Make seamless MAE payments at these 4 Cambodian destinations you NEED to visit in 2025

[This is a sponsored article with Maybank.]

Looking for an adventure that takes you through ancient cultures and time-persevering architecture?

Cambodia awaits.

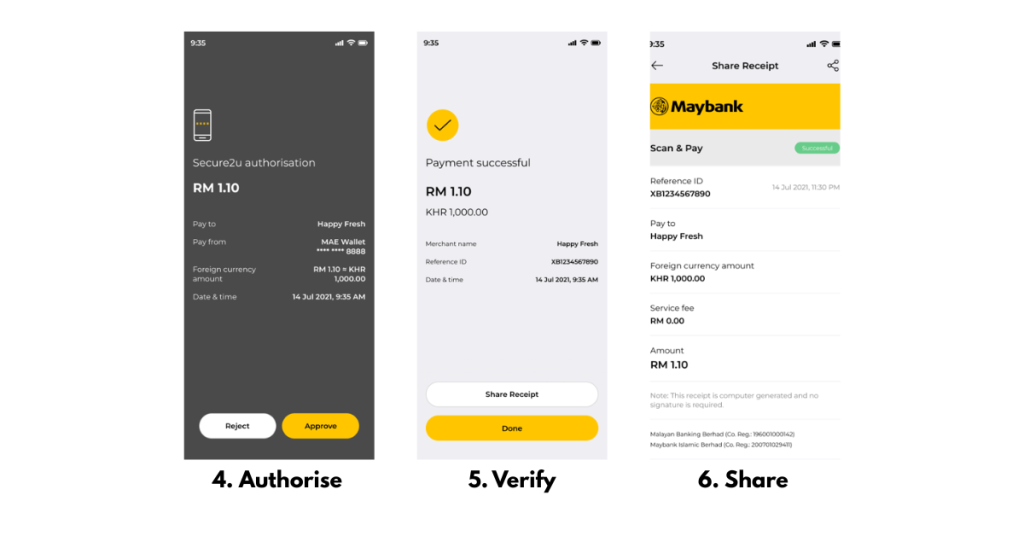

From the stone temples of Angkor Wat to the idyllic paradise of Koh Rong Island, this enchanting kingdom offers travelers a chance to revisit old history and reconnect with nature, supported by warm Cambodian hospitality.

With visa-free access for Malaysian passport holders and direct flights from Kuala Lumpur to major Cambodian cities, there’s never been a better time to explore this underrated Southeast Asian gem.

If you’re worried about dealing with the tiresome cash exchange process, however, fret not for you can now streamline your transactions with Maybank.

Through the MAE app, users can now make QR payments seamlessly by simply scanning the displayed KHQR code, just like making DuitNow QR transactions here in Malaysia.

Offering instant conversions and zero hidden charges, Maybank gives users the chance to skip the cash exchange process, allowing you to focus on the “experience” part of your adventure.

And with these four shining gems up for your viewing, you’ll want all the time you can get.

1. Angkor Wat

Rising from the jungles of Siem Reap, Angkor Wat is the crown jewel of Cambodia and a must-visit for any traveller.

As the largest religious monument in the world, this 12th-century temple complex and UNESCO World Heritage Site is a breathtaking blend of spiritual serenity and architectural grandeur. Angkor Wat tells stories carved in stone, with intricate bas-reliefs and majestic galleries that reveal centuries of Khmer history and mythology.

Dictionary time: Khmer refers to the ethnolinguistic group that makes up the majority of Cambodia’s population.

Arrive at sunrise to witness golden light spilling over its iconic lotus-shaped towers, an unforgettable moment for photographers and spiritual seekers alike.

Originally built as a Hindu temple and later transformed into a Buddhist sanctuary, its labyrinthine corridors and towering spires will make you feel like you’ve stepped back in time.

Best time to visit: November to March

Travel tip: Book a guide! Angkor Wat is an extensive complex with over 100 ancient temples and ruins, making it easy to miss key locations and interesting facts.

2. Siem Reap

Heading back to the present, Siem Reap is more than just a gateway to Angkor Wat, it’s a vibrant city that blends ancient wonder with modern charm.

This lively hub in northwestern Cambodia welcomes travellers with gracious hospitality, colourful markets, and a rich cultural scene.

By day, explore centuries-old temples and peaceful rice paddies; by night, dive into the energy of Pub Street, where street food, live music, and busy night markets create a festive atmosphere.

Siem Reap also offers authentic cultural experiences, from Apsara dance performances to hands-on Khmer cooking classes and much more. Whether you’re riding a tuk-tuk through village roads or browsing handmade crafts at the Old Market, the city delivers an unforgettable mix of tradition and adventure.

With a wide range of accommodations—from budget-friendly hostels to luxury resorts—Siem Reap is perfect for every kind of traveller. It’s a place where Cambodia’s soul comes alive, just waiting to be explored.

Best time to visit: November to March

Travel Tip: For those interested in the night scene, you can choose to stay near the lively Pub Street and get around easily. But if you’re someone who appreciates a quiet night in, try scouting out accommodations in the Wat Bo area.

3. Phnom Penh

Southward, across Tonlé Sap, the largest freshwater lake in Southeast Asia, lies Cambodia’s bustling capital, Phnom Penh, a city where the past and present converge into a cultural metropolis.

Set along the banks of the Mekong and Tonlé Sap rivers, the capital offers a riveting blend of ancient Khmer heritage, French influence from the colonial period, and contemporary urban culture.

History comes alive at the Royal Palace and Silver Pagoda, while the haunting Tuol Sleng Genocide Museum and Killing Fields provide sobering insight into Cambodia’s recent past.

Returning to the present, explore vibrant local markets like the Russian Market, unwind at riverside cafes, or explore the emerging art scene that spans street art to galleries.

Whether you’re seeking culture, cuisine, or contemporary city vibes, Phnom Penh offers travelers a city filled with opportunities and warm smiles.

Best time to visit: Mid-April for Khmer New Year or October/November for the Water Festival

Travel Tip: When travelling around this area, consider using ride-hailing apps like Grab or PassApp, especially at night.

4. Koh Rong Island

If you’re looking for something a little serene, however, Cambodia’s tropical paradise, Koh Rong Island, serves as an ideal hideout from the bustle.

Located off the coast of Sihanoukville, this stunning island boasts powdery white-sand beaches, crystal-clear turquoise waters, and a laid-back atmosphere that invites total relaxation.

Whether you’re lounging on the quiet shores of Long Set Beach, snorkeling among vibrant coral reefs, or exploring lush jungle trails, Koh Rong offers an escape from the everyday.

As the sun sets, witness bioluminescent plankton light up the shallow waters, making for an unforgettable night swim straight out of James Cameron’s Avatar.

With limited development and an unspoilt charm, Koh Rong offers the perfect destination for those looking to reset and reconnect with nature.

Best time to visit: Mid-November to early May

Travel Tip: While these pristine beaches aren’t worth missing, beware of potential sandflies. You may want to keep some coconut oil on hand for protection.

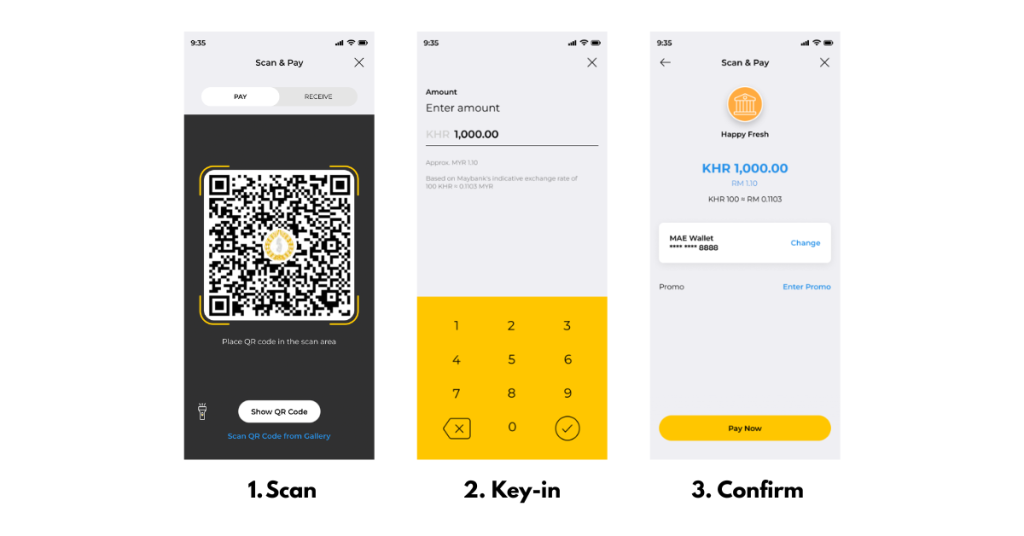

How to use Cross-border QR

By simply scanning the merchant’s KHQR code at these hot spots and putting in the amount in Cambodian Riel, you can quickly see how much you would be spending in Malaysian Ringgit, before confirming your payment.

And good news—this convenience extends beyond Cambodia. Maybank also offers this Cross-border DuitNow QR service in Singapore, Thailand, and Indonesia too.

Simply look out for these banks’ QR codes and take that hassle-free getaway across Southeast Asia, sans currency exchange.

| Country | QR Code |

|---|---|

| Singapore | |

| Thailand | |

| Indonesia | |

| Cambodia |

- Learn more about Maybank’s Cross-border DuitNow QR service here.

Also Read: This biz helps brands in M’sia reach cities & kampungs with its 38k+ retail network

Featured Image Credit: Cambodia Facebook

6 ways to manage and protect your precious banking access from online hacks or scams

[This is a sponsored article with Maybank.]

Bank fraud has become more prominent. In the first seven months of 2022, Malaysians lost about RM415 million to scammers.

As a response, Bank Negara Malaysia (BNM) is urging banks to implement measures to combat online scams by June 2023.

But these safety measures by banks must go hand-in-hand with our own awareness and practices when online banking.

So, how can we safeguard ourselves against fraud?

Maybank had us highlight six ways you can protect your bank accounts from online scams, and how you can utilise the bank’s security features to do so.

1. Steer clear of using public WiFi and public computers

Public WiFi and public computers are convenient when you need to stay connected on the go.

But some security risks posed by them include hackers spying on your browsing and banking activity, malicious hotspots, and keyloggers.

The latter is where hackers covertly monitor your keyboard strokes to retrieve data like your username and password.

Whenever possible, stick to using mobile data and only trust your own devices when online banking.

If you must use public WiFi, consider using a virtual private network (VPN). This creates a private network only you can access.

2. Ignore links from unknown sources, and key in banking URLs manually

Phishing attacks are where hackers create similar-looking websites to execute bank account scams. These links are sent with a luring message, enticing you to participate in a promotion that’s often too good to be true.

When you enter your login details through the link, scammers can retrieve your details, and use them to make fraudulent transactions.

To avoid phishing attacks, ignore links from unknown emails, phone numbers, and social media accounts.

When making payments, Maybank users should use the MAE app or manually key in Maybank2u’s official URL (https://www.maybank2u.com.my).

You could also look for “https” in the site’s URL, which triggers a lock icon in your browser, meaning that the server is encrypted and safe.

As an added measure for fraud prevention, Maybank no longer includes links in any direct text messages (SMS) when notifying users of updates, transactions, and the like. Hence, be wary of messages posing as the bank that includes links.

3. Generate long, unique passwords, and set up reminders to change them often

Be honest, how many of us use similar passwords with small variations for different accounts?

Understandably, doing so helps us remember our passcodes. Yet, our security becomes more vulnerable.

Thus, it’s advisable to generate long, unique passwords for each account you own, and note them down in a secure place.

It’s also good practice to change your passwords several times a year, and set reminders to do so.

4. Ensure two-factor authentication and banking notifications are turned on

Two-factor authentication adds a layer of security when logging in to your online banking account.

For example, the MAE app requires you to provide your fingerprint biometrics, facial recognition, or PIN.

This two-factor authentication extends to approving a transaction too.

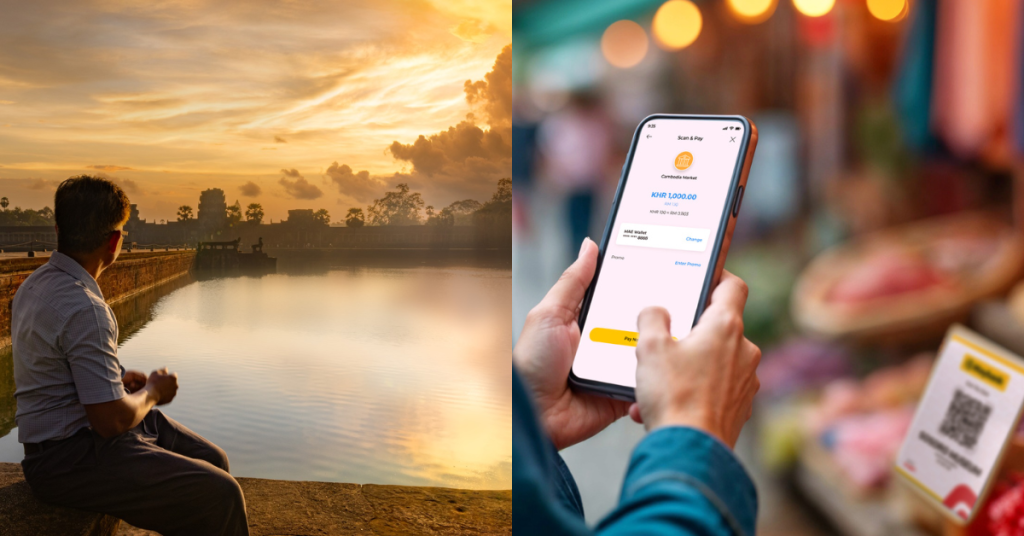

Instead of six-digit TACs, Maybank advises users to set up Secure2u by June 2023 on their phones to approve or reject banking transactions within 50 seconds.

Secure2u pairs your device with your Maybank2u account, offering an extra level of security as all transactions performed can only be authorised on your registered device. Secure2u’s two-factor authentication is device binding, which also reduces your exposure to TAC fraud.

Likewise, ensure that your banking notifications are turned on to receive alerts of any activity happening in your account. It is also advisable to go through your online banking statements periodically.

5. Keep your banking app updated

Generally speaking, it’s important to keep the apps on your phone updated, as they improve an app’s performance and security.

Since MAE debuted in 2019, Maybank has added updated security features that may not be extended to the M2U MY app. These include Secure2u, and the newly launched Kill Switch.

6. If you think you’ve been scammed, use Kill Switch

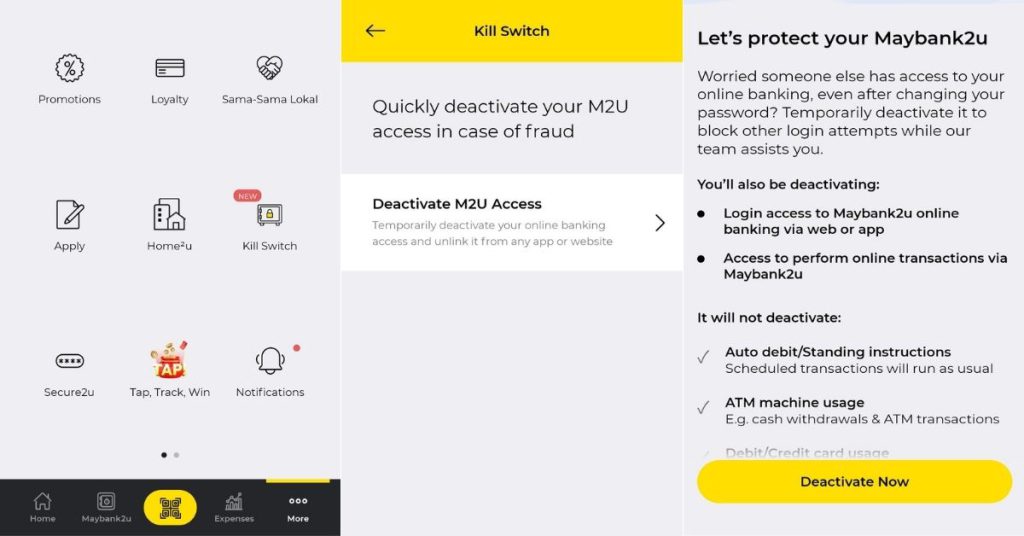

In the event you suspect that a scammer has your online banking details, or you suspect that an unauthorised transaction has been made, use Maybank’s Kill Switch.

Kill Switch is a self-service feature that lets you deactivate all online banking access to stop more transactions from going through.

It’s a measure Maybank implemented to safeguard customers’ online security, following BNM’s mandate for all banks to increase cybersecurity.

When you use Kill Switch, you’ll temporarily deactivate your Maybank2u access. That means you’ll be barred from performing any online banking functions. This includes JomPAY or FPX payments, using Scan & Pay (QR pay), and DuitNow transfers.

That said, you can still withdraw money from the ATM, and use your Maybank debit or credit card. You can also receive money in your current or savings accounts.

Be aware that Kill Switch is not a preventative step to guard your online banking account. It’s an emergency feature that only stops your account from being further misused after you realise you’ve been scammed.

Kill Switch can be found on the MAE app when you tap on “More” (the three dots) in the bottom right corner to find the “Kill Switch” icon.

If you just launched the MAE app and using the Maybank2u feature for the first time, you’ll have to enter your Maybank2u password. Then, tap on “Deactivate M2U Access” to proceed.

If you’re using the Maybank2u website, you can find Kill Switch in “Settings”, under the “Security” tab. Then, you can click on “Deactivate M2U Access” and proceed after reading the T&C.

To reactivate, visit a Maybank branch or call Maybank’s Group Call Centre (MGCC) at 1300-88-6688.

Once your details have been verified, you can immediately log in to the MAE app or Maybank2u site with your existing username and password.

However, you should reset your password after reactivation, to further safeguard your account.

Also Read: Here are Watsons’ promotions for cosmetics, medications, and more, to benefit from in 2023

Featured Image Credit: Vulcan Post

7 ways you can reduce your electricity, phone, and internet bills in Malaysia

[This is a sponsored article with Maybank.]

Through adulthood, it’s common for us to lament about how high our bills can be. While we can’t run away from paying them, what we tend to forget is that lowering their cost is within our control, so long as we proactively try to do so.

Here are some things we as consumers can do to consciously lower the cost for the upcoming 2023. These tips aren’t revolutionary, but they are mindful habits we can start practising to lower that number on your bill.

A word from our sponsor: Maybank is offering to pay your bills for a year, or give you 50% off your bills. This is part of their “Let Us Pay Your Bills” offer that’s taking entries from now to December 31, 2022.

To stand a chance to win, users must use JomPAY to pay a minimum of RM10 for their electricity, phone, internet, water bills and more. JomPAY is on the MAE app, M2U MY app, or Maybank2u site.

More details below.

Electricity

Confession: “I leave the lights on in various rooms although it’s bright outside.”

– Sarah, Managing Director

Look around your room right now. Are your curtains drawn even though it’s bright outside and your room lights are on?

It’s muscle memory for us to switch on the lights to brighten the space. But if there’s already natural sunlight shining from your windows (supposedly better for the eyes and productivity), you don’t need additional lighting.

Additionally, you could switch your lighting system to LEDs, as they’re known to be more durable, and energy efficient. After all, lighting your home contributes a rough 20% of your energy cost.

Confession: “I leave the AC on even when I’m shivering in my room.”

– Joyce, Sponsored Content Writer

I tend to shiver in my room with my AC blowing at 16°C. Then, I’d increase the temperature to as high as 27°C, so my AC becomes an expensive fan of sorts.

Obviously, the better, cost-efficient fix would be to switch off the AC, and rely on a fan instead.

Keeping your AC filter clean, maintained regularly, and at temperatures between 23°C to 25°C can also maximise its energy efficiency.

Furthermore, choosing energy-saving appliances can save you on hefty electricity costs in the long term. When shopping for electrical appliances, pay attention to their energy efficiency labels.

They indicate how much electricity (kWH) an appliance consumes. The more stars (out of five) an appliance receives, the more efficient it is.

Confession: “I leave my PC on for the whole day even though I’m not even using it.”

– Claudia, Writer

We shouldn’t be leaving electronics or appliances turned on if they aren’t in use. But also, look around your home and consider how many plugs are left on right now, but are unused.

Even when you put your PC into sleep mode, it could still be burning phantom power between 0.1W to 2W.

The amount of electricity may sound negligible, but they can rack up your bill without you even noticing it. Switching off your devices from the plug point itself will cut off the use of phantom power.

Confession: “I don’t wait for a full load of laundry before using the washing machine.”

– Rikco, Business Development Executive

Take a guess, how many shirts should be in a full load for an 8kg washing machine?

Answer: 40!

Washing machines can consume lots of power, so collecting closer to a full load before washing would save on electricity costs.

Phone & internet

Confession: “I’m paying way over RM100 for my mobile plan but I don’t actually fully utilise the data plan.”

– Sade, Managing Editor

Do you really need to be paying between RM110-RM150 a month for 70GB of internet data, with unlimited calls and SMS?

With office and home WiFi, apps like WhatsApp, Telegram, or social media are mainly used to stay in touch, and SMS are only sent once in a blue moon.

Sharing a postpaid plan with some friends is an option to bring your monthly mobile cost down. Some even let you split the bill among five to eight individual mobile lines.

Switching to a prepaid plan is another method, and you could spend as little as RM20-RM30/month for unlimited calls and 4G mobile data.

Confession: “I pay for lightning-fast internet speeds but am barely at home to use it.”

– Fadhilah, Video Editor

Modern Malaysian households are reliant on WiFi, which became essential when working from home.But for those who’ve returned to office life, lightning-fast internet speeds aren’t too necessary for standard web browsing, social networking, and video streaming.

For our writer, Claudia who mainly goes online to browse the internet or watch YouTube videos, she finds 30Mbps sufficient, which costs her as low as RM90/month.

Hence, choose a plan that suits your needs.

Confession: “I forget to pay my bills and wish someone could help me do it.”

– Everyone in the office

This sounds like a no-brainer, but forgetting to do so has caused our Managing Editor, Sade, to get her water supply cut off upon returning from a vacation.

It’s easy to overlook your bill payment deadlines, but keeping track of them is now made more convenient with a service like JomPAY, which allows you to:

- Choose from an extensive list of payees, from local councils to utility services;

- Set your favourite billers, to ensure payment details are always correct;

- Set recurring payments, so no deadlines are missed.

Maybank is offering to pay your bills for a year as its grand prize, or give you 50% off your bills. The “Let Us Pay Your Bills” offer by Maybank is taking entries from now until December 31, 2022.

Maybank is selecting up to 100 winners to sponsor a year’s worth of bills.

There’s also a monthly prize for December 2022 where 2,000 winners will be selected to get 50% off their bills from their monthly bill.

To win any of these discounts from Maybank, users must pay a minimum of RM10 for their electricity, phone, internet, water bills and more. Users can earn chances at this discount by paying bills using JomPAY, which can be found on the Maybank2u site, M2U MY, or MAE app.

Using JomPAY to pay your bills is quite simple, and the whole process can be done all through your phone.

For existing users of the MAE app, simply select JomPAY as your payment option when settling your bills, and enter your biller code, reference information, and the amount you’re paying.

When using the Maybank2u website, you can access JomPAY by choosing the “Pay & Transfer” tab. This will automatically lead you to use JomPAY after you’ve selected your bank account to pay your billers.

From there, you’ll just have to enter the billing amount and proceed with the payment.

- Use JomPAY to pay your bills via Maybank2u here.

- Read other finance-related articles we’ve written here.

Also Read: 5 reasons to treat your employees with an office at Colony’s luxury coworking spaces

Featured Image Credit: Vulcan Post

Get 28% off your CNY family meals & stand a chance to win 5g of 999.9 gold using MAE

[This is a sponsored article with Maybank.]

When I used to travel back to my hometown in Penang for Chinese New Year, I’d always be so eager to stop by my favourite eateries whose humble stalls and shops were basically local institutions.

Chomping down on a plate of char kuey teow, expertly fried by the man my family calls Taxi Station Uncle (whose cart stall stood next to a taxi station) would be a signal to me that Chinese New Year had indeed begun.

Unfortunately, the pandemic had made it difficult for most to visit their own Taxi Station Uncles and that may continue to be true this year even if travel restrictions have been lifted.

But to make it easier for you to continue buying from your favourite eateries—and more importantly for them to be able to sustain their operations—Maybank’s Sama-Sama Lokal initiative basically gives these eateries an online presence by allowing them to sell their food through the MAE app.

Getting your CNY meal delivered to your doorstep

In Klang Valley (because that’s where I’ll likely celebrate the festivities this year), eateries on Sama-Sama Lokal are plenty. But there is also a healthy list of grocery stores, confectionery shops, and fruit peddlers too.

With a quick search, I’ve managed to narrow down options of vendors from which to order poon choi and yee sang for the festivities.

To help me save on my food, Sama-Sama Lokal is offering 28% off (maximum value of RM10) on orders above RM30, as part of their Fu-ture Fortune Chinese New Year campaign this year.

Deal: Use the promo code SSLCNY28 to enjoy the offer. Validity is from now until February 28, 2022.

On top of that, I’ll save even more money because they are also offering free deliveries of up to RM10 per transaction too.

The best part is that the merchants you shop with will receive 100% of what you pay because Maybank does not take any commission from the transactions that happen on Sama-Sama Lokal.

That way, vendors can keep their prices lower and allow you, the customer, to enjoy a more affordable reunion dinner this Lunar New Year.

Earn chances to strike gold

Every time you spend or perform transactions using the MAE app—including buying food on Sama-Sama Lokal—you’ll earn chances to participate in the Fu-ture Fortune game where you tap on a Golden Orb of your choice to reveal your prize.

These could include cash prizes and shopping vouchers to be used at partner merchants such as Zalora, Caring Pharmacy, Shopee and more.

Come Tuesdays however, one of the orbs that you tap on could reveal the prize that every participant will be eyeing to win: 5g of 999.9 gold.

If you’re not familiar with fine metal terminology, this essentially means that the gold you stand to win is 99.99% pure, which is equivalent to 24-karat pure gold. And 5 grams of this metal is worth around RM1,380 at the time of writing.

Winners of the 5g 999.9 gold will be notified via the MAE app. The prize equivalent of 5g 999.9 gold will be deposited in the winner’s Maybank MIGA-i account, and subject to the gold price as the date of when it is credited.

It’s a win-win situation

Speaking of expenses, if you anticipate needing to dole out stacks of ang paos to friends and relatives this year, you might want to consider doing so using e-Angpao on the MAE app.

Each e-Angpao you spend earns you a chance to win a lucky draw prize of RM888 cash and a chance to play the Fu-ture Fortune game.

If you’re shopping for new clothes or dining out with friends, using the cashless Scan & Pay feature on MAE also earns you chances to win up to RM88 cashback for every transaction worth RM30 and more.

As per the theme of the campaign, you’ll also earn chances to strike gold.

Tip: Using the MAE app during the weekends can potentially double your chances of participating in the game. So make sure to enable push notifications on your phone.

The Fu-ture Fortune campaign starts now and ends February 27, 2022 so you’ve got plenty of time to try your hand at winning some prizes while you celebrate the Year of the Tiger.

- You can learn more about MAE or download the app here.

- Read more on what we’ve written about Maybank here.

Also Read: This M’sian rewards platform is rewarding its 1mil users with cash vouchers and a lucky draw

Why You Should Download The Maybank App (Even If You Don’t Have An Account)

It is very close to Chinese New Year and everyone is getting ready to balik kampung to visit their families and get that sweet, sweet angpao. Or if you have a more modern aunty, you might just get an e-Angpao.

Maybank, will be joining in the huat spirit by offering cashbacks and promotions to their users, and extending it to non-Maybank users as well, starting with…

1. Up to RM18 Cashback with QRPay and MAE from the Maybank App

Maybank’s ‘CNY Ho Yeah! With M2U oh Yeahhhh!’ campaign means you can get RM8 instant cashback with a minimum spend of RM38, and RM18 instant cashback with a minimum spend of RM88.

The full list of participating merchants can be found here, and it includes merchants such as Guardian, Ninjaz, GO Noodle House, Hush Puppies, and even Cold Storage.

Do note that to enjoy this you must activate Maybank QRPay on your Maybank App, and link it to your current, savings or MAE account. Debit and credit cards are not entitled to cashback.

Special bonus for Maybank users: if your Maybank QRPay is linked to your current or savings account, scanning and paying is really fast! Unlike other e-wallets, you don’t have to hog the queue lines topping up before paying.

2. Passing The Prosperity Ong

Maybank App’s e-Angpao feature is now back again, allowing you to send e-Angpaos to friends and relatives with relative ease.

This way, you don’t even have to buy physical angpao and you’ll be saving the trees too. Family members or friends who are overseas can also get angpao through Foreign Telegraphic Transfer or Western Union.

Better yet, you can join in the spirit of giving by donating through MaybankHeart where your donations can go to people in need.

3. Get More When You’re Giving

To make things a little more festive for CNY, Maybank App has updated their Jewel Rush game, giving you a chance to win some additional cash.

All you have to do is tap on the gold coins and avoid the firecrackers—it’s just that simple. After, you can cash out your winnings into MAE.

You’ll also get more chances to play the game when you:

- Donate at least RM5 to MaybankHeart

- Send at least an RM5 e-Angpao to your friends and family

- Tackle chores such as paying your bills or topping up your mobile phone plan via Maybank2u website and the Maybank App, all while on the go.

Here’s a short guide on what you’ll need to do to activate a MAE account:

For Maybank Users

If you’re a Maybank user, I’m sure you already have the Maybank App installed on your phone. If not, then you’ll have to head on to the Apple App Store or Google Play Store to download the app.

1. Login to your Maybank2u account

2. Sign up for MAE if you haven’t by clicking on the ‘M’ icon,

3. Key in your email address and invite code,

4. That’s it, you have your MAE account.

Non-Maybank User

But don’t fret—even if you’re not a Maybank user, the promotion is extended to you as well and you can benefit from it just like a regular Maybank user. The setup process will take slightly longer, but it’s still just a one-time process.

1. Download the Maybank App on Google Play Store or Apple App Store,

2. Click on the ‘M’ icon and select Experience MAE Now,

3. Key in your details, which will include: Full Name, Mobile Number, IC Number, etc.,

4. And that’s it, you’re a MAE user now.

MAE takes being an e-wallet a step further—think of it as an e-wallet coupled with banking features. After topping-up the MAE e-wallet, pay with it by scanning a QR code, or even request to split bills with your friends.

TL;DR

CNY Ho Yeah! With M2U Oh Yeahhhh! campaign gives you cash rewards when you transact from the Maybank App or Maybank2u website. You can enjoy cashback when you pay with Maybank QRPay or MAE.

Sending e-Angpao, donating to MaybankHeart, and paying your bills will net you additional chances to play Jewel Rush to win some sweet cash. Promotion ends on February 15, 2020.

- For more info on the ‘CNY Ho Yeah! With M2U oh Yeahhhh!’ campaign, click here.

Also Read: Social Enterprises Will Shake M’sia’s Economy, But Here’s What Needs To Be Fixed First

Top 4 Things Said By Retail Businesses That We Hope To Never Hear In 2019

A lot of us enjoy the satisfying sensation of a good “retail therapy” session.

But the moment gets ruined when we’re ready to leave the shop with our purchases, only to hit a roadblock—the payment process.

Malaysian consumers have already voiced their confidence in going cashless, but some merchants have yet to take the right steps towards this same vision.

It’s 2018 and merchants are expected to keep up with the advancements of commerce, but we consumers are still faced with these 8 scenarios. I personally hope to see these lessen in the coming years.

1) “We only accept cash here.”

For consumers, seeing the “only cash” signboard at the cashier can affect a customer’s decision on whether they frequent a restaurant or shop.

We understand that not every business can do much because they may not be properly established (i.e hawker stalls, roadside stalls), but technology is advancing to the point where such services can be offered and set up at no cost to the merchant or consumer.

2) “You need to spend a minimum amount of RM50 to use your credit card.”

Back in November 2017, a Facebook post by user Ikram Zidane went viral when he shared a screenshot of a conversation he had with Bank Negara Malaysia (BNM).

They mentioned that merchants are prohibited from imposing a minimum purchase for goods bought using payment cards, which is a great rule when moving to a true cashless society.

Fast forward to 2018 and some merchants still feel burdened by the transaction fees for credit card payments, especially when the purchase itself is menial.

Other institutions also see this as a pain point and are working to help remove this unnecessary strain on customers to reach that minimum amount if they want to pay with their card.

3) “Do you have small change?”

Am I the only who despises having coins around? To me, they serve very little purpose and I can’t wait for the day when my great grandchildren will show me a 50 cents coin and claim it as an antique.

So every chance I get, I pass the small change to the merchants. But not every Malaysian shares this same habit, which results in a lot of merchants often finding themselves short of small change.

Thus customers often find themselves in situations where the merchants will have to excuse themselves while they scurry off to neighbouring stores get change, which honestly, is a waste of time for everyone.

4) “There’s an extra charge if you use your credit card instead of cash.”

Similar to an earlier point, some merchants charge an additional 2% to the bill when purchases are made using a debit or credit card, essentially to cover the cost of the card transaction fee.

This shouldn’t be an issue anymore though as BNM has announced that retailers are not allowed to impose surcharges for payments using debit and credit cards.

-//-

So to retail business owners, I hope this gives you an idea of what things can look like from the other side.

These “complaints” may seem menial at first, but as it piles up, it can really ruin my shopping sessions. I’m more than happy to revisit your store if given the right experience, and one way that can be done is how I can pay you.

Living in the 21st century, most of us consumers now even leave our wallets at home and walk out with just our phones, so having an option to pay by just scanning a QR code sounds more appealing than needing to wait for you to give us small change (especially coins).

To switch up your business to align with this, one option you can look at is Maybank and their recent feature known as Maybank QRPayBiz; a system that allows businesses to process payments directly via QR codes on the app.

https://www.youtube.com/watch?v=eYBiboPWpHM&feature=youtu.be

You won’t need to pay any fees to set up an account and for now, there aren’t any transaction fees imposed on any party. There are no issues with cashflow because the payments are directly made to your bank accounts.

The registration isn’t complicated, you can instantly register via the Maybank QRPayBiz app that’s available in 3 languages and there is no documentation required.

If you manage to invite your friends who also run businesses to sign up as a Maybank QRPay merchant, you can earn RM100 with each successful referral (so long as you receive a minimum amount of 5 Maybank QRPay transactions with accumulated value of RM100).

It’s a pretty win-win situation for all since you get access to millions of ready customers (any Maybank account holder can make use of Maybank QRPay) while we get a better experience by being able to pay faster with no worries.

2019’s coming, not too late to jump on that cashless bandwagon with this small change that can benefit everyone at no cost.

- For more information on Maybank QRPayBiz app, you can check out the official website here.

- You can also download the app via the links for Android and iOS here.

This article is written in collaboration with Maybank.

Also Read: 5 Cool HR Programmes By Global Companies That Your Workplace Should Try Out

Feature Image Credit: Yelp.com