Dasmond Koh’s NoonTalk Media has debuted with an IPO at a valuation of S$43.6M

[Editor’s note: The article has been updated to reflect additional comments from NoonTalk Media]

Homegrown media entertainment company NoonTalk Media’s IPO order book has been covered for both public and placement tranches, raising gross proceeds of S$4.8 million. The company’s shares will start trading today.

Of NoonTalk Media’s available 4.5 million public tranche shares, there were valid applications for 5.3 million shares, making it 1.2 times subscribed.

In addition, the 17.5 million placement shares available were also fully spoken for.

The shares were priced at 22 cents each, giving the company a market value of S$43.6 million.

Sheng Siong Group’s MD is one of NoonTalk Media’s anchor investors

The managing director of Sheng Siong Group, Lim Hock Leng, was one of its anchor investors. Hock Leng took up 4.4 million shares.

Meanwhile, Union Energy Corp took up two million shares, while Singapore-based family office Qilin Wealth Fund and former member of parliament and executive director of CITIC Envirotech Chong Weng Chiew took up 1.35 million shares each.

Dasmond Koh, NoonTalk Media’s executive director and CEO told Vulcan Post that “NoonTalk Media couldn’t have come this far without the support of everyone. By getting listed, I am able to give back to the local entertainment industry by expanding our footprint globally.”

“This IPO is not an end game for the company, but the start of realising our goal — to help develop our market to a more robust and dynamic one, where Singaporeans can own a piece of their culture,” he added.

NoonTalk Media’s revenue streams

Between 2020 and 2022, NoonTalk Media reported revenues of S$3.04 million, S$3.83 million and S$6.37 million respectively.

The company has two main revenue streams, its management and events arm, and its production arm.

Its production arm comprises services relating to multimedia creation and production, film and television production and video production, while its management and events arm comprises management of artistes and talent, management of studio venue and equipment, management of projects (including livestreaming services) and events conceptualisation.

NoonTalk was the appointed provider of production services for Chingay 2021 and 2022, which is organised by the People’s Association.

Some of the company’s other marquee projects in recent years are ChildAid 2021, an annual charity concert in aid of The Straits Times School Pocket Money Fund and The Business Times Budding Artists Fund. The company also produces films and television programmes.

However, its profits in the same period were S$73,939, S$189,244 and S$22,407 respectively.

Terence Tan, Chief Financial Officer of NoonTalk Media, explained that the significant gap between the company’s revenues and earnings were due to higher administrative expenses incurred.

“Our administrative expenses increased by S$745,933 or 76 per cent from S$981,968 in FY2021 to S$1,727,901 in FY2022. The increase was mainly due to (a) increase in professional fees and related expenses for the preparation for the Listing, (b) increase in depreciation of plant and equipment arising from renovation works performed following the extension of office lease, (c) increase in depreciation of right-of-use asset on arising from extension of office and studio lease at a higher rental rate, (d) staff costs and (e) others,” he elaborated.

The company’s loans and borrowings

As at 30 June 2022, the aggregate outstanding amount of NoonTalk Media’s outstanding borrowings

stood at S$4.15 million. The IPO document stated the breakdown of these borrowings, with the bulk of it (S$2.2 million) attributed to convertible bonds, followed by convertible loan (over S$1.44 million).

“Our borrowings are used for work capital purposes,” Terence told Vulcan Post.

Meanwhile, Noontalk Media’s remaining bank borrowings of about S$0.5m has interest rates ranging from 0 to 9.8 per cent, with loan maturities ranging from this year to November 2024.

Featured Image Credit: NoonTalk Media

Also Read: S’pore firm PropertyGuru to list in US on March 18, will be valued at US$1.78B after SPAC merger

MRANTI’s I-Nation 2022 will host talks confronting environmental & biz sustainability

[This is a sponsored article with MRANTI.]

Since 2019, the Malaysian Global Innovation & Creativity Centre (MaGIC) has hosted its annual E-Nation conference to build sustainable, innovation-driven entrepreneurship for the country.

E-Nation saw participants such as tech and social entrepreneurs, investors, academicians, corporates, policymakers, and government agencies.

Following the convergence of MaGIC and Technology Park Malaysia (TPM), the agency is now known as Malaysian Research Accelerator for Technology & Innovation (MRANTI).

Bringing back its flagship event, the conference will be called I-Nation. MRANTI believes this event will strengthen its position as a research commercialisation agency, driving the Fourth Industrial Revolution (4IR) agenda.

I-Nation will take place on November 29-30, 2022 at MRANTI Park, Bukit Jalil. The conference will revolve around the theme, “Global Reset: Tech for Impact”.

Day 1: Globalisation in a digital world

The I-Nation conference will comprise talks that focus on 4IR in line with environmental, social, and corporate governance (ESG) goals, such as:

- Economic Inclusivity;

- Supply Chain;

- Healthcare;

- Climate Change;

- Food Security.

Day one of I-Nation will kick off with a speech that poses the question: What can be achieved if countries were to become truly digital?

From changes in governing models to setting up virtual companies internationally, Taavi Kotka, former Estonian Government Chief Information Officer, and Head of the Estonian e-Residency Programme Council will lead this talk.

Did you know: e-Residency provides non-Estonians access to form a company in Estonia, along with other processes like banking, payment processing, and taxation, all without being a resident.

In terms of Malaysia’s landscape, the implementation of 5G infrastructure for our socioeconomic benefit can be seen as an example. Meant to accelerate the development of high-speed and affordable connectivity, businesses are also able to compete on a global scale.

5G connectivity is now being rolled out, and MRANTI Park already offers it to businesses that are leveraging its facilities.

Taavi will look into real-life examples of digitalisation in government taking place in the world today in his presentation.

Next up, MRANTI’s own Group CEO, Dzuleira Abu Bakar, will be taking the stage with other government leaders, including the Ambassador of Germany to Malaysia, the High Commissioner of India to Malaysia, and the British High Commissioner to Malaysia.

They will discuss examples of innovations that have helped propel economic growth in the respective countries they represent.

The session will also look at how innovations can be turned into policies and processes. This can be exemplified through MySejahtera, which was developed by a local IT company and implemented by the government to facilitate contact tracing efforts in response to COVID-19.

Moving on to the subject of climate change, day one will also cover talks that break down Malaysia’s establishment of a Voluntary Carbon Market (VCM). For context, the VCM is an exchange enabling companies to invest in climate-friendly projects and solutions happening in the market.

It’s an initiative meant to promote low-carbon business models, and to show how companies can innovate amidst the shift to environmentally friendly practices to slow down the effects of climate change. Some industries that can be commended in this area include renewable energy sectors, electric vehicle solutions, as well as projects in waste management, and energy efficiency.

The panel will feature Nithi Nesadurai, Director & Regional Coordinator of Climate Action Network Southeast Asia (CANSEA) Malaysia, and Vaibhav Dua, Partner at McKinsey & Company Malaysia. Also joining this discussion is Bryan Lim, Executive Director and Head of Healthcare at Khazanah Nasional Berhad.

Day 2: Raising B40 living standards, and exploring agritech in food security

Recently, a post on Facebook went viral of a story detailing how an entrepreneur selling teh tarik ikat tepi managed to change his fate, supposedly moving out of the B40 income group to T20. What can be done to help more of Malaysia’s B40 achieve a similar future?

Day two of I-Nation will feature philanthropist and founder of Yayasan Chow Kit Malaysia Dato’ Dr. Hartini Zainudin. She will be one of the speakers exploring the strategies for raising Malaysia’s B40 income and lifestyles.

Agriculture and farming methods have changed drastically in the past decade, and more people in younger generations are beginning to find this industry appealing, thanks to agritech.

At Vulcan Post, we’ve seen a durian farmer’s son implement 5G to detect freshly fallen durians, and ex-accountants growing Japanese musk melons in their Putrajaya IoT farm.

Technology can assist in optimising agricultural operations, along with increasing productivity and income generation, all while being eco-friendly.

Dr. John Tey Yeong Sheng from Universiti Putra Malaysia’s Institute of Agricultural and Food Policy Studies, and Wong Chee Chiew, Partner at Kearney Malaysia, will be joining a panel discussion to share their insights about agritech’s role in food security.

Other speakers at I-Nation presenting their views on sustainability include Dr Billy Tang, founder of People With Disabilities (PWD) Smart Farmability, and Lakshmi Lavanya Rama Iyer, Head of Policy and Climate Change at WWF Malaysia.

-//-

On top of thought-provoking conferences, MRANTI states that I-Nation will be an experiential one, where participants can get involved in satellite events and exhibitions taking place at MRANTI Park.

If you’re interested in participating in I-Nation 2022, you can register your interest here with your details, admission is free.

Also Read: Here’s what IPC’s new work pods can offer mall goers who are also workaholics

Featured Image Credit: Dzuleira Abu Bakar, Group CEO of MRANTI

MAS releases another statement to address misconceptions on the FTX collapse

The Monetary Authority of Singapore (MAS) issued a statement yesterday (November 21) to address misconceptions with regards to the collapse of crypto exchange FTX.

The collapse of FTX came as a shock to many, wiping out many investors.

In the statement, MAS pointed out that “the most important lesson from the FTX debacle is that dealing in any cryptocurrency, on any platform, is hazardous”.

It added that it is not possible to protect local users who have dealt with FTX, since FTX was not registered and regulated in Singapore.

MAS also addressed concerns of why Binance was placed on the Investor Alert List (IAL), while FTX was not.

“While both Binance and FTX are not licensed here, there is a clear difference between the two: Binance was actively soliciting users in Singapore, while FTX was not. Binance in fact, went to the extent of offering listings in Singapore Dollars and accepted Singapore-specific payment modes such as PayNow and PayLah,” said MAS.

These actions by Binance were seen as a possible violation of the Payment Services Act, since Binance was not licensed in Singapore.

In contrast, MAS argued that there was no evidence that FTX was specifically soliciting Singapore users. While Singaporeans can access both Binance and FTX online, FTX was not placed on the IAL because they were not specifically courting users from Singapore.

MAS has also stressed that it is not possible to list all the exchanges that are not licensed in the IAL, since there are hundreds of such exchanges.

The Purpose of the IAL is to warn the public of entities that may be wrongly perceived as being MAS-regulated, especially those which solicit Singapore customers for financial business without the requisite MAS licence.

It does not mean that the thousands of other entities operating offshore, which are not listed on the IAL, are safe to deal with… Even if a crypto exchange is well-managed, cryptocurrencies themselves are highly volatile and many of them have lost all value.

– MAS

MAS also warned that even if a crypto exchange is licensed in Singapore, it would only be regulated to address money-laundering risks, and not to protect investors.

FTX’s backers have marked their investments down to zero

Following the revelation that FTX founder Sam Bankman-Fried was using FTX’s token FTT as its capital, questions of FTX and Alameda’s solvency were raised.

When Binance announced that it was liquidating its remaining FTT, holders panicked and attempted to sell their own FTT holdings, which precipitated a crisis at FTX.

During this time, Fried attempted to save FTX by selling the company to Binance.

The deal has since fallen through, and in response, Sequoia Capital, one of FTX’s early investors, sent a letter to its own investors and notifying them that Sequoia had marked their investment down to $0.

Last week, Temasek Holdings followed suit, announcing that it was writing off its entire investment in FTX, which amounted to US$275 million. Temasek had previously participated in two funding rounds for FTX, with on being a Series B funding round in October 2021 and the other being a Series C funding round in January 2022.

In a statement addressing this move, Temasek noted that “it is apparent from this investment that perhaps our belief in the actions, judgement and leadership of SBF, formed from our interactions with him and views expressed in our discussions with others, would appear to have been misplaced”.

The crypto winter claims another casualty

FTX is the latest in a string of bankruptcies and collapses within the cryptocurrency ecosystem. Beginning in May, many companies within the Web3 world have encountered crises, and some giants of the crypto spaces have not proved resolute enough to weather the storm.

Terraform Labs, which launched the algorithmic stablecoin Terra alongside the collateral token Luna, saw the values of both tokens plummet overnight.

The crash of the Luna tokens also brought down several other companies, including crypto lending platform Celsius, and hedge fund Three Arrows Capital.

Other companies, such as Crypto.com and Bybit, have also been forced to lay off some workers.

Featured Image Credit: Monetary Authority of Singapore

Also Read: The collapse of troubled crypto exchange FTX and how it will shape the crypto market

5 M’sian SME bosses share their biggest hiring mistakes, and how they overcame them

[This is a sponsored article with JobStreet.]

I’ve interviewed many entrepreneurs who became the managers of their companies with little to no prior HR—or any business management—experience.

With hiring, firing, and retaining talent piled onto their plates, they must also set the tone of their company’s culture. Surely, they’ve suffered some hiring mistakes in the past.

These pain points are what JobStreet hopes to alleviate for SMEs, with its range of HR solutions to help companies of all sizes find and secure the right talents.

Following that, JobStreet called on us to find five Malaysian SME bosses to learn about their biggest hiring mistakes, and how they overcame them to build valuable teams for their companies.

They are:

- Carliff Rizal, founder and CEO of YesHello;

- David Lim, founder and CEO of Grouppe Dionne;

- Sarah Enxhi, co-founder and Managing Director of GRVTY Media (Disclaimer: GRVTY Media is the parent company of Vulcan Post);

- Jasmine Mohan, founder and CEO of The Good Fat Company;

- Lucas Eng, founder of Balak’s.

Rushing to hire, and believing that skills supersede bad attitudes

Recurring mistakes these founders made included rushing their hiring processes, and hoping a candidate’s bad attitude could be exchanged for skills.

It was a mistake Sarah made at her media company. This led to toxicity and unhealthy cliques forming, due to a lack of transparency building up among the company’s members.

“Looking back, all the signs were there,” Sarah reflected, “I shouldn’t have excused poor character just because of the presence of skills.”

Restaurateur, David faced a similar situation when he hired a young European chef for his French fine dining restaurant in Shanghai.

David shared that the hot-tempered chef would dictate how the restaurant was run while refusing to follow instructions, and believing he was above customers.

When Carliff was setting up his SaaS startup, he hired contract workers for ad-hoc projects to fulfil specific needs at a time.

While this worked fast in building YesHello’s software, it was difficult to repurpose short-term employees for other projects. They simply weren’t a good fit for the company, nor did they intend to stay.

Did you know: JobStreet’s Talent Search gives employers access to its passive candidate pool, and you can filter job seekers by searching for desired skills and other relevant keywords, then reach out to them easily.

Jasmine summed up succinctly, “If there’s one thing I’ve learnt, it’s to not look purely at credentials, but focus on how much that person can work with us to grow our business.”

That’s not to say that credentials don’t matter at all, though. Lucas, who formed his wooden furniture company at age 24, shared that his biggest hiring mistake was rushing to hire someone who could not perform their role.

Letting go of the hire three months later, Lucas realised that the exercise was a waste of resources.

Did you know: JobStreet gives access to a large pool of 5.2 million job seekers, allowing you to target high-calibre candidates in Malaysia. Via JobStreet’s recruitment services, you also can save time and only engage with shortlisted candidates for the role.

Setting up strong company core values and processes to grow the team

Facing up to their hiring mistakes, these bosses took a step back, looking into themselves and what they’d like to see in their companies. From there, they established strong company core values that would determine their hiring decisions and overall work cultures.

It’s exactly what Sarah did to rebuild her workplace’s culture.

Job applicants who don’t practice GRVTY Media’s core values are weeded out, and this sentiment extends to all employees both old and new, even interns.

“Other than ensuring that everyone intimately knew the core values, I had to ensure that I, too, practised them. This was to set an example to everyone, and increase transparency in any communication between myself and the teams.”

Did you know: JobStreet can serve companies in need of a high-performance job ad by allowing employers to promote branding features that uplift their Employer Value Proposition. Using JobStreet’s Branded Ad, you can state points to promote your company culture and highlight the benefits of the job role, amongst other things.

Employers can also register to get a free job ad.

Jasmine stated that, being a startup, it’s important to focus on hiring people who buy into the total vision of the company. They should also be totally vested in the company’s growth, as the impact of growth cascades down to everyone in the team.

Another element Jasmine found pivotal was that although everyone in the team had their individual responsibilities, her company’s hierarchy is kept flat.

She elaborated, “We are such a small company, everyone does everything. There is no room for ‘I’m hired to do accounts, that’s all I do’.”

One crucial characteristic Carliff looks for in every team member is whether someone is a responsible person, or if they would play the blame game in situations. “There’s no 50-50,” he added.

Carliff also described that whenever there is a breakdown in any situation, the team will not fault the person, but the processes, then amend their workflow accordingly.

Though Lucas disclosed that he’s yet to find the right person for Balak’s sales role, he’s learnt to never rush when it comes to hiring job applicants.

“We will no longer hire people urgently even if we are in need of employees,” he said.

Did you know: JobStreet can also provide companies with a dedicated talent consultant, providing personalised job ad writing, posting services, candidates screenings, shortlisting, and validation.

David now ensures stringent background checks and evaluations are done on job candidates, especially those filling high positions in the company.

Some pieces of advice on hiring

Ultimately, it’s clear that these bosses believe hiring candidates who fit into their company’s core values trump their skills.

As Carliff put it, “Hire them for fitting your core values. Know exactly what kind of environment you want in your office, because if you want players, you need a team.”

Sarah stated to not make any compromises when it comes to a candidate’s character.

“Don’t tell yourself, ‘Oh, it’s okay that this person is rude, they don’t mean it, and they’re so good at [insert relevant skills]’. It’s not okay, this will only lead to more problems in the future,” she explained.

“Nobody is that talented that they are worth your peace of mind in the company.”

Jasmine advised that founders need to have a pulse on their company as a whole, not just the view from the top.

Lucas shared a reminder to fellow employers that someone’s age doesn’t necessarily determine their potential in the company.

He noted that it isn’t right to assume an older candidate has more experience. More chances should be given to the younger generation to prove themselves.

“They may have better ideas and creativity to bring to the company, and from there we can grow together,” Lucas said.

-//-

All-in-all, SME owners and hiring managers looking for tools to easily reach ideal candidates can look to JobStreet for help.

The platform has seamless integrated sourcing that eases the search for talents, with greater candidate reach via job alerts through its app and other technologies.

Embedded industry data to create the most effective job ads are also part of JobStreet’s offerings that may aid in a business’ hiring needs.

If you’re recruiting or know someone who’s recruiting, JobStreet offers free job ads to new customers. Register to get a free job ad here.

Also Read: Here’s what IPC’s new work pods can offer mall goers who are also workaholics

Featured Image Credit: Carliff Rizal, founder and CEO of YesHello / Sarah Enxhi, co-founder and Managing Director of GRVTY Media / David Lim, founder and CEO of Grouppe Dionne / Jasmine Mohan, founder and CEO of The Good Fat Company / Lucas Eng, founder of Balak’s

Meta to Twitter: 8 tech firms that are laying off employees, including in S’pore offices

Amidst market turmoil, a looming recession, and the Russia-Ukraine war, the number of global tech layoffs has been rising at an alarming rate.

According to layoffs.fyi, this year has seen 850 tech companies laying off a total of 136,989 employees so far, and this number has been rising gradually across the months.

These layoffs are also hitting close to home — Singaporean employees are getting axed from top tech companies such as Microsoft, Twitter and Meta.

After facing an upsurge in online activity during the pandemic, these tech giants were led with a false sense of security. The pandemic created a once-in-a-lifetime condition for exponential growth and encouraged tech firms to hire and expand more than they should have.

However, the growth rate of these companies were unsustainable — the tech bubble has burst and these tech giants now have no choice but to downsize.

Here is a roundup of some of the major tech layoffs in 2022:

Shopee

Sea’s e-commerce arm Shopee axed its employees for the third time this year a week ago, as Sea struggles for profitability. According to posts shared on LinkedIn, affected teams include those in human resources and from learning and development.

The tech giant started its string of global layoffs in June, after reporting a nearly US$1 billion quarterly loss for Q2 2022. The company let go of its regional workers in its ShopeeFood and ShopeePay teams, following its shutdown in India and France after just five months of its launch in those regions.

Shopee then subsequently slashed more jobs in September, affecting staff in its gaming arm Garena and research and development unit Sea Labs. In the same month, the company also closed its operations in Argentina, Chile, Colombia and Mexico.

According to Sea co-founder Forrest Li, the company wants to tighten its expenses as it seeks to cut costs. In an internal memo, Forrest said that Sea’s top management will forego their salaries, and that its leadership team will not take any cash compensation “until the company reaches self-sufficiency”.

Besides that, Shopee also made headlines for withdrawing multiple job offers based in Singapore. The e-commerce firm reasoned that due to adjustments in hiring plans, a number of roles at Shopee were no longer available.

Sea has reportedly laid off more than 7,000 employees, or around 10 per cent of its global workforce over the past six months, from which about 180 employees, or three per cent of its workforce, were reportedly laid off in Singapore, China and Indonesia in total.

Meta

In an attempt to cut cost, Facebook owner Meta Platforms laid off 11,000 employees, or 13 per cent of its global workforce this month — marking its first ever mass layoff since the company was established 18 years ago.

According to Meta’s executives, the layoff has affected employees at “every level and on every team, including individuals with high performance ratings”. More than 50 of the affected positions were located in Singapore.

In addition, about half of the affected jobs comprise tech roles, while the rest were mostly in business and recruitment.

Aside from cutting down its workforce, Meta will also be reducing discretionary spending and extending its hiring freeze through Q1 of 2023, said Mark Zuckerberg in a message to employees. Meta first announced its hiring freeze back in May.

These cost-cutting moves comes at a time where Meta’s metaverse division, Reality Labs, is raking up losses amounting to US$10 billion a year, and this amount is expected to increase in 2023.

Furthermore, the company also issued a weak revenue forecast for Q4 2022, falling short of Wall Street’s expectations for earning. Prior to this, Meta posted two consecutive quarters of revenue declines.

After closing his US$44 billion purchase of social media platform Twitter, new Twitter CEO Elon Musk laid off half of the company’s global workforce, or about 3,700 employees, in order to lower its costs. According to Musk, the company is currently losing more than US$4 million per day.

Former CEO Parag Agrawal, finance chief Ned Segal and senior legal executives Vijaya Gadde and Sean Edgett were among the top executives laid off by Elon.

Although it is unclear how many employees in Singapore were affected, The Straits Times reported that the job cuts included individuals from its marketing, sales and engineering teams.

In addition, The Straits Times also reported that the billionaire is also considering firing more Twitter employees in the sales and the partnership sides of Twitter.

These layoffs represent the biggest workforce cull Twitter has seen, but this is not the first time the company has sought to reduce its headcount. Twitter initially implemented a hiring freeze in July, and subsequently laid off 30 per cent of its talent acquisition team.

In response to the layoffs, former CEO and co-founder of Twitter Jack Dorsey took responsibility and apologised through a tweet for growing the company size too quickly.

Coinbase

Digital asset trading platform Coinbase Global eliminated 60 jobs in its latest series of job cuts as it plans to downsize its recruiting and institutional onboarding groups.

“Today’s actions were surgical. We are just making sure we are not wasting a dollar,” Coinbase’s chief financial officer Alesia Haas told Bloomberg TV.

The company’s job cuts come a week after “crypto market headwinds” contributed to Coinbase’s Q3 net loss of US$544.6 million for 2022, compared to a Q3 profit of US$406.1 million last year.

Prior to this, Coinbase laid off about 1,100 employees, reducing its workforce by 18 per cent back in June in response to a volatile crypto market. In addition, the company also implemented a hiring freeze and rescinded a number of accepted offers.

While the number of affected employees in Singapore is unknown, former employee Clinton Gleave wrote on LinkedIn that the company cut off access to its systems before notifying said employees.

“We lost systems before being notified, I even just reserved a place for team drinks for tomorrow,” he said.

According to Bloomberg, Coinbase had hired aggressively in recent years, with its workforce ballooning by about 1,200 employees this year to take advantage of the crypto craze. However, its CEO and co-founder Brian Armstrong cited a recession in the U.S. and an upcoming “crypto winter” as to why the company made these job cuts.

GoTo

Indonesian tech conglomerate GoTo Group laid off 1,300 employees, or about 12 per cent of its workforce including in Singapore last Friday to curb costs and reach financial self-sufficiency.

According to The Straits Times, the job cuts will affect employees in all divisions. The company, formed through a merger between ride-hailing provider Gojek and e-commerce firm Tokopedia, did not disclose the headcount of employees affected in its Singapore operations.

A quick search on LinkedIn unveiled some of the roles impacted by the layoffs, which includes engineering roles, data science roles and creative roles.

In addition, GoTo announced its financial results for Q3 of 2022 just yesterday — the company saw its net loss widen to 20.32 trillion rupiah (S$1.8 billion) for the nine-month period ended September 30, a steep increase from 11.58 trillion rupiah last year.

Stripe

Online payments processor Stripe laid off about 14 per cent of its workforce, or 1,100 employees, in late October in a bid to reduce its costs amidst rising inflation and interest rates as well as the looming recession.

“We overhired for the world we’re in, and it pains us to be unable to deliver the experience that we hoped that those impacted would have at Stripe,” said Stripe CEO Patrick Collison in a memo to staff on November 3. He emphasised that these job cuts were necessary to correct Stripe’s leadership’s errors of judgement.

A particular LinkedIn post by Isabella Mendoza, Stripe’s partner development manager based in Singapore, pointed out that the company’s people and recruiting team was hit the hardest in this layoff.

In order to aid retrenched Stripe employees to secure new jobs, two tech researchers in Singapore put together a spreadsheet comprising the details and job experiences of the former Stripe employees. At least 30 affected employees based in Singapore have put down their names on the spreadsheet.

Back in June, Wall Street Journal reported that Stripe has lost its valuation by 28 per cent. The company was last valued at US$95 billion after securing US$600 million in a funding round back in March.

The company is now valued at US$74 billion.

Microsoft

Microsoft laid off about one per cent of its global workforce, or about 1,000 employees, in October following its slowest revenue growth in more than five years in Q3 2022.

Although the layoffs were spread out across the company, some of the most impacted divisions comprise gaming and government services. The number of affected employees in Singapore was not disclosed.

According to Forbes, these layoffs are reportedly a part of ‘structural adjustments’ to streamline Microsoft’s workforce in the face of extensive macroeconomic issues.

“Like all companies, we evaluate our business priorities on a regular basis, and make structural adjustments accordingly. We will continue to invest in our business and hire in key growth areas in the year ahead,” Microsoft said in a statement to Axios.

This round of layoffs comes after Microsoft improved its compensation packages for employees. In May, the company’s CEO, Satya Nadella, announced that the budget for merit-based salary hikes would double to retain top employees.

Prior to this, the company told its employees back in May that it would be slowing down hiring in the Windows, Office and Teams groups as it braces for economic volatility, according to The Business Times. Two months later, Microsoft began eliminating a number of job offers.

Amazon

Amazon.com laid off its employees in its devices group last week and is targeting around 10,000 job cuts globally, including in its retail division and human resources, as reported by Reuters. The company’s devices group works on the Alexa virtual assistant.

The elimination of 10,000 roles through reductions in more units will amount to about a three per cent cut in Amazon’s roughly 300,000-person global workforce. The company has offered voluntary buyouts to some human-resources staff, the source familiar with Amazon’s job-cut plans said.

The number of affected employees in Singapore is still unknown.

“We continue to face an unusual and uncertain macroeconomic environment,” said Amazon senior vice president of devices and services, Dave Limp. “In light of this, we’ve been working over the last few months to further prioritize what matters most to our customers and the business.”

Amazon has announced periodic layoffs since 2000. However, each round has numbered in the hundreds or less, in contrast to the recent announcement.

These layoffs are expected to extend into 2023 as its leaders continue to make adjustments. “Those decisions will be shared with impacted employees and organisations early in 2023”, said Andy Jassy, CEO of Amazon, in a letter to the company’s employees.

Featured Image Credit: Edgar Su via Reuters/ Salon/ Forbes/ Michael Petraeus

Also Read: Shopee axes more employees in its third round of layoffs – staff in S’pore office also affected

How Jane Chuck’s Motherchuckers became the 1st local name to collab with Italy’s Superga

If you’re on social media, chances are you’ve come across content creator Jane Chuck or one of her many brands such as HEJAÜ, Chuck’s, or Motherchuckers.

Under Motherchuckers, the entrepreneur has recently collaborated with Superga, an Italian shoe brand, to release a collection by the name of “All You Need is a Lil’ Sole.”

The Superga x Motherchuckers sneakers were officially launched on November 12 at Superga’s new store at 1 Utama. We reached out to Jane Chuck to learn how this partnership came to be.

A synergetic collaboration

Superga arrived on Malaysian shores in 2017, opening its first retail outlet in Suria KLCC. Five years later, the shoe brand opened its second location in 1 Utama back in October 2022.

Superga is no stranger to collaborations, having collaborated with influential people across the globe to create capsule sneaker collections, such as supermodel Emily Ratajkowski, Singaporean influencer Drea Chong, and now, Jane Chuck.

“While Motherchuckers and Superga share a sensibility towards comfort and a timeless aesthetic, what gravitated them towards each other was the former’s bright, cheeky approach to elevating wardrobe staples and the latter’s century-old heritage in craftsmanship,” a press release stated.

Jane told us that the collaboration was initiated by Superga, who “slid into Motherchuckers’ DMs”. She believes the Italian brand was interested in Motherchuckers because it already had a strong presence in Malaysia despite being new in the market.

“I guess Superga spotted that, and we are honoured to be part of its first Malaysian collab,” she added.

Sneakers and sweaters

Aside from being Superga’s first collaborative project in Malaysia, this collection is also Motherchuckers’ first foray into footwear, which Jane said is intentional.

“We’ve been manifesting to only launch footwear when there’s an international opportunity or collaboration,” the entrepreneur shared. “We got a DM from Superga last May 2021 and the whole process took about one and a half years to launch it this November.”

This process included Motherchuckers adding its own touch onto Superga’s 2630 Stripe, 2402 Mule, and 2750 Strap in two shades each.

Motherchuckers’ take on 2630 Stripe sees two distinctive colourways—Neptune and Butter, cyan and ecru shades respectively. Meanwhile the Superga Mule now comes in Fuchsia Orchid and Oatmeal.

The Strap also now features two new earthy colourways as well as a blue logo side tab as seen throughout the collection.

According to the press release, this collection aims to be a “celebration of self-expression”, with Jane saying, “To be comfortable is to be true to yourself”.

Alongside participating in this shoe collection, Motherchuckers is also launching the Sole Searcher Capsule collection, a clothing line that includes a series of sweaters, joggers, shorts, socks, as well as caps.

Some of the pieces are branded with “Superchuckers”, denoting Motherchuckers’ and Superga’s partnership.

Similar to Superga’s shoes and Motherchuckers’ own designs in the past, all of these releases seem to be staple pieces with a bit of a retro look.

Bringing Malaysia onto the world stage

While Motherchuckers has already been making a name for itself in Malaysia, Jane believes that this collaborative effort with Superga signifies a step forward for her clothing brand.

“This collab will open a door for Motherchuckers to the international market,” she said. “We are definitely working towards expanding the brand internationally. We have big dreams, and we’d like to keep it hush-hush until it happens.”

This tactic seems to have been used for the Superga collection, which was over a year in the making without fans’ knowledge, so perhaps there’s already something in the works for Motherchuckers that Malaysians can keep an eye out for.

- Learn more about Superga here, and Motherchuckers here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: To help SMEs expand in M’sia, Lalamove offers affordable, on-demand interstate deliveries

Featured Image Credit: Motherchuckers / Superga

5 reasons to treat your employees with an office at Colony’s luxury coworking spaces

[This is a sponsored article with Colony.]

Whether your company is operating fully back at the office, WFH, or hybrid work, being exposed to a new environment can spark a much-needed break from the mundane. For companies with a dedicated budget for leisure and retreats, Colony’s luxury coworking spaces make an enticing option.

Some locations Colony is present at include Eco City, KLCC, Mutiara Damansara, and Star Boulevard—the brand’s 35,000 sq ft flagship outlet.

Each branch comes with upscaled, private workspaces, namely Colony’s Private Offices and Luxe Suites. On top of having fully furnished rooms, the latter has its own mini-bar and Google Home setup.

There are also Reserved Desks available for those who prefer the traditional coworking space setup of having a private desk while being around others.

Here are five benefits of choosing Colony as your new office.

1. Luxuriously designed spaces to inspire creativity

Uniquely designed, each Colony location comes with a personality of its own.

Whether it’s a New York Tribeca aesthetic at Star Boulevard, a British colonial-inspired one at Eco City, or boasting elements of Gentlemen’s Club at KLCC, Colony creates a warm and welcoming space.

These distinctive designs coupled with contemporary furnishing can serve as inspiration, beneficial for those doing creative work.

Not to mention, the space serves as a beautiful backdrop for content creators, for example.

2. 5-star hospitality, so you can focus on tasks that matter

Colony has prided itself on its 5-star hospitality from the very start, something we’ve personally experienced before too.

To elaborate, all workspaces at Colony are granted printing and scanning credits, mail and parcel-handling services, as well as daily housekeeping. Those opting for a Luxe Suite will even get access to personal butler services.

Believing that people should always be taken care of, Colony’s hospitality team would even go the extra mile for their clients. For example, one Senior Community Manager at Colony had travelled across the country during the RMCO just to hand a laptop to one of their guests.

Another incident of Colony’s exemplary hospitality was shown when a guest tore his shirt at a metal frame of Colony’s entryway.

Not only did Colony’s team provide a first aid kit to address his small gash, but they also presented him with a brand-new shirt of the same size and design.

Having all the luxuries of being attended to will provide your employees with the time and space to focus fully on their tasks, without the disruptions of minuscule to-do’s.

3. Community events for team-building activities and celebrations

Hosting a community of mature startups and corporates, Colony provides guests access to thoughtfully curated events to mingle with distinguished professionals.

Some events organised by Colony this year included a Halloween-themed movie night at its KLCC outlet, group yoga at Mutiara Damansara, and a “build your own” doughnut day.

They also had a Deepavali celebration where Colony’s Community Managers at Star Boulevard held a beautifully planned feast for guests.

Even if you plan to host your own team-building celebration at Colony, the coworking space has partners on board to help in the planning process, from event decor to catering, among other requests.

This gives you the opportunity to focus on the smaller details that will make your team event or celebration a productive and memorable one.

4. A kids’ playroom to put working parents’ minds at ease

With the year-end school holidays coming up, working parents in your team may appreciate a dedicated space to keep their kids close while they work.

Colony meets this demand with its kids’ playroom, where there are toys and other educational materials available in the space to keep guests’ children occupied.

There are also desks and chairs, so parents can work in proximity to their children as they play for as long as they please.

5. Ultra flexible plans for lower-commitment leases

If you’re already convinced to experience Colony’s luxury coworking space, but are unable to commit to a long-term lease of 30 days minimum, you can opt for the Ultra Flex Solution plan.

Under Ultra Flex, you could terminate your contract with Colony in one working day, and get your deposit back within seven working days.

This flexible plan also has a lowered deposit at RM500, as opposed to a regular two-month rental deposit. To add, you’ll have the opportunity to freeze and resume your memberships anytime.

Colony’s Ultra Flex Solution can help businesses achieve the agility to work around unforeseen issues easily.

With the uncertainty brought on by the current economic situation, Colony’s flexible leases are an opportunity to experience luxury coworking without long-term commitment.

- If you’re interested in making a booking at Colony’s luxury coworking spaces, you can reach them here.

- Read other articles on Colony here.

Also Read: To help SMEs expand in M’sia, Lalamove offers affordable, on-demand interstate deliveries

Featured Image Credit: Colony

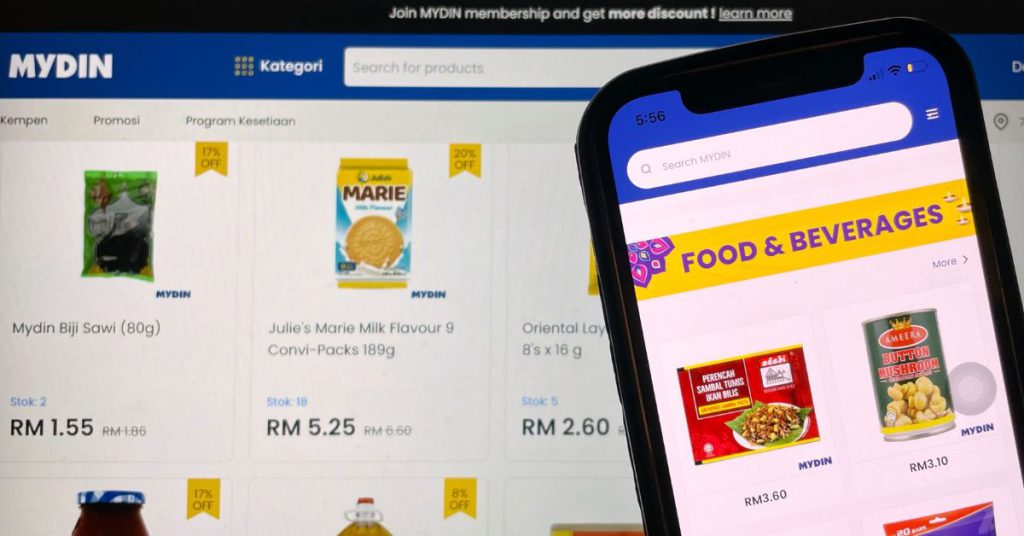

MYDIN has launched its ecommerce platform and app, here’s how Dropee played a part in it

[Written in partnership with PubliCT.io, but the editorial team had full control over the content.]

The rise of online grocery delivery services has been a steady growth over the past decade, with the pandemic further amplifying the necessity of such solutions.

Some providers have come and gone though, with a notable one being honestbee in the past, and more recently, HappyFresh.

However, something to note was that they came in with online solutions first, then proceeded to try and set up their own stores (retail for honestbee, cloud for HappyFresh), but ultimately were unable to keep up with the costs.

Thus far, it appears that the majority of online grocer services that have remained active are run by brands that established themselves as retail hypermarkets first.

Perhaps this trend will work to the advantage of MYDIN too, who newly established its online ecommerce website, mydin.my, as well as its mobile app.

The launch of these B2C platforms is powered by Dropee, a B2B ecommerce solution provider.

According to Aizat Rahim, the managing director of Dropee, the partnership started in January 2021, after MYDIN reached out to TERAJU, the Unit Peneraju Agenda Bumiputera, about looking for a digital solution to transform their business operations nationwide.

And that’s when Dropee came in.

Dropee currently manages over 110,000 businesses on its platform, and more than 26,000 of them are actually purchasing some of their inventories from MYDIN’s B2B warehouses.

“We believe one of the strongest factors [MYDIN] partnered with us compared to other players is because of the way we are working with the retailers as well as the quantity of retailers being served by Dropee,” he elaborated.

Although Dropee has been focused on B2B solutions on marketplace and software enablement, the team realised that for the company to understand the full cycle of the B2B supply chain, they had to work closely with retailers and their customers to understand the movement of goods in the chain.

Furthermore, MYDIN also agreed to promote Dropee’s core offering for businesses to purchase and manage their inventories using the same integrated platform between Dropee and MYDIN.

With all this in mind, Dropee thought it would be one of the best pilot partnerships they could have, with Aizat saying it “makes absolute sense” for Dropee to take up the project.

Building the infrastructure

Dropee’s tasks in the partnership involve building an entire supply chain of operations for MYDIN, managing MYDIN’s own vendors and suppliers as well as managing stock inventories across multiple central warehouses, retailers, and even other marketplaces like Shopee, Youbeli, and more.

Equipping part of its Dropee Direct solution called Dropee Omni, MYDIN is also able to have an all-in-one marketplace inventory sync where users can manage their inventories, sales, orders, and products across different platforms.

Apart from the website, there’s also the matter of the app. Although Dropee does not have an app of its own, the team has built applications to integrate with their core marketplace for clients.

“Most of Dropee’s existing retailers prefer to handle their business operations on a PC rather than a mobile app,” Aizat explained.

“With that said, we understand that, depending on the goals and directions of our clients such as MYDIN, [it’s important that] our system is also capable of building and integrating the app for their internal dashboard management.”

Anticipating the future

While MYDIN is Dropee’s first consumer-facing project, the partnership seems to be off to a great start. However, Dropee also anticipates possible issues down the road such as managing deliveries nationwide.

“As of today on the platform, MYDIN transacts at least around more than 50,000 online orders monthly nationwide, even on the outskirts of Malaysia,” Aizat reported.

“Hence, to manage the vast amount of orders on the platform, we have worked together with MYDIN to integrate with Third Party Logistics (3PL) partners to ensure the goods can be delivered in a timely manner.”

Compared to existing online grocery platforms, Aizat believes that MYDIN’s is different due to the pricing engine the team has specially developed to allow users across Malaysia to get the best prices and bundle deals.

To test the theory, we looked for the same product across various similar online platforms such as Lotus’s, myAEON2go and Jaya Grocer.

In particular, we compared the prices of a 1-litre carton of Marigold full-cream UHT milk. On Lotus’s, it’s priced at RM6.75, while on Jaya Grocer it is RM5.70. On myAEON2go, it’s RM6.65.

Interestingly, on MYDIN, it says the original price is RM6.20 when viewing it from the catalogue, but it has been discounted to RM5.55, indeed making it the most affordable pricing out of the bunch.

While this comparison doesn’t paint a full picture of what MYDIN offers compared to other websites, it does seem like a lot of the items listed are discounted, perhaps indicating the presence of the pricing engine Aizat mentioned earlier.

However, MYDIN doesn’t offer same-day delivery yet, though it aims to do so by the end of the year.

- Learn more about MYDIN here, and Dropee here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: Here’s what IPC’s new work pods can offer mall goers who are also workaholics

Featured Image Credit: MYDIN

Who’s to blame for Temasek’s S$380M loss on FTX? Could the failure have been avoided?

Disclaimer: Opinions expressed below belong solely to the author.

I have to say I’m quite amazed to have witnessed the outpouring of expertise in finance, investment and company valuations over the past week, following the news that Temasek decided to write down its US$275 (S$380) million stake in the collapsed FTX.

Turns out that Singapore is not only packed with financial professionals in the glitzy skyscrapers of the CBD, but every other rambunctious online commenter (be it some no-name individual on social media or a wannabe news outlet that’s trying to be “edgy”, looking for controversy) is surely related to Warren Buffett himself!

I, therefore, assume they all must have heavily shorted FTT tokens, just waiting for the company to collapse, before making off with a handsome profit. No?

Sarcasm aside, however, could the FTX debacle have been avoided? Could Temasek somehow see what no other major company and millions of investors noticed?

The List of Shame

Let’s take a look at some of them, shall we? Let’s see who all those incompetent fools, who didn’t do their “due diligence” and gave Sam Bankman-Fried their money are:

- BlackRock (the largest asset manager in the world, with AUM of US$10 trillion)

- Sequoia Capital

- Softbank

- Tiger Global

- Binance (yes, CZ chipped in early on as well)

…among about 40 investors in total have, over the previous three years, poured US$1.8 billion into FTX.

Now, are you trying to tell me all of these companies and all the people in them involved in valuing literally thousands of businesses they fund with their own and their client’s money, know nothing about due diligence?

That they are incompetent lunatics thoughtlessly throwing money around, particularly to some hippie techie with a haystack for a haircut?

Or, here’s a thought — it is sometimes simply impossible to spot fraud, unless you specifically know what you’re looking for?

Fake it till you make it

Let’s be clear. FTX collapsed because a leaked document from its sister company, Alameda Research, revealed the flimsiness of its balance sheet, which consisted mainly of the FTT token. This eventually prompted a “run on the bank”, as panicked users began withdrawing more money than FTX had on hand, leading to liquidity issues.

The nature of the bankruptcy was, therefore, at least as much psychological in nature, as it was financial.

And to be fair to Fried and his cabal of weirdos running FTX from a penthouse in the Bahamas, the entire crypto environment rests on similarly weak foundations, driven by what people think about cryptocurrencies rather than real use cases driving their adoption.

As far as company evaluation may have gone when Temasek and others put their money in, their primary concern is likely to have been in the growth numbers of the exchange, not in the interrelations between Fried’s companies.

And if it wasn’t for that leak on November 2, FTX may have still existed and happily grown for years, because nobody would have been spooked by what was hiding underneath.

After all, all that FTX effectively engaged in is similar to how entire banking systems function — fractional reserve.

I guarantee you that if deposit holders in DBS, OCBC, UOB (or any bank in the world), descended onto their branches en masse to demand cash withdrawal, each of them would fall within days, because they simply don’t have your money — they lent it out.

In the absence of similarly legitimate products (loans/mortgages) in the crypto space, Fried decided to gamble with customers’ money, propping up his own company, trying to inflate it and his own stature until the returns on investment allow him to pay the shadow debt off.

The gamble failed and he’s now likely to find himself in a barren cell, but it’s important to understand that his behind-the-scenes machinations were most likely invisible to his investors.

You don’t know what you don’t know

Nobody can independently verify that a CEO of a tech company has not installed a backdoor in the system allowing him to withdraw billions of customers’ money without triggering red flags in the accounting department.

Much of the risk in investing stems from the fact that you simply don’t know what you don’t know. You don’t even know if the figures that you are presented are legitimate.

And even if they were audited by someone, you don’t know if that someone is not a part of the scam — as it was the case with Arthur Andersen and Enron, in the US$60 billion bankruptcy 20 years ago.

Enron, lauded by Fortune as the ‘most innovative’ for six years in a row, was audited by one of the largest accountancy practices on the planet and it still turned out its leadership managed to cook the books.

Even if you had access to all of the accounts on the day of your investment, you still have no guarantee that fraud is not going to happen at some point in the future.

Ultimately, you put faith in other people, who come to you with some track record and recommendations from other investors.

Temasek failed to spot the scam just like BlackRock did, just like Masayoshi Son’s Softbank did, or Sequoia, one of the most famous VCs, did. It’s just the risk you have to accept as an investor and diversify your portfolio, so that successful bets make far more than your failures.

Just like Temasek has done for decades:

Over the past two years, its portfolio has grown in value by S$97 billion, and quadrupled in less than 20. Perhaps this should be the headline story instead?

Featured Image Credit: Bloomberg

Also Read: FTX hacker dumps prices of ETH using stolen coins, revealing another vulnerability of crypto