On the evening of August 23, 2023, an intimate event called “Valuations and Investors” took place at WORQ’s outlet in Glo Damansara, PJ. Various stakeholders in the business ecosystem showed up, ourselves included.

The main goal (besides mingling with others in the entrepreneurial field) was to learn more about the strategies that go into valuing your company and how to make it more attractive to investors.

The two-hour event was organised by NextUpAsia, a Facebook community for Malaysian entrepreneurs.

While there, we had the pleasure of listening to the insights shared by Jet Lim, a seasoned investor and founding partner of 5X Capital. It’s registered with the Securities Commission Malaysia (SC) and principally engages in private equity, advisory, and private client investment services.

After the event, we decided to ask around and find out what other attendees thought was an impactful takeaway from the session, and here are the lessons they mentioned.

1. There are three factors investment firms typically look at when valuating companies.

Jet explained that investors like 5X Capital would mainly look at revenue, profit, and net asset value (NAV) when valuating (or valuing) a company.

Dictionary time: Revenue refers to revenue multiple. It’s a form of relative valuation where an asset’s worth is estimated by comparing it to the market’s pricing of comparable assets.

Source: Wall Street Prep

Jet shared that revenue multiples are typically for companies with high growth potential but are not yet profitable. A simple example he gave was tech companies that command higher growth rates and generate revenue “very differently”.

In terms of profit, investors would look at the price-earnings ratio or the EBITDA multiple. The latter refers to a company’s earnings before interest, taxes, depreciation, and amortisation.

Jet said that the profit method is more commonly used for companies that have a stable business with consistent profit. Lastly, there’s the NAV method which normally indicates businesses with no strong exit premium, or a down-trending business.

That said, the investor emphasised that there is no right or wrong method for valuating companies, as it all depends on the investor’s expectations.

Speaking to Lily Sim, the founder of a fitness company called Runfiit, she shared with us that knowing the ways investors determine a company’s valuation has given her guidance on how to plan her business further.

“I do think there’s still a lot to work on,” she explained in terms of her own venture. “[Private investment] companies like 5X Capital usually look at SMEs for RM5 to RM20 million revenue.”

“I know that I’m at step one and they’re targeting companies at step five. At least [through this talk], I know the direction that I should be headed.”

2. The process and details of valuating companies should be kept private and confidential, even amongst staff members.

As employees, it may seem a little disheartening to be kept in the dark regarding the welfare of the company you’re working at.

For example, when the founders of the company you’re employed at say they want to raise funds, you may be curious as to how it’s being done.

But after the talk, Daniel Lui (a legal counsel at Beam Mobility) told us that he had a better understanding of what goes on behind the scenes and realised why employers prefer to keep it private.

“Most times, founders will not show you (the employee) the investment deck. You’ll never see it as it’s none of your business,” he explained.

“It’s important information. You don’t want it to be leaked as these are business strategies, how much money you’re going to earn, and maybe more importantly, how much you’re losing now.”

He further reiterated that these particulars should not be aired to just anyone, especially your competitors. “So you keep it between founders and investors.”

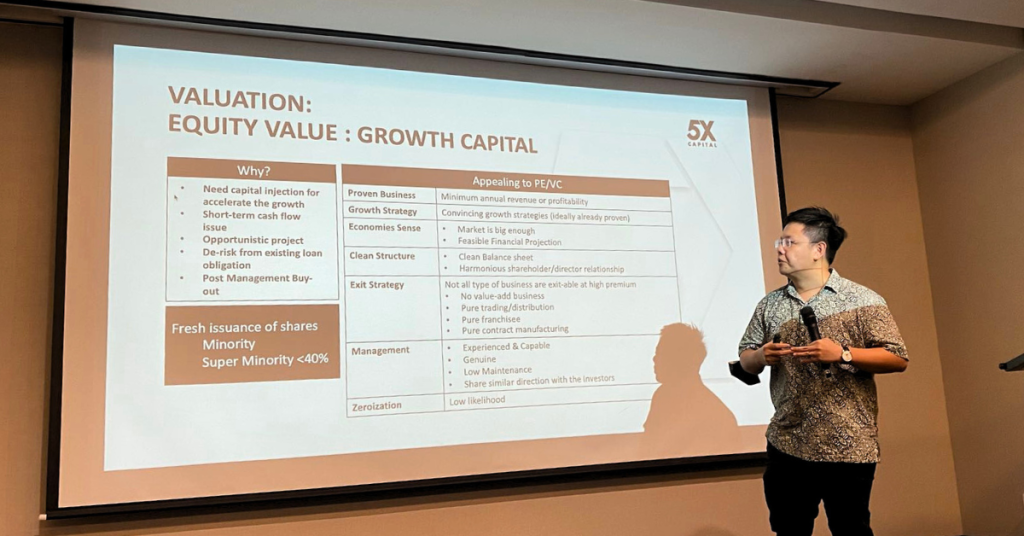

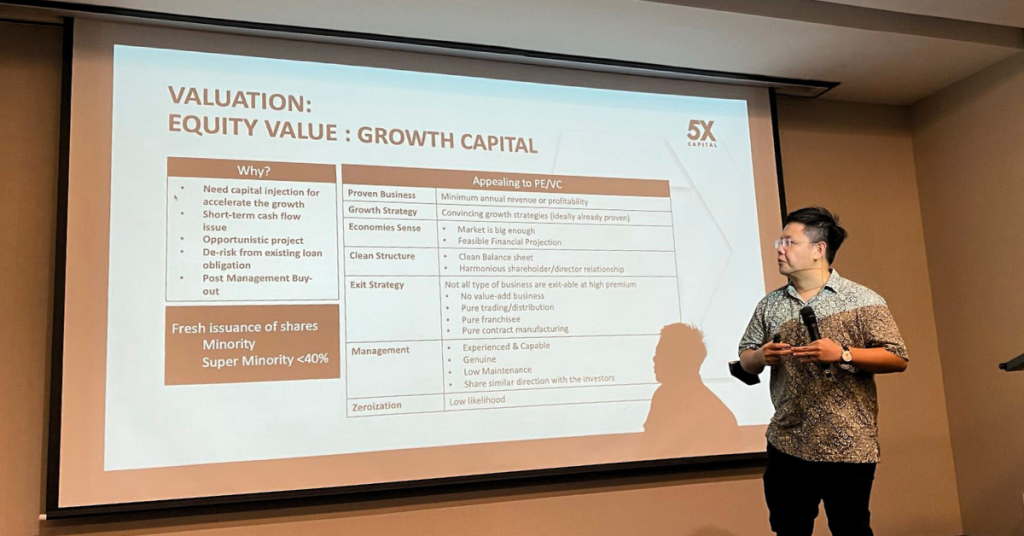

3. Different investment firms approach companies as investments differently.

Based on Jet’s talk about valuations and investors, Daniel Lui (who is also the co-founder of BizVentureHub) found it insightful to see the ways different investment firms approach investments.

(We’re aware that the previous point also came from Daniel, albeit with him answering in a different capacity, but his point here was worth including too, which is why he appears twice in this article.)

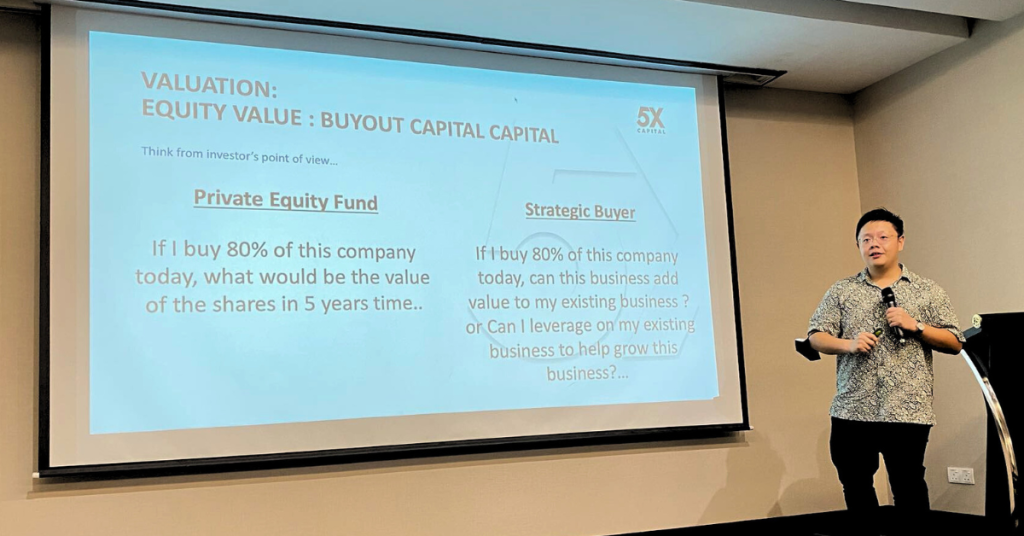

For example, private equity firms and strategic buyers look at exit strategies differently when considering a company’s buyout capital.

To elaborate, private equity firms find exit strategies important as not all types of business are exit-able at a high premium. This includes businesses that operate as pure franchisees, pure contract manufacturing, and pure trading or distribution.

On the other hand, strategic buyers find exit strategies less important, but have greater emphasis on tech companies.

“A lot of times, we as the startup founders want to sell to them, but we don’t know what they want and what they’re thinking. You may think they’re being unreasonable and selfish,” he confided.

“With this sharing, I think founders, startup owners, and business owners can see their options and see how to better structure their business and investment decks to these investors. At the very least, you’ll know the standard and what they will look at.”

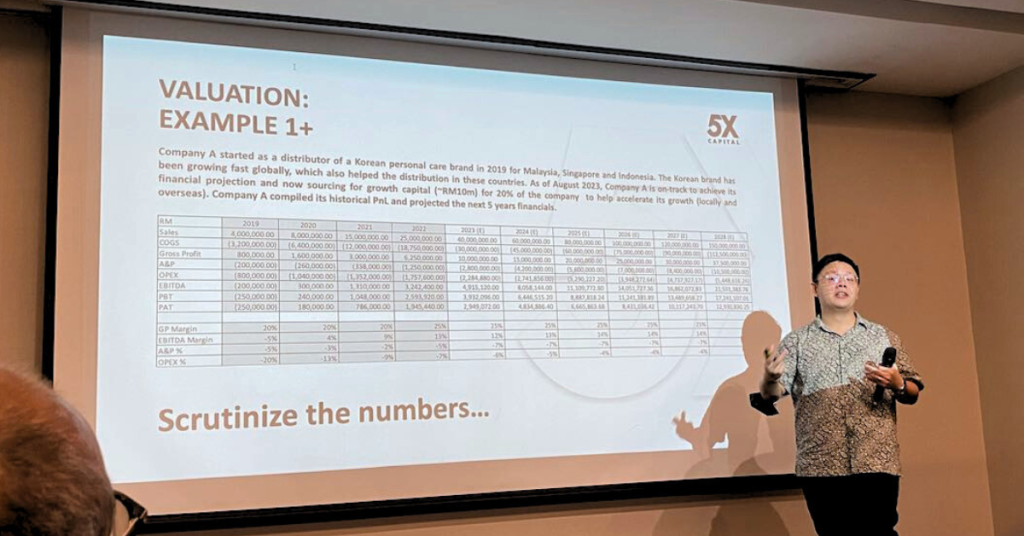

4. It’s crucial to have the right information to back up your company’s valuation claims.

This was the main takeaway by Geoffrey Yeow, the CEO and co-founder of myFITBOX, a local company bringing healthy snacks and drinks to customers conveniently.

“I think it’s a lesson to us entrepreneurs, where when we make up these valuations to really have the numbers to back it up. It’s about data, statistics, doing your homework, and presenting a convincing story to investors as to why the company is a viable investment for them.”

He also found it comforting to know that, “Even if you run out of valuation, they (investors) will go through the books properly and look at your profits and things that you’re suggesting, and check whether that’s actually a viable number.”

As for how it’ll impact his business personally, Geoffrey explained that he’s now aware that he should come up with a growth plan that is more sustainable and convincing. “And to have those details very clearly mapped out before going to investors,” he added.

5. There are various funding options out there for companies to explore when seeking investors.

Speaking to Daniel Cerventus, the host of the event and founder of NextUpAsia, he shared that there are a lot of funding avenues in Malaysia that are usually not explored.

He also mentioned the helpfulness of Jet breaking down the different types of investors that are available in the market. To elaborate, Daniel explained that he, as an occasional angel investor himself, would consider different factors than Jet and 5X Capital when evaluating an investment.

“When I do any angel rounds, I usually won’t have any projections as it’s too early. There’s nothing to project. It’s more of looking at the team, who’s the founders and their capabilities, do we trust them and the team,” Daniel shared.

“Versus someone who invests in a much later stage, they’ll look at all these other stuff that we don’t usually think of at an early stage.”

-//-

Overall, I found the event to be quite insightful as it seems that some of the information shared by Jet isn’t common knowledge, even amongst those within the startup scene.

And from the people I spoke to, the consensus appeared to be that having such business talks benefits local entrepreneurs in planning their next move forward, and improves their chances of scaling up.

Some other topics that the organisation could cover in its future events include accessing capital and government grants, how to get started on practicing ESG as an SME, as well as how to network for entrepreneurial success, because I can see those being the common questions founders may still have.

- Read articles we’ve written about Malaysian startups here.

Featured Image Credit: NextUpAsia