Also read: Navigate hybrid work’s pain points like productivity & security issues via this webinar

Featured Image Credit: Vulcan Post

11 interesting, lesser-known features to help maximise your Samsung Galaxy S23 Ultra usage

With the Samsung Galaxy S23 Ultra being such a powerhouse thanks to a new Snapdragon 8 Gen 2 chip and a 5,000mAh battery, you’d want to get the most out of your purchase.

Realistically, there are probably well over 100 tips and tricks to maximise your usage of the S23 Ultra, though not all of them are necessarily that useful, new, or interesting.

After tinkering around, we’ve shortlisted 11 specific tips and tricks to access lesser-known or hidden features on your new phone.

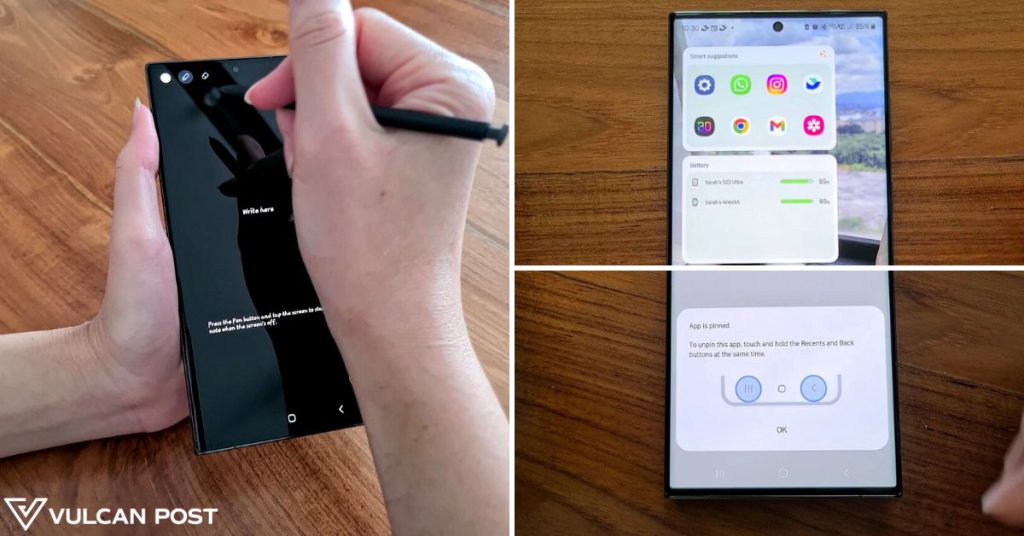

1. Widget customisation: see info you need from different apps at a glance

Customisation is a big part of the Android experience, and you’re missing out if you think it’s nothing special. (I’m talking about myself, prior to finding out about this feature for this article…)

A long press on your home screen will bring up customisation options, where you can choose to add several widgets to the home screen.

Basically, a widget is a component of an app. For example, in your Clock app, you can set a timer, alarm, or check the time. Each one of these features can be a widget offered by your phone.

So, if I were to add a timer widget to my home screen, this means I can set a timer faster and easier, without having to first go into the Clock app.

Widget customisation on the S23 Ultra also allows you to access your most frequently used apps faster, and see the battery levels of your phone and other accessories at a glance.

2. Dolby Surround Sound: have better audio for apps and games

Known for its surround sound and spatial audio technology, Dolby Atmos is widely used across cinemas and home TV systems worldwide.

If you’re a sucker for good audio, then it’s likely that you’d want to enjoy the same on your phone. You can apply this feature to all your audio, or selectively apply it to just videos, music, gaming, and more.

3. Maximum screen resolution: see everything on your screen with more clarity

Warning: once you turn this on, you may never want to go back to the default screen resolution. By default, your S23 Ultra is on FHD+ resolution (2316 x 1080), and the maximum resolution is WQHD+ (3088 x 1440).

It definitely will eat up your battery faster, but in theory, the S23 Ultra’s 5,000mAh battery should still give you at least a work day’s worth of use on this setting.

4. Video auto tracking: keep your subject in focus when recording

This one’s pretty self-explanatory, and is activated in your Camera app settings. Say if you’re filming your pet doing something, or if you’re panning your camera around a bit but want a specific object to stay in focus, this feature should come in handy.

Just turn on the setting and tap on your object of focus, and you should be seeing results.

5. Extract text: “copy” words on a piece of paper and “paste” it in Samsung Notes

For this, you’d need to have Samsung Keyboard as your default, as it cannot be found on other keyboards.

Click on the three dots in the upper right corner of your keyboard, and you’ll see the feature. Using your phone camera, the software identifies words it’s detecting from a piece of paper, a sign, or anything else, and pastes them into your Samsung Notes.

It’s supposed to be a more convenient way to take down notes without actually typing anything, but it’s far from perfect.

If the text it’s trying to identify isn’t very legible or written in bad handwriting, your notes can become a confusing mess. In a pinch though, it could still be better than nothing.

6. Pin an app: restrict someone else’s usage of your phone to only a specific app

To those paranoid about people going through their phone when passing it around to look at something, this security feature will come in handy.

Found in the Advanced Settings section of your phone, activating this means that you can restrict someone from exploring other apps in your phone.

For example, if I pin the YouTube app and hand my phone to someone else, they cannot leave the app to go through my messages or pictures.

Unpinning an app can only be done through inputting your PIN code for your phone.

7. Object eraser tool: remove unwanted objects from your photos

Warp reality with the tap of your finger—that random piece of trash on your floor in the nice selfie you took? Gone. A photobombing tourist in the distance when you’re trying to capture a cultural landmark? Gone.

It’s another feature that isn’t perfect and is best used on small objects against a less noisy background, so that the software can fill up the void more convincingly.

If you want a job well done, you’d probably have to seek out more professional software, but this gets the necessary done faster.

8. Screen off memo: write fast notes with the S Pen without unlocking your phone

When your phone is locked and you pull out the S Pen, Screen off memo will automatically trigger. It can be toggled in your settings.

With it on, you don’t have to click any buttons or swipe anything, just pull out the S Pen and start scribbling on your screen, just like how you would with Samsung Notes.

If your S Pen is already out and you want to use Screen off memo, press and hold the button to activate it.

9. Pause USB power delivery: charge up your phone while gaming without heat building up

This setting allows you to bypass charging the battery when you’re gaming, so that your phone doesn’t overheat and reduce performance, which also avoids battery degradation in the long run.

When in a game and running low on battery, plug in your charging cable and turn on the charger, click on Game Booster (usually around the corners of your screen, near the tray, home, and back buttons), and you’ll find this feature in its settings.

10. Hide status bar: take screenshots that don’t reveal phone information

As someone who usually has to take screenshots to put into articles, an annoying part of that routine has always been perfectly cropping out the status bar at the top of my phone, since it looks messy.

With this setting activated in Advanced Features, this is a worry of the past.

11. Set multiple timers: run up to five timers at a go

So, you’re waiting for the laundry to be done, cooking some Maggi, and trying to catch a livestream countdown all at once.

Instead of picking one thing to set a timer for, you can set timers for all of them, and they’ll run concurrently.

To activate this, you must have at least one timer already running, then just add more (up to five) with the + button on the upper right corner. Each one can be independently paused and deleted.

- Learn more about the Samsung Galaxy S23 Ultra here.

- Read more of our reviews about the S23 Ultra here.

Also Read: Navigate hybrid work’s pain points like productivity & security issues via this webinar

Navigate hybrid work’s pain points like productivity & security issues via this webinar

[This is a sponsored article with Dell.]

At Vulcan Post, we’re no strangers to hybrid work. We’ve implemented a company-wide WFH day once a week, and have even experimented with the glorified four-day work week for a month.

Research from late 2021 found that 80% of Malaysian employees prefer to WFH weekly, with almost half preferring to do so at least three days a week. The same is reflected in Singapore as well, with eight in 10 workers favouring flexible working arrangements.

From our own experience, we’ve come to realise that there is no “one size fits all” approach to hybrid work practices.

Depending on the industry, work processes, company size, and many other factors, hybrid work can be implemented in different ways and at various capacities.

However, regardless of the frequency or arrangements of working remotely, there are common concerns across the board, which include difficulties in upholding team-based collaboration, maintaining company productivity, and protecting data security.

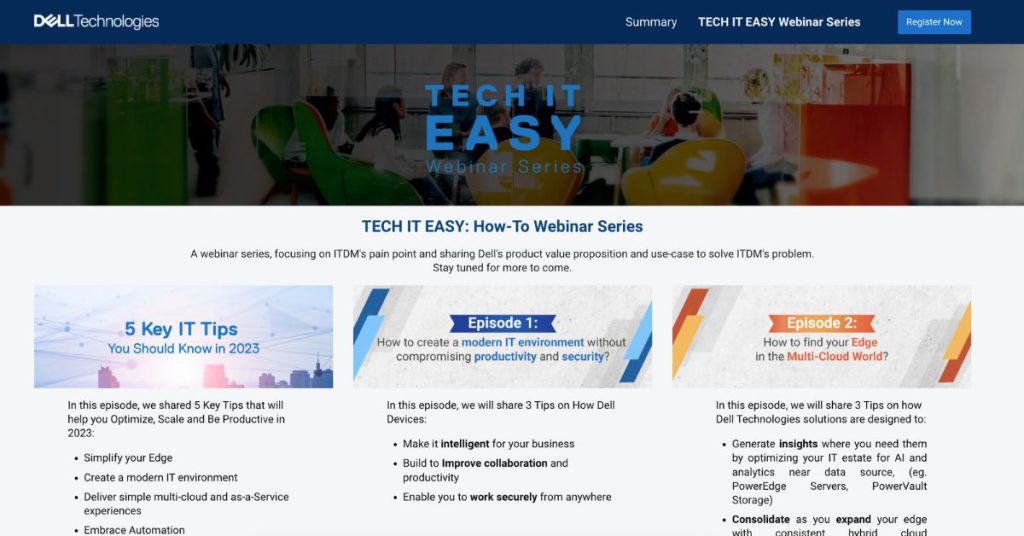

To help navigate these pain points, Dell Technologies (Dell) rolled out their Tech IT Easy Webinar Series.

So far, they’ve kicked off the programme on January 11 with a talk on “5 Key IT Tips You Should Know in 2023”, with “you” being the decision-makers in companies.

With the next webinar session happening on March 30, 2023, here’s what you can expect when attending the free 40-minute talk, and the following ones.

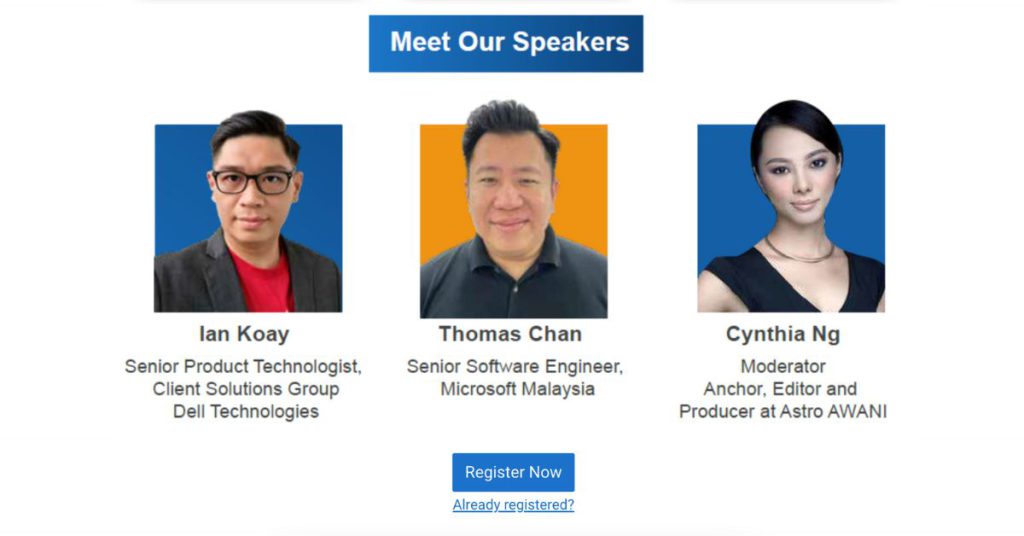

The first episode will be moderated by Cynthia Ng, who’s an anchor, editor, and producer from Astro AWANI, and will feature Ian Koay, the Senior Product Technologist from Dell’s Client Solutions Group, alongside Thomas Chan, a Commercial Master Trainer from Microsoft Malaysia.

Solutions to maintain employee productivity while hybrid working

Episode 1 of the Tech IT Easy Webinar Series is titled, “How companies can create a modern IT environment without compromising productivity and security”.

To help companies adopt hybrid working styles easier, this episode is set to address the challenges and proposed solutions for how employee productivity can be better managed when hybrid working.

For example, current employee management tools seem to be focused on tracking workers’ time on screen to measure productivity. But these systems can leave them feeling invaded rather than empowered.

So, are there better tools available to help managers improve employee productivity, and build trust at the same time? This is just one of the issues Episode 1 intends to explore.

Understanding the security challenges that come with working on the cloud

Furthermore, the webinar will discuss overcoming security and privacy threats surrounding hybrid work.

It’s inevitable that companies will move more processes to the cloud, as it’s an efficient way for an organisation to streamline their operations, scale and adapt faster, and maybe even reduce costs in the long run.

But this is a transformation that can impact data security in an organisation, if not executed knowledgeably.

One suggestion that was touched on in the previous webinar was for companies to develop proper strategies on how to upload their data to cloud systems.

In addition, managers must educate their employees in using the tools in place for hybrid work. This not only equips staff members with the necessary resources to work off-site, but it will also help maintain the company’s data security.

Episode 1 will explore more potential security challenges that come with hybrid working, and how those can be overcome.

Creating the right infrastructure for hybrid working

As part of implementing an effective hybrid working environment, companies also need to have the right infrastructure.

The webinar will also share tips on the kinds of Dell devices companies can leverage to improve their collaboration and productivity, while working securely no matter the location.

If you’re looking to gain more insights into how all this can be done, you can register for the Tech IT Easy Webinar Series Episode 1 here.

At the end of the day, each company has their own set of needs, and will need to find a hybrid working style that can accommodate their processes and employees.

Of course, for that to happen, employers must be willing to try new ideas and embrace change. While it can be a challenging journey, there is support available in many forms, with one example being Dell’s webinar.

- Sign up for the free Tech IT Easy Webinar Series Episode 1 here.

- Read about other Malaysian startups here.

Also Read: ZCOVA expands to offer lab-grown diamonds with a message that “if you want it, then get it”

Featured Image Credit: Vulcan Post

Credit Suisse turmoil sends ripples across banking sector, but MAS assures stability

The Monetary Authority of Singapore (MAS) announced yesterday (March 16) that it has been in close contact with the Swiss Financial Market Supervisory Authority (FINMA), the parent supervisory authority of Credit Suisse, on recent developments surrounding the bank.

The Credit Suisse branch in Singapore has its main activities in private banking and investment banking, and does not serve retail customers.

FINMA and the Swiss National Bank (SNB) have also issued a joint statement on Wednesday (March 15) affirming that Credit Suisse continues to meet the higher capital and liquidity requirements applicable to Swiss systemically important banks.

Amidst fears of a wider financial crisis, MAS assured that Singapore’s banking system remains “sound and resilient”.

The banks in Singapore are well-capitalised, and undergo regular stress tests against credit and other risks. Their liquidity positions are healthy, underpinned by a stable and diversified funding base, added MAS.

These banks have also confirmed that their exposures to Credit Suisse are insignificant. However, following the string of United States bank failures as well as fears of a wider financial crisis, the stocks of Singapore banks have slumped yesterday.

Credit Suisse saw its shares plunge more than 30 percent

Credit Suisse, the second largest bank in Switzerland, saw its shares plunge more than 30 per cent after Ammar al-Khudairy, chairman of its largest shareholder, Saudi National Bank, said that it would not buy more shares in the Swiss bank on regulatory grounds.

Prices on Credit Suisse’s bonds also fell to distressed levels, indicating that investors were pricing in the possibility the bank could default.

However, the shares of the bank bounced back as much as 40 per cent the following day (March 16) in early Zurich trading after it managed to secure a loan amounting 50 billion Swiss Franc (S$72.52 billion) from SNB.

Credit Suisse is one of the 30 global financial institutions that are deemed to be “too big to fail”, and is designated as The sudden collapse of Silicon Valley Bank: How did it happen, and is S’pore affected?

Automate mundane tasks: Microsoft unveils AI-powered Copilot to Word, Excel, Outlook and more

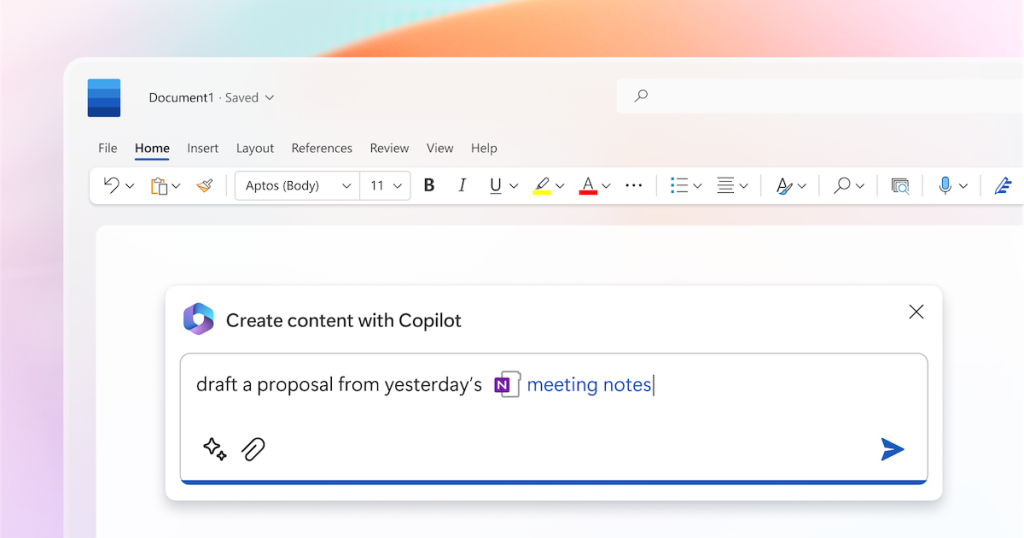

Microsoft has unveiled the latest innovation in productivity, its AI-powered Microsoft 365 Copilot.

The system uses large language models to augment the user’s data in Microsoft 365 apps to generate content that helps the user be more productive, creative, and efficient.

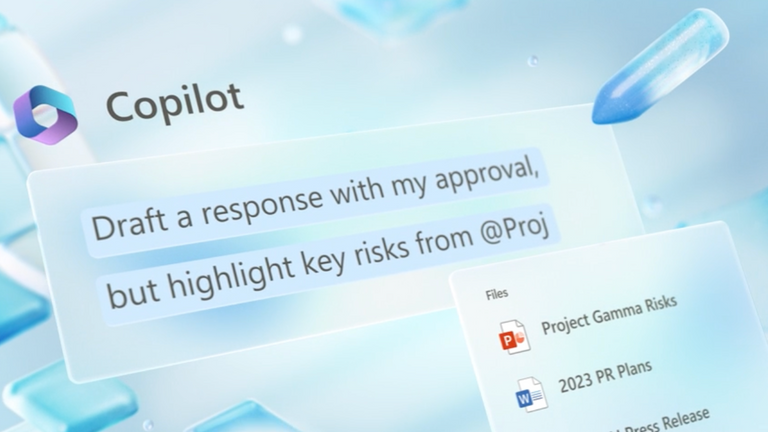

Copilot is integrated into Word, Excel, PowerPoint, Outlook, Teams, and other Microsoft 365 apps. It also features a Business Chat feature that uses natural language prompts to automate tasks across the Microsoft Graph and Microsoft 365 apps.

For instance, you can give it prompts like “Tell my team how we updated the product strategy,” and it will generate a status update based on the morning’s meetings, emails and chat threads.

“Today marks the next major step in the evolution of how we interact with computing, which will fundamentally change the way we work and unlock a new wave of productivity growth,” said Satya Nadella, Chairman and CEO, Microsoft. “With our new copilot for work, we’re giving people more agency and making technology more accessible through the most universal interface — natural language.”

What exactly does Copilot do?

The system aims to unlock productivity by reducing the amount of busywork users have to complete.

The AI-powered language model is expected to unleash creativity by jumpstarting the creative process with pre-existing content.

Copilot in Word allows users to freely edit and iterate on this content, creating and prompting Copilot to shorten, rewrite, or give feedback as needed. Copilot in PowerPoint helps create beautiful presentations using content from documents created weeks or even years ago. Just type in whatever you’d like — the number of slides, the styling, the content — and it will automatically generate it for you.

Copilot in Excel can analyse trends and produce professional-looking data visualisations in seconds. Meanwhile, Copilot in Outlook can summarise long email threads and quickly draft suggested replies, allowing users to clear their inbox in minutes instead of hours.

Additionally, Copilot in Teams can summarise meeting discussion points, indicate areas of agreement or disagreement, and suggest action items in real-time during the meeting. Copilot in Power Platform can help automate repetitive tasks, create chatbots, and produce working apps in minutes.

According to GitHub data, developers who use Copilot are 88 per cent more productive, 74 per cent able to focus on more satisfying work, and 77 per cent able to spend less time searching for information or examples.

Copilot also provides a new knowledge model for organisations, harnessing the massive reservoir of data and insights that are largely untapped today.

Business Chat can surface information and insights across all business data and apps, helping users save time searching for answers. Business Chat is accessible from Microsoft 365.com, Bing when the user is signed in with their work account, or from Teams.

This AI-powered language model works behind the scenes, combining the power of large language models, such as GPT-4, with Microsoft 365 apps and business data in the Microsoft Graph. Copilot is more than just OpenAI’s ChatGPT embedded into Microsoft 365.

Shaping the future of work with AI

As with any new pattern of work, there will be a learning curve, but those who embrace this new way of working will quickly gain an edge. Nadella noted that the Copilot system would fundamentally change how people work with AI and how AI works with people.

Microsoft’s Copilot AI-powered language model marks a major step in how people interact with computing, which will fundamentally change the way people work and unlock a new wave of productivity growth.

It aims to unlock creativity, uplevel skills, and reduce busywork, providing a new knowledge model for organisations by harnessing the massive reservoir of data and insights that are largely untapped today.

The enterprise sector can easily benefit from Microsoft’s solution, as it addresses a critical issue that ChatGPT users previously faced: the difficulty of obtaining context from various business documents.

Furthermore, any prompt that functions in Excel, Powerpoint, or other applications can now be utilised directly from Copilot. As such, Copilot will serve as the go-to starting point for any knowledge-based work, marking the true start of AI’s integration into the workplace.

Featured Image Credit: Microsoft

Also Read: Google to Baidu: Tech giants are creating own ChatGPT versions, but will they make a difference?

5 programmes backed by Penang’s govt that startups in the state should take advantage of

[Written in partnership with Digital Penang but the editorial team had full control over the content.]

Where do you build your network, when do you pitch your ideas, and how do you raise funds?

These are all nagging questions that every budding entrepreneur would have had before. There’s no one-size-fits-all answer to them though, as solutions can vary depending on what you and your startup need.

That’s a whole other thing to navigate. Understanding this, Digital Penang, a government-linked company (GLC) owned by the state of Penang for digitalisation efforts, wants to help bridge that knowledge gap with these five upcoming events.

1. To build up budding entrepreneurs – IdeaPesta 2023

Open to universities and colleges in the northern region, this programme allows participants to collaborate with corporate entities and Digital Penang.

The goal is to encourage technological ideation and innovation at the university level and build up budding entrepreneurs with the support of private companies.

There are several cohorts within a year, where participants will undergo two stages—ideation development, and pitch day.

Each challenge winner is then shortlisted for the Founders’ Grit Seed Programme and has the chance to intern with corporate partners. This helps with talent and network building that can be useful in future endeavours.

Universities and colleges that partner with Digital Penang for this programme will also receive RM10,000 sponsorship funds.

Participation criteria:

- Student or lecturer

- Be currently in the field of engineering, IT, computer science, or business administration

Registration details: This programme is free of charge for participants.

Registration timeline: The deadline for the programme will be arranged by the participating universities. It will be based on the selected semester that the programme is launched internally on campus.

2. To help entrepreneurs build an MVP – TechStarsStartup Weekend Penang

Digital Penang is also collaborating with Techstars, one of the largest international pre-seed investors, to bring the first ever TechStarsStartup Weekend in Penang.

This bootcamp programme will allow participants to match with potential technical or business co-founders to build a venture together in 54 hours.

Participants will get the chance to be closer with experienced mentors from the tech industry and receive coaching.

You can expect to see well-known names in the tech scene like Daniel Cerventus Lim at the event, who also recently hosted at the BIZ Gear UP! business conference last month.

On the other hand, Techstars has produced resilient startups like DigitalOcean, Zipline, and SendGrid.

This programme’s goal is to aid entrepreneurs in creating a minimum viable product (MVP). They’re also planning to reach out to other organisations connected to youth entrepreneurship.

Participation criteria:

- Young adults (preferably students from universities, colleges, and vocational institutions) who aspire to be the next generation tech entrepreneurs

- Be dedicated, passionate, and enthusiastic about building a startup in the tech industry

Registration details: N/A

Registration timeline: At the moment, this programme is still a work in progress. There will be more information shared closer to its launch date at the end of May 2023.

3. To help founders find mentors – Founder Institute FI Core

This is another programme that helps Penang-based tech startups and entrepreneurs develop their ventures while receiving experienced mentoring.

In collaboration with Founder Institute, this programme aims to help Malaysian tech startups grow on a global scale. It can be quite challenging as participants will be working with local and international mentors, as well as Silicon Valley experts.

The partnering company has a proven track record of building up aspiring entrepreneurs in terms of skills and funding. This includes startups like Udemy, Involve.AI, and Malaysia’s own Aonic (formerly known as Poladrone), which raised USD4.29 million in October 2021.

This is not to say that the programme comes with guaranteed funding. Rather, it assists startups in preparing to get funding.

However, unlike TechStarsStartup Weekend Penang, the commitment period is much longer. The Founder Institute FI Core is a virtual programme that lasts for 14 weeks and will have two stages—launch and growth.

Participation criteria:

- Tech startups based in Penang

- Participants will have to go through two assessments to qualify. First a psychometric test, then an assessment by the programme’s directors. Only those who pass both will be enrolled into the programme.

Registration details:

- Early bird registration ends on March 19, 2023 is fixed at US$399

- Normal registration past March 19, 2023 is fixed at US$499

Registration timeline: The programme is already open for registrations and will officially close on April 16, 2023

4. To match young startups with angel investors – Pitch Island

In this programme, young startups in the early stages of raising funds (between RM50,000 to RM350,000) will have the opportunity to match up with angel investors from Penang.

The pitch session will be based on tech verticals on the following dates:

| Dates | Tech verticals |

| April 29, 2023 | Creative Content, Web3, and Blockchain |

| June 17, 2023 | EduTech Startups |

| August 26, 2023 | IoT, HardTech and DeepTech |

| October 28, 2023 | Cloud, SAAS and E-Commerce Startups |

| December 16, 2023 | SMEs and Micro SMEs |

This pilot programme aims to address the early-stage funding gap for startups in Penang, as well as to build the angel investment landscape in the state.

Participants can expect to gain quality feedback from established angel investors to further grow their startups, improve pitching skills, and hopefully secure an investment interest.

Participation criteria:

- Tech startups based in Penang

- Have a minimum of two founders in the venture

- Revenue is below RM150,000 as of FYE2022

- Venture must be on the specific technology vertical based on the event session vertical being held (e.g., If that particular session is about EdTech, then only EdTech companies can pitch)

Registration details: This programme is free of charge for participants. However, do note that there will be a deadline for startups to submit their pitch deck.

Registration timeline: At the moment, this programme is still a work in progress. There will be more information shared closer to its launch date which is yet to be determined.

5. To get stakeholders to mingle – Founders’ Meetup

Previously known as the Coffee and Curry Puff event, this monthly meeting has been gathering experienced founders, investors, mentors, and other stakeholders to share their experiences.

This year, Digital Penang will be running a Ramadhan Special with two events.

The first is titled “Technology Empowerment” and will happen on March 30, 2023, starring CC Leong from My.minda and William from Twilight Foundry. The second on April 27, 2023, is titled “From Dropout to Startup Founder” and stars Thiruvengadam from Buidl Studio.

The programme is open to startup founders and the public alike, with just one catch: you should be keen about tech entrepreneurship.

It’s essentially another networking/sharing session that touches on best practices, basic skills, raising funds, and overcoming challenges. This helps shape the right perspective of budding entrepreneurs about the reality of tech entrepreneurism in Malaysia.

Participation criteria:

- Anyone interested in tech startups and entrepreneurship

Registration details: This programme is free of charge for participants.

Registration timeline: This programme happens on a monthly basis. Interested participants can find more information about upcoming events here.

-//-

If you’re a newcomer to the scene, joining such programmes may appear intimidating, but if it’s of any comfort to you, many of the other participants might also be in the same boat.

Plus, with so many of them being free to join, there’s no harm in finding the programme that best suits you and going for it. After all, where opportunity presents itself, will you regret taking it up, or will you regret not taking it up?

Also Read: 6 ways to manage and protect your precious banking access from online hacks or scams

Featured Image Credit: Digital Penang

How the collapse of Silicon Valley Bank has and will affect the M’sian startup ecosystem

If you’ve been reading the news lately, you might have come across the terms “Silicon Valley Bank” and “collapse” quite a few times.

But for those who haven’t, here’s what happened.

In summary, customers grew concerned over Silicon Valley Bank’s (SVB) financial position as the bank had been buying a lot of assets that were no longer worth the price the bank had paid for them.

This came to a head on March 10 when the bank experienced a flood of deposit withdrawal requests (US$42 billion’s worth). SVB was unable to raise the cash needed for this, which led to its subsequent failure.

This is the textbook definition of a bank run.

Dictionary time: A bank run is when a large number of customers of a bank or other financial institution withdraw their deposits at the same time over fears about the bank’s solvency.

This led to the Federal Deposit Insurance Corporation (FDIC)—equivalent to Perbadanan Insurans Deposit Malaysia (PIDM) in Malaysia—to assume control over the bank.

To further understand the severity of the situation and whether Malaysians should be worried, we spoke to two experts—Justin Lim, the investment principle at Nexea, and Nicholas Chong, president at Impact Consulting Kuala Lumpur.

What exactly was the problem?

To Justin, there are three issues with SVB—customer concentration, risk management, and asset liability management.

The first issue relates to the fact that SVB had a large concentration of depositors of the same category—that is, Silicon Valley startups.

As for its risk management, Justin pointed out that SVB had sizeable unhedged interest rate positions. Lastly, he believes SVB’s asset side of the balance sheet was not designed to meet the liquidity demands of the deposit withdrawals.

While there might be many in Malaysia who are unfamiliar with the bank and thus think it’s not a big deal, SVB is actually among the top 20 largest banks in the United States.

Furthermore, a lot of the tech startups in Silicon Valley relied on SVB as their primary bank. Due to the collapse, these startups were suddenly unable to access their money, leading to many other issues for them.

The US Federal Reserve has now set up an emergency lending facility to stem the risk of contagion.

Yet, despite this, SVB’s collapse has sent jitters across the globe.

The shot heard around the world—including Malaysia

While SVB depositors were the most affected by this collapse, the incident’s impacts extends beyond that, causing shockwaves across the market.

“Investors and other startups that were not depositors of SVB were also trying to assess their exposure to the banks,” Nicholas pointed out. “Are their investors exposed? Are their suppliers affected? Would the banks follow suit?”

He continued, “Markets in Malaysia have definitely reacted, especially bank stocks. However, this is likely a knee-jerk reaction from fear of a systemic contagion.”

From what Justin sees, though, the local startup scene is unaffected by this.

“As for NEXEA, it is business as usual—busy building the ecosystem with Cradle in the MyStartup accelerator,” he commented.

Are the worries justified?

Both Justin and Nicholas think it’s very unlikely we’ll see similar incidents in Malaysia.

“Malaysian banks are highly regulated by BNM, and they are likely to have much better risk management practices compared to SVB,” he assured.

Deputy finance minister Steven Sim has also spoken up and said that an assessment made by local financial authorities have affirmed that Malaysia’s banking system remains competitive and resilient.

Banks are one thing—what about the sentiments of those in the startup ecosystem? Has it caught the contagion?

“I also know of several startups in Malaysia who were concerned about indirect exposures to SVB, potentially through their investors or via systemic contagion,” he said. “Fortunately, the impact to Malaysia seems to be largely muted, aside from some market jitteriness.”

Comparing it to the Lehman Brothers’ bankruptcy that played a hand in the 2008 financial crisis—a comparison many have been doing—SVB’s crash seems to be much more contained.

As Nicholas put it, SVB’s collapse appears to be idiosyncratic in nature and not an indicator of a larger, brewing matter.

Justin believes that unless they have been invested in by a US institution, it is unlikely that startups in Malaysia will be affected.

“Other than the risk of a regional late-stage funding slowdown, we don’t expect any effect on Malaysian early-stage startups,” Justin added. “After all, the majority of Malaysia’s venture funding comes from local institutions and individuals.”

“If anything, South East Asia’s boring but stable banking regime highlights the benefits of good regulation.”

Lessons to learn

Both Justin and Nicholas seem to be rather optimistic about the situation. It might be true that the Malaysian landscape remains stable, but there are those in the West speculating that this will have repercussions for years to come, specifically in the tech startup sector.

For one, prominent startup accelerator Y Combinator has been very vocal about the collapse. Its CEO Garry Tan tweeted that 30% of SVB depositors will be at risk of not being able to make payroll and has thus started a petition calling on the US Congress to act on the collapse.

According to SVB’s own website, 11 of 15 Y Combinator startups with IPOs bank with SVB. Not only that, seven of those began with SVB Startup Banking.

For context, Y Combinator has supported Malaysian companies such as Durioo and Pandai.

In any case, there must be lessons to gain from this happening. Some have drawn a parallel between SVB’s crash to what might happen to Malaysia’s EPF should it be unable to liquidate. Others think it shows the fickleness of crypto.

Perhaps, this occasion also highlights the importance of trusting home banks, and why home banks should also do more to support our local startup ecosystem.

And for the everyday person—this is also a good reminder not to put all your eggs (and investments) in one basket.

- Read other articles we’ve written about Malaysian startups here.

Also Read: 6 ways to manage and protect your precious banking access from online hacks or scams

Featured Image Credit: Silicon Valley Bank / Wiki Commons