New gacha RPG Reverse 1999 has been getting lots of hype, here’s our early review

Going into Reverse 1999, I confess I was a bit of a hater. I mean, I kept getting blasted with their ads on social media, and as interesting as the premise seemed, any ad would start to get annoying after the fourth or fifth time you’re forced to watch it.

Still, the ads did their job of piquing my interest, so I found myself pre-downloading the game and waiting patiently for the server to open on October 26 at 8PM (MYT).

For those who don’t know, Reverse 1999 is a turn-based strategy roleplay game (RPG) first launched in China earlier this year. The game is centred around the concept of time, and more specifically, travelling back in time.

As the name suggests, something happened in 1999, dubbed the “Storm”. This incident somehow messed with the time-space continuum and since then, the world has been travelling back in time from era to era.

The game seems to have gotten some rave reviews on Reddit, but I couldn’t help but wonder if those reviews were overhyped.

So, if you’re wondering the same thing, here’s my candid review of the game. Keep in mind that there will be some plot spoilers for the first chapter.

The mysterious, cold open

Straight away, the game opens to a girl with a British accent (Cockney perhaps?) talking crazy about music and records while trying to pirate a ship. However, her plans are foiled when some enemy group called the Manus Vindictae begins attacking the ship.

If this sounds random to you, you’re not alone. The cold open of the game made me wonder if I accidentally missed some content, but I actually like that. The confusion kept me on my toes, wanting to learn more about exactly what was happening.

And I will say, it’s refreshing to play as not some random amnesiac or someone who knows nothing about the world that they’re living in. Those plot devices a little too overdone, don’t you think?

The plot unravels a bit more before you get to “name” your character. I put that in quotes because you’re not playing as some kind of nameless traveller, wanderer, or whatever, but an actual fleshed out character that goes by the name of “Vertin”, which I assume is our last name.

(I wanted to name my character Claudia, but apparently there’s an in-game character with the same name, so I surrendered.)

Vertin (the player) is addressed with the vague title of “Timekeeper”. Vagueness seems to be a key component of the introduction, with terms such as “arcanist” and “the Storm” and “the foundation” being thrown about.

I like that the game trusts players enough to allow us to piece the plot together in this manner. Because of that, I find the world building and lore to be very well-done, as in, there were no cringy monologues and lingo-dense texts trying to explain the world the game is set in.

Instead, the plot is cleverly unfolded to the player through Regulus, the trouble-making, music-loving pirate the game opened with.

As an arcanist who just learnt about the conundrum with the “Storm”, Vertin and another character, Sonetto, get to explain the basics of the world to Regulus, simultaneously briefing us (the players) on all major concepts of the universe, too.

Basically, we as the Timekeeper, keep track of the “Storm”. This “Storm” is what transports everyone to another era, and it can’t be witnessed by those who aren’t arcanists.

The Timekeeper gets to witness the “Storm” as it occurs, while other arcanists must return to a safe space in the “Foundation”. So far, no one has been able to brave this storm alongside the Timekeeper, except for Regulus, whom we’ve just met.

I’ll stop there with the plot, but it’s been off to quite the interesting start thus far. There are many more mysteries to explore still, such as what the Manus Vindictae group is, who the people behind the “Foundation” are, and why the “Storm” happened in the first place.

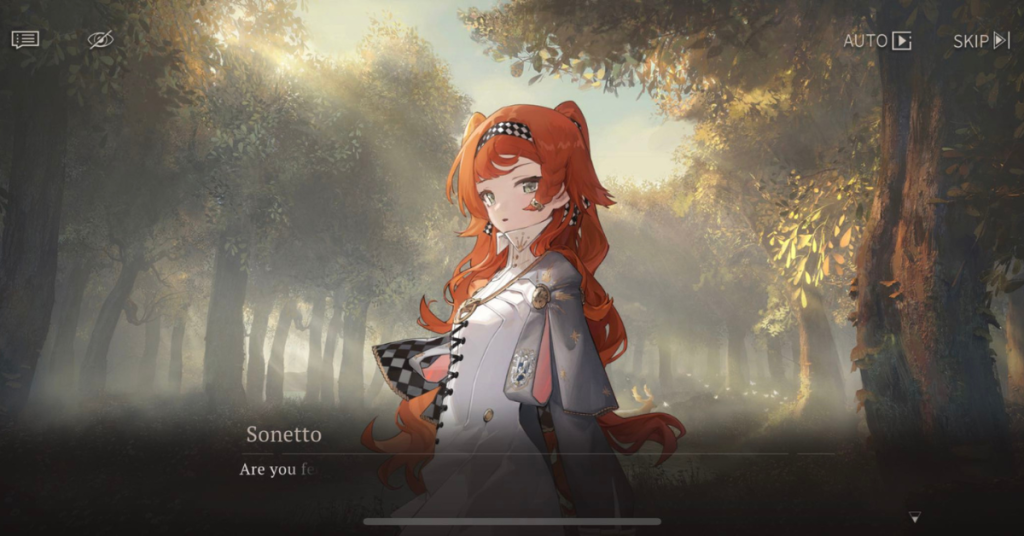

The art, animation, and characters

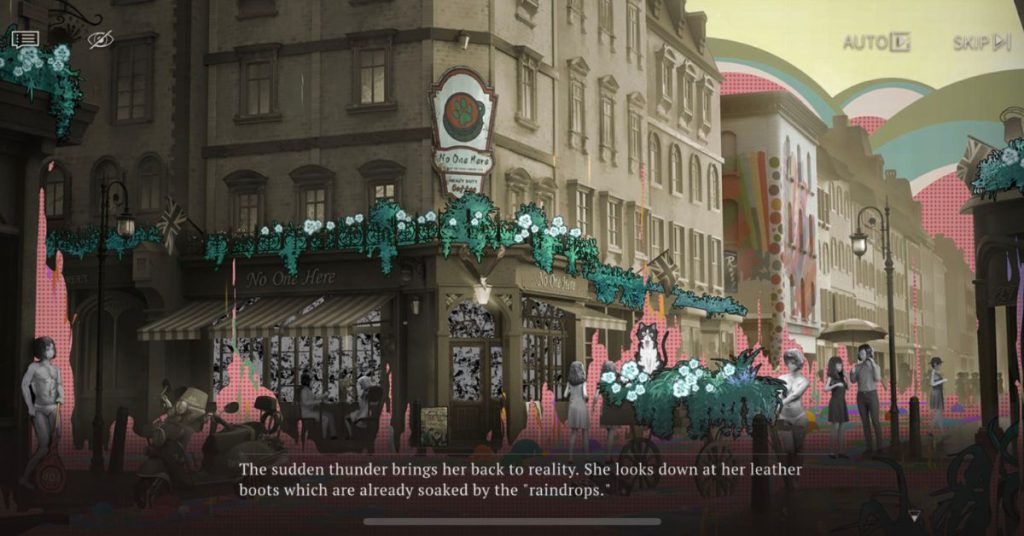

With an anime-esque design to the characters, the art style of the game overall is a little moody in a good way, with great use of colours and lighting.

The backgrounds are all lovely too. The vaporwave-ish art it introduces during the “Storm” is a refreshing change, too. Maybe it’s an allusion to the late 90s glitch art, a clue about why things happened the way it did in 1999?

Instead of static art, the game uses Live2D models of the characters in dialogue scenes, which adds immersion while also looking way cooler. The movements are smooth, and the gestures add extra personality and characterisation.

As for the character designs, I do think they’re charming, but I’m a little put off by how everyone looks to be… a young girl?

On the character development front, though, the game appears to have put a decent bit of effort into fleshing them out, especially if you go and explore their profiles.

There’s some lore behind the gacha mechanics, tied into the plot of the game itself. I’m someone who doesn’t concern themselves too much about summoning characters, so this doesn’t affect how I feel about the game overall.

That said, some seem to be disappointed by the rates, while others have defended it.

So far, the game hasn’t been that generous with its rewards and gifts, and you won’t be able to pull much right off the bat. I’ve only gotten enough so far to do around 15 summons. Gifts from the game have mostly been Dust and Sharpodonty for me, which is used to level-up characters.

The dialogue and voice-acting

In comparison to the plot, I find the dialogue to be just fine, nothing overly witty or memorable. The game lets the player pick dialogue options from time to time, but it’s just for the sake of interactivity. Sometimes the only option is something like “Sure”.

As for the audio design, I do like the foley, though the background music hasn’t been as outstanding. I feel that there’s potential though—when opening one of the event cards (the Roar Juebox), it plays charming swing music characterised by the ’20s.

One of the key pulls of this game, it seems, is the British accents, for whatever reason. The game’s backdrop of England has become quite attractive to players. Some reviewers I came across keep calling the accent “authentic”, which I’m not very sure about.

Given, I’m not like an accent expert so I don’t know whether it’s authentic or not. I can’t find who the voice actors are, so I can’t verify whether the game actually hired local VAs to pull off the accents either.

I will say, I was expecting to cringe more at the accents and voice lines, but so far, it’s been decent, if not good.

Listening to the voice lines from some other characters that I haven’t unlocked online, there’s quite a range of diverse voices. An-An Lee speaks Cantonese and has a Canto accent when speaking English, Bkornblume is… German?

In any case, I do like that the voice actors don’t just have a general American accent, and the diverse accents make the world a bit more fascinating.

You can listen to some of the voices on the official website, under the cast section, to make your own judgement.

The gameplay

Turned-based strategy isn’t my favourite type of gameplay to begin with, so this part of my review is a bit biased.

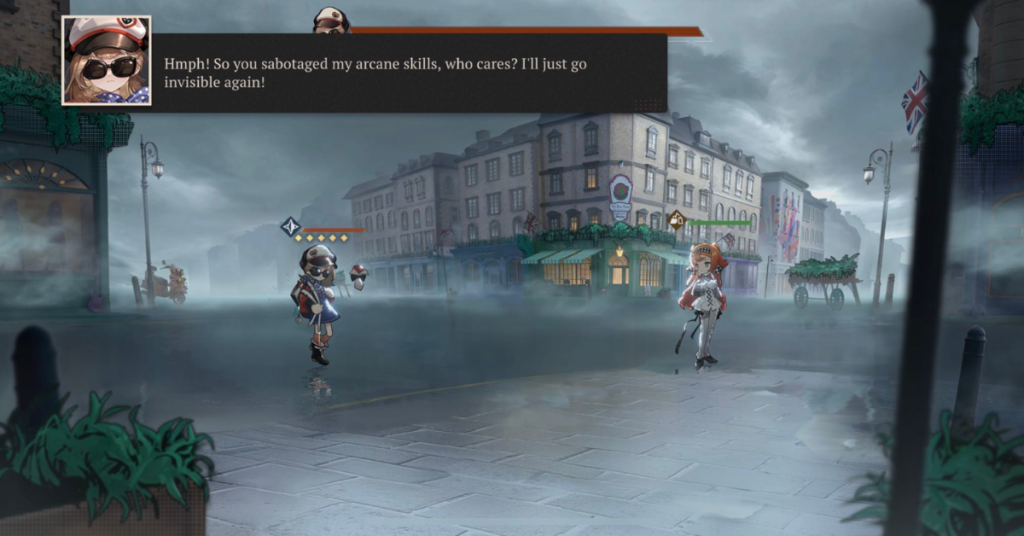

That said, there are mechanics here that I like. Instead of just aimlessly spamming an attack button, actions are done through cards. The same action cards stack if you move them next to each other (which costs action points), or you can strategically play so that similar cards naturally end up next to each other.

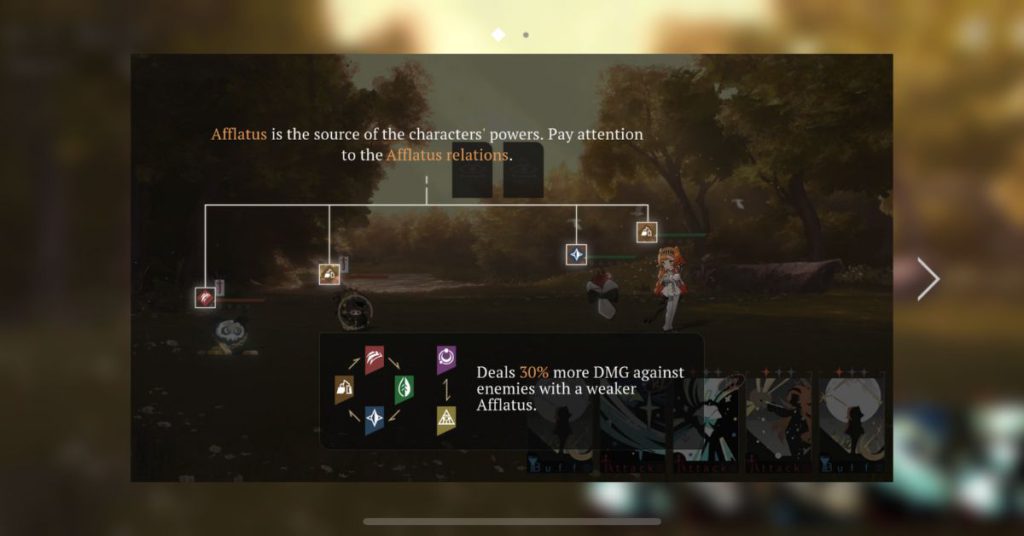

Each arcanist has a special category, or Afflatus, as they call it. There’s Mineral, Plant, Star, and three others that I haven’t learnt the names of. Each category has an affinity against another category, and a weakness to another. It’s like a game of rock, paper, scissors whereby one element dominates over another, and so on and so forth.

Action types include debuff, buff, and attack. There’s also something called Moxie, which if you build up, lets you pull an ultimate move.

For someone who doesn’t like turn-based strategy, I will say that Reverse 1999’s gameplay has been pretty good so far.

My last comment on gameplay is that this is one of those games where the characters become little Chibi models in the action scenes.

On the bright side, instead of a static 2D fight scene, the camera actually moves in and out to give an extra layer of dimension.

The verdict

Overall, Reverse 1999 has been really charming, and I can’t wait to learn more about the universe. The world building is lovely, the lore is intriguing, and the gameplay is decently fun for what it is.

Some may feel that the translated dialogue (Chinese to English) can be janky at times, but it didn’t ruin my experience. Others had gripes with the lack of autobattle, but I haven’t gotten far enough into the game yet to have an opinion on this.

While the characters so far haven’t managed to charm me entirely, I’m excited to meet more people from the cast. I’ve spoilt myself a little bit scrolling through the cast of characters on Reverse 1999’s fandom page, and saw some designs I find fascinating (here, and here).

Also, there’s a character called Medicine Pocket, which makes me laugh. In fact, if you read their original Chinese names, you’ll find everyone has very literal names. Sonetto’s is actually the Chinese phrase for sonnet, which translates directly to fourteen-line poem.

Characters aside, I’m intrigued to explore more of the eras as well as the different areas of the game, while continuing to unravel the mystery behind the “Storm”.

All that said, my mobile gaming habits tend to be more something more mindless, usually as a boredom-killer. For a game like Reverse 1999 where the plot dominates, though, I prefer playing it on the PC.

So, yes, I’ve downloaded the game on my PC and cannot wait to dig into it the rest of this weekend (the data is synced to your account). The question is, will you be partaking?

Also Read: Cybersecurity shouldn’t be an afterthought for your biz, here’s how this laptop can help

Featured Image Credit: Reverse 1999

Learn how to leverage cloud solutions for your biz by joining this free webinar in November

[This is a sponsored article with Time.]

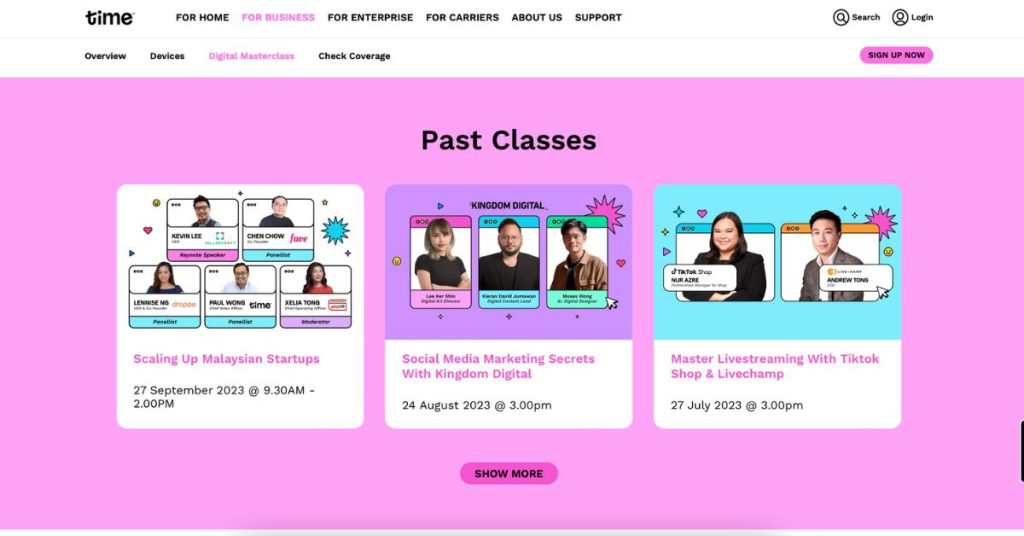

Time Digital Masterclass is an ongoing webinar series by Time.

The free masterclasses cover a diverse set of topics designed to empower SME owners with valuable knowledge for achieving business success in the digital world.

Four classes have been hosted so far this year, with a hybrid event that took place both virtually and physically in September which covered the topic, “Scaling Up Malaysian Startups”.

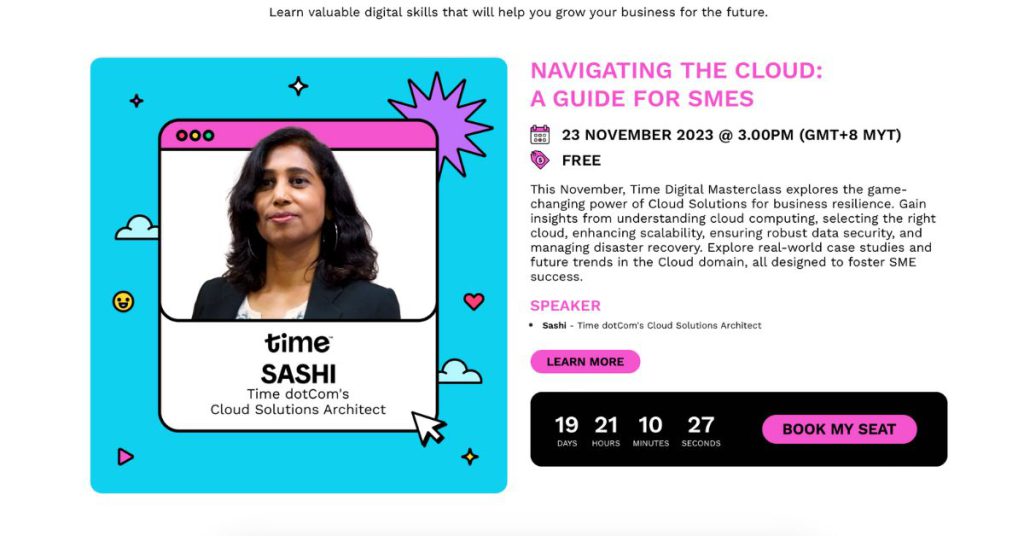

This November 23, 2023, Time Digital Masterclass is back for its new installation which is titled, “Navigating The Cloud: A Guide for SMEs”.

Navigating the cloud space

Cloud services are vital for startups and SMEs, especially when it comes to boosting your business’s scalability and flexibility.

For SME owners, this means that as your company grows or faces fluctuations in demand, you can easily adjust your cloud resources without the need for significant capital investments. It can be seen as a quick and cost-effective way to adapt to changing business needs.

Furthermore, cloud computing can give you and your team the ability to access work data wherever they are, making it easier to employ flexible work arrangements.

In the upcoming Time Digital Masterclass webinar, you’ll learn about how cloud solutions can play a pivotal role in your SME’s growth, starting by picking the right cloud services to suit your unique business needs.

You’ll also get to learn about real-life success stories from SMEs that have benefited from using Time’s cloud solutions, as well as get a glimpse of upcoming cloud trends.

Hear from a seasoned tech expert

Speaking on the subject is Time’s Cloud Solutions Architect, Sashi, with expertise in improving both on-premise infrastructure and cloud technology solutions.

She will discuss how cloud security can enhance data safety for your business and provide disaster recovery solutions for unforeseen events, drawing on her IT experience and knowledge.

So, if you’re curious about getting more insights into how cloud computing can boost your business’s agility, you can sign up for the free webinar here.

- Check out previous Time Digital Masterclass sessions here.

- Read about other Malaysian startups here.

Also Read: Cybersecurity shouldn’t be an afterthought for your biz, here’s how this laptop can help

Featured Image Credit: Vulcan Post

Generali M’sia & UNDP want innovative insurance ideas, winning solutions get up to US$40K

[Written in partnership with Generali, but the editorial team had full control over the content.]

Through their Insurance Innovation Challenge Fund (IICF), Generali and United Nations Development Programme (UNDP) are seeking innovative insurance solutions that will enhance the resilience of SMEs in Malaysia.

A United Nations organisation, the UNDP fights to end the injustice of poverty, inequality, and climate change. Meanwhile, Generali is a global insurance provider that has been active in Malaysia since 2015.

Together through the IICF, they are looking for submissions with long-term sustainable solutions to safeguard SMEs against climate and other risks, be it through scaling up existing solutions, partnering with diverse distribution channels, and integrating new technology solutions.

For example, products can cover stock and machinery, business continuity, staff, specific or multiple risks.

Through an open selection process, the IICF will facilitate and incentivise the development of two or more solutions.

Winning applicants will each be awarded up to US$40,000 including financial and technical assistance to support the development of their proposed solutions.

Beyond that, the winners may be able to access the UNDP’s global presence in over 170 countries as well as its networks. Promising solutions could later be considered for further engagement as part of UNDP’s Insurance and Risk Finance Facility or other UNDP initiatives, too.

How to join

Interested participants wishing to apply for the IICF can submit their application and supporting documents to irff.challenge@undp.org by November 27, 2023.

Eligible applicants must be insurance solution providers, such as insurers, intermediaries and aggregators, insurtechs, distribution channels, and other related private sector actors.

The applicants must also already have an established insurance product or solution that they would modify or adapt to reach SMES.

Some examples of modifications might mean either extending into new geographies, leveraging new distribution channels, or using technologies to scale access and experience.

What they’re looking for

While the main attribute of the solution that the UNDP and Generali are looking for is that it builds SME resilience, the team will also be looking for:

- The introduction of innovative business models, technologies, ideas, or products that specifically focus on SME resilience in Malaysia.

- Demonstration of self-sustainability, achievable through sufficient scaling and increasing efficiency and impact.

- A distribution strategy that isn’t just simply selling insurance in isolation, but rather one that compliments other services provided and needed by SMEs.

- There demonstrable sustainable development goals (SDGs) present.

- The proposed project must have scale potential.

- Innovations should also include a focus on ensuring gender equity.

Submitted applications that meet the eligibility criteria and are complete will then be evaluated by a UNDP Evaluation Panel.

Here’s the breakdown of the evaluation criteria:

| Percentage | Objective |

|---|---|

| 40% | Proposed innovative solution which builds on an existing product or solution (introduction of a new idea that shows development approach and impact, project quality including intervention logic and feasibility, product or service to a target group) with consideration of risks |

| 20% | Experience of management and development team in developing inclusive insurance products |

| 10% | Potential for scale up, replication, and long-term sustainability (financial, environmental, social) |

| 30% | Value for money and cost-effectiveness |

Applications that score above 50% will be evaluated in full to be considered for awarding the project.

Rejected applicants will get a notice accompanied by a short explanation.

If you still have more questions about the IICF, there will be two sessions of Q&A sessions you can ask them at. The timings are:

- October 31, 2023 at 3:30PM

- November 8, 2023 at 3:30PM

You can register to join the October 31 virtual session here and the November 8 one here.

Empowering SMEs

This IICF initiative is a part of Generali’s broader commitment to raise awareness and promote insurance as a key tool to drive financial inclusion among SMEs who are highly vulnerable to risks.

“SMEs account for about 97% of total businesses in Malaysia—they are not only the bedrock of the country’s economy, but also a priority to us at Generali,” said Fabrice Benard, the CEO of Generali Insurance Malaysia Berhad.

According to a press release, Generali has been working with UNDP to develop insurance and risk finance solutions globally since 2022.

Aside from the IICF, Generali and UNDP are also developing a loss prevention framework for SMEs to harness the power of data, awareness, and understanding of risks for businesses in vulnerable communities.

On top of these solutions, there will also be an Asian edition of Generali’s flagship SME EnterPRIZE project, which has already successfully been running in Europe over the past two years.

According to SME EnterPRIZE’s website, the project was designed to promote a culture of sustainability among SMEs with the goal of inspiring SMEs to develop sustainable business models, while rewarding the “best success stories”.

- Learn more about the Insurance Innovation Challenge Fund here.

- Read other articles we’ve written about insurtech here.

Also Read: 6 ways to get the most out of your aircon to comfortably survive Malaysia’s rising heat

Featured Image Credit: Generali / PLM Interiors

Here’s a masterlist of all the tax reliefs individuals can claim for YA 2023 in Malaysia

Tax season will be coming up early next year for Malaysians making an income of at least RM34,000 for the Year of Assessment (YA) 2023.

Those who have received their Income Tax Return (EA) Form can do this on the MyTax portal by logging in or registering for the first time.

Some amendments in tax reliefs were made for YA 2023, and there are new additions introduced too. Claiming these incentives can help to lower your tax rate and pay less in overall taxes.

With that, here’s LHDN’s full list of tax reliefs for YA 2023.

Self, parents, and spouse

1. Automatic individual relief: RM9,000

By filling in the LHDN e-Filing form, you’re eligible for an automatic tax deduction of RM9,000. As the name suggests, this will be automatically done by the system.

2. Further education fees (self): ≤ RM7,000

A tax relief of up to RM7,000 is claimable if you’re paying for your own further education at a recognised higher learning institution in Malaysia. Here are the criteria:

- Any course of study at a Master’s or Doctorate level is eligible for this relief.

- Only courses in law, accounting, Islamic financing, technical, vocational, industrial, scientific, or technology are claimable for undergraduate degrees or lower.

- Any course of study taken for the purposes of upskilling or self-enhancement are claimable, but only up to RM2,000. Such courses must be recognised under the National Skills Development Act 2006.

3. Spouses and alimonies: ≤RM4,000

This relief is claimable only if your spouse has no source of income, or if they opt for a joint assessment in your name. However, if your spouse has a gross income exceeding RM4,000 derived from sources outside of Malaysia, you cannot claim this.

Husbands who are paying alimony to a former wife can claim this relief for the amount of alimony paid, or up to a limit of RM4,000. Only formal alimony agreements qualify for this tax relief.

Medical

4. Medical expenses for parents: ≤ RM8,000

You can claim a maximum of RM8,000 if you’ve paid for your parents’ medical treatment, special needs, and caretaker expenses.

5. Medical expenses for self, spouse, or child: ≤ RM10,000

You can now claim up to RM10,000 for yourself, your spouse, or children undergoing medical treatments for serious or difficult-to-treat diseases. These illnesses include AIDS, Parkinson’s disease, cancer, renal failure, leukaemia, and heart attack.

Vaccinations and fertility treatments (like IVF or IUI undergone by married couples) are also claimable under this category.

Furthermore, up to RM1,000 in relief is dedicated to a full medical checkup, mental health checkup or consultation, and COVID-19 detection test for yourself, spouse, or child.

For YA 2023, the scope has expanded to include intervention expenditure for Autism, Attention Deficit Hyperactivity Disorder (ADHD), Global Developmental Delay, Intellectual Disability, Down Syndrome, and specific learning disabilities.

These are limited to RM4,000 where:

- Diagnostic assessment is certified by a medical practitioner registered with the Malaysian Medical Council

- Early intervention and rehabilitation programme is conducted by a health profession practitioner that’s registered under the Allied Health Profession Act 2016

Disabled persons

6. Equipment for disabled self, spouse, child, or parent: ≤RM6,000

If you’ve purchased special support equipment for yourself, your spouse, children, or parents who are disabled, you’re eligible for tax relief of up to RM6,000.

Disabled individuals would need to be registered with the Department of Social Welfare (JKM) and be certified as OKU.

7. Disabled individual (Self): RM6,000

Disabled persons registered under JKM are eligible for a further deduction of RM6,000 under this relief.

8. Disabled spouse: RM5,000

Those who have a disabled spouse are entitled to a further relief of RM5,000 under this relief.

9. Disabled children

Disabled child relief: RM6,000

Parents with an unmarried child who is physically or mentally disabled, regardless of their age, are eligible for a tax relief of RM6,000. Children must be certified by JKM as a disabled person.

Disabled child aged 18 and above pursuing higher education: RM8,000

Additionally, there’s an exemption of RM8,000 if parents have an unmarried disabled child receiving a tertiary education. This deduction is an add-on to the disabled child relief if they are:

- Pursuing a diploma and above in Malaysia; or

- Pursuing a degree level and above outside Malaysia; or

- Serving under articles or indentures in a trade or profession in Malaysia

Lifestyle

10. Lifestyle purchases for self, spouse, or child: ≤RM2,500

A tax relief of up to RM2,500 is deductible for the purchases of lifestyle equipment for personal use by yourself, your spouse, or children. Items include:

- Purchase or subscription of books, journals, magazines, newspapers, or other similar publications (in the form of hardcopy or electronic) for the purpose of enhancing knowledge;

- Purchase of personal computer, smartphone, or tablet;

- Purchase of sports equipment and gym memberships; and

- Internet subscription

Extra relief for tech: ≤ RM2,500

On top of the lifestyle purchases relief, there is an additional relief of up to RM2,500 for the purchases of a personal computer, smartphone, or tablet.

Extra relief for sports activities: ≤ RM500

An extra deductible of up to RM500 is claimable for expenses related to the cost of purchasing sports equipment, entry/rental fees for sports facilities, and registration fees for sports competitions.

Parenthood

12. Breastfeeding equipment: ≤ RM1,000

Mothers who are breastfeeding a child aged two years and below can claim a relief of up to RM1,000 if they’ve purchased personal breastfeeding equipment.

This deduction can only be made once every two years of assessment.

13. Childcare and kindergarten fees: ≤ RM3,000

Parents with children aged six and below, who are in daycare centres or kindergartens, can claim a tax relief limited to RM3,000.

This deduction can only be claimed by either one of the child’s mother or father.

14. Skim Simpanan Pendidikan Nasional (SSPN): ≤ RM8,000

SSPN (Skim Simpanan Pendidikan Nasional) is a savings plan that encourages parents to invest in their children’s higher education.

Parents who make a deposit into the SSPN account established under Perbadanan Tabung Pendidikan Tinggi Nasional Act 1997 are eligible for a relief of up to RM8,000 for their annual net savings (total deposit in 2023 minus total withdrawal in 2023).

15. Unmarried child under 18: RM2,000

Parents can get a tax relief of RM2,000 for each child of theirs under 18 years old. This deduction can only be claimed by either one of the child’s mother or father.

16. Child aged 18 and above pursuing a full-time education

Child aged 18 and above in Pre-U Courses: RM2,000

Parents can claim a tax relief of RM2,000 for each unmarried child aged 18 and above, who is undergoing preparatory courses, such as foundation, A-Levels, or matriculation.

Child aged 18 and above pursuing further studies: RM8,000

RM8,000 is claimable for parents with unmarried children aged 18 and above if they are a full-time student pursuing:

- A diploma or higher (excluding the above mentioned preparatory courses) in Malaysia;

- Any courses at institutions of higher learning recognised by the Ministry of Higher Education (MOHE)

Insurance and investments

17. Life insurance, EPF, or approved schemes

Life insurance for retired public servants: ≤RM7,000

Retired public servants receiving a pension can claim tax relief of up to RM7,000 for their life insurance premiums or Takaful contributions. Effective YA 2023, those in this group can qualify for EPF contribution reliefs of up to RM3,000 made voluntarily.

Employees’ life insurance: ≤RM3,000

Employees in private and public sectors with no pensions are eligible for a tax relief of up to RM3,000.

Employees’ EPF: ≤RM4,000

Such employees can also claim up to RM4,000 for EPF contributions or other approved schemes. These investments include self-contributions to EPF without employer input.

18. Deferred annuity & PRS: ≤ RM3,000

You are eligible for a tax relief limited to RM3,000 if you’ve made contributions in the deferred annuity scheme or the PRS (Private Retirement Scheme). This relief is in effect from YA 2012 to 2025.

19. Education and medical insurance: ≤ RM3,000

You are eligible for a tax relief of up to RM3,000 if you pay insurance premiums related to education or medical benefits for yourself, spouse, or children.

20. SOCSO & EIS: ≤ RM350

You can also claim a relief of up to RM350 for contributions made to SOCSO (Social Security Organisation) and EIS (Employment Insurance System) for YA 2023.

Local EV expenses

21. Costs related to EV (electric vehicle): ≤ RM2,500

Those who own an EV can claim costs related to EV charging facilities, including installation, rental, hire-purchase of equipment, or subscription fees. This is extended to YA 2027.

-//-

Before claiming the tax reliefs above, remember to keep all proof of spending such as statements, invoices, and receipts. This is to prepare for a possible audit by tax authorities in the future.

Under the tax laws, you are required to keep the records supporting your tax returns for up to a period of seven years.

- Read more about what we’ve written on taxes here.

Also Read: TikTok takes online shopping interactivity to new heights for M’sian merchants this 11.11

AI already makes 4 million decisions at OCBC each day, as the bank adds ChatGPT to the mix

Disclaimer: Unless otherwise stated, any opinions expressed below belong solely to the author.

Starting this November OCBC will be rolling out a dedicated ChatGPT-powered client to all 30,000 of its employees worldwide, following a successful six month trial on a group of 1,000, which concluded last month.

You may be wondering — “so what? Doesn’t everybody have access to ChatGPT anyway?” — and the answer to that is: no.

Big corporations or governments cannot really use OpenAI’s miracle tool as the rest of us would. This includes their staff, who are forbidden from accessing it for work. The reason for that is both privacy and security.

Bank’s employees cannot be transmitting potentially sensitive, revealing data to a server hosting a ChatGPT instance thousands of miles away, typically in another country. This would create a vulnerability for the bank and its clients.

Imagine something as trivial as asking an AI bot to summarise a loan application or an investment proposal, or even just somebody’s lengthy email.

It would require uploading their contents, which may contain names, NIRC numbers, addresses, phones, emails as well as details of a particular decision, to a 3rd party server, controlled by somebody else.

Once this information leaves bank’s premises it could be accessed by unauthorised people and used by someone for nefarious purposes.

At the same time, of course, big companies understand they cannot be left behind. At the very least, AI tools can offer significant productivity uplift for their staff, making many tedious tasks much easier.

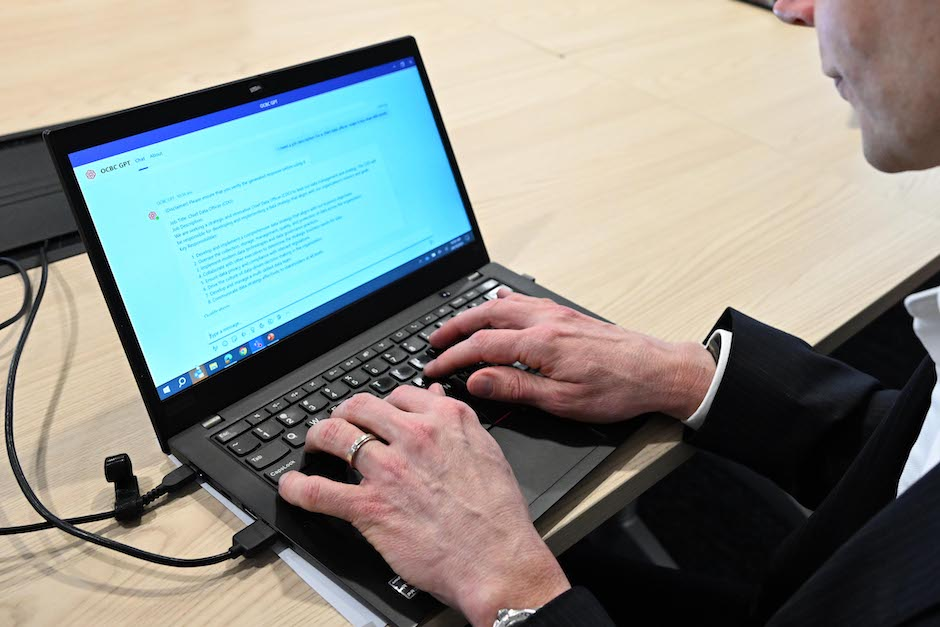

Which is why OCBC had spent six months between April and September testing a locally deployed version of ChatGPT — OCBC GPT — for use specifically by its staff, who reported performance improvements of up to 50 per cent in completing many regular tasks.

“We are excited to be one of the first banks in the world to deploy generative AI tools at scale. We believe that these tools have the potential to transform the way our employees work by automating a wide range of time- consuming tasks, freeing up their time to focus on more strategic and value-added work. This in turn helps us provide better customer service by spending more time building relationships with customers and developing innovative products and services.”

Donald MacDonald, OCBC’s Head of Group Data Office

It is the first bank in Singapore to offer such a tool, launched in cooperation with Microsoft (which, as we know, bought itself a major stake in OpenAI) and one of the first in the world.

Automating decisions

Buried in the press release about GPT launch was an interesting tidbit about the scale of current use of AI at OCBC, where automated systems are already making millions of decisions without human intervention every single day.

“Currently, more than four million decisions – in processes such as risk management, customer service and sales – are made by AI in the Bank daily. This is projected to increase to 10 million by 2025.“

2.5 times more in just two years. Of course banks process tons of data about millions of their customers, so the scale isn’t perhaps quite as shocking. People wouldn’t be able to process such enormous volume of information by hand. But we also tend to forget how much work technology is doing behind the scenes.

Despite being left red-faced after a phishing scam debacle around Christmas of 2021, OCBC appears to be doing well on artificial intelligence, which should prevent such crises from occurring in the future.

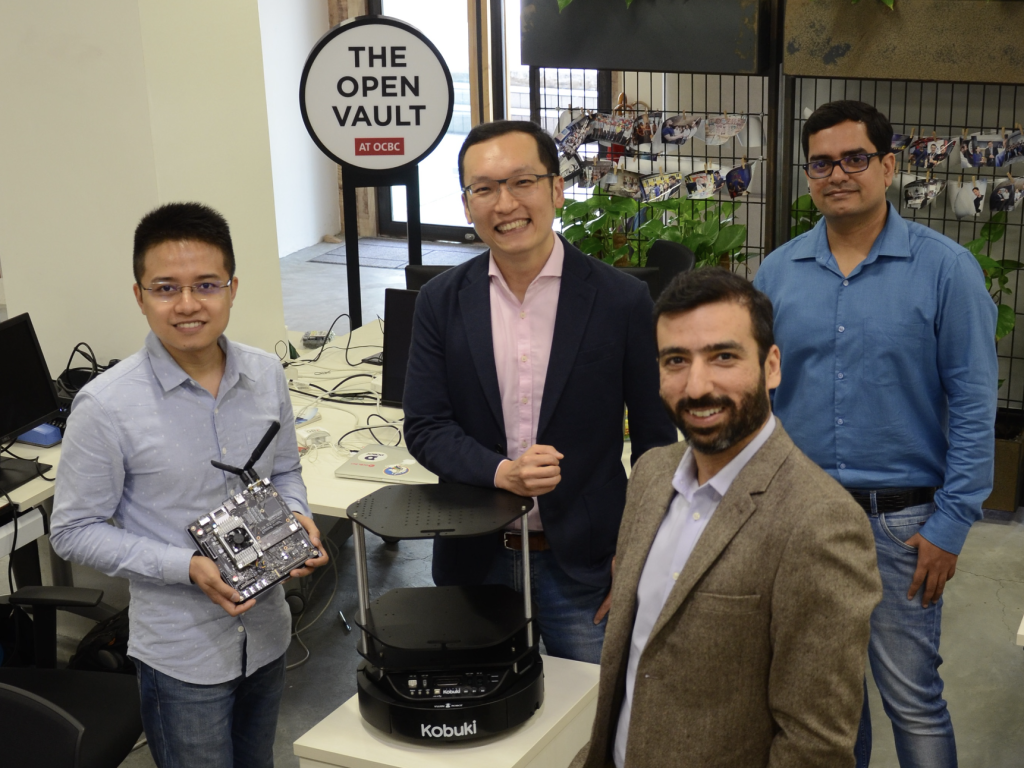

And it’s not like they haven’t seen the future coming, as the bank launched its dedicated AI Lab in 2018, followed by a postgrad AI scholarship since 2019, which has been completed by approximately 300 of its staff already.

The next frontier seems to be employing AI in more customer-facing roles, enhancing digital experience of interacting with banks over the internet, with a reduction of human time required, given that it continues to be the most obvious bottleneck at the moment (as anybody who tried calling any bank, or visiting any branch, can confirm).

Given how human-like AI chatbots already are, we may soon be spared long waiting times for a call centre operator and have access to a dedicated, artificial one of our own, at any time, day or night.

Also Read: ChatGPT designs a new microchip in just 100 minutes, following 125 messages in plain English