Startup founders, take note: Industry experts reveal investor-attracting strategies

Southeast Asia’s startup scene is booming. Tech startups in the region are slated to be valued at US$1 trillion by 2025, and Singapore is the key driving force behind this boom.

Dubbed “the Silicon Valley of Asia”, Singapore is one of the fastest growing startup communities in the world, with over 4,000 tech startups housed in the city-state.

These emerging tech startups in Singapore collectively raised US$253 million in funding last year, but securing funding is no easy feat.

At the Asia Tech x Singapore 2023’s startup event, Innovfest x Elevating Founders, yesterday (June 8), venture capitalists (VCs) shared what startup founders need to know before approaching investors. Here are some key takeaways:

The importance of the elevator pitch

Lim Ee-Ling, the executive director, market launch, at 500 Global, explains that there are five types of pitches: a thirty-second pitch, a networking pitch, an investor meeting pitch, a demo day pitch, and a sales pitch.

The most crucial pitch to grabbing the attention of investors is the thirty-second pitch. Often referred to as an “elevator pitch”, this should be concise enough to deliver the core essence of the startup within the duration of an elevator ride.

At the thirty-second pitch, the deal there is you’d want to get the investor to be intrigued enough to say ‘tell me more, I want to hear more’.

– Lim Ee-Ling, Executive Director, Market Launch, 500 Global

But when it comes to delivering this pitch, most entrepreneurs tend to miss the mark completely.

Since the thirty-second pitch is constrained by limited time, Markus Bruderer, a partner at Singapore-based business incubator and startup accelerator Antler, suggests a strategic approach to make the most of it.

In this short timeframe, it is crucial to succinctly summarise the problem that your business solves, introduce yourself, and provide a simple overview of the product-market fit. Creating a bit of FOMO (fear of missing out) by highlighting any significant momentum or traction that the venture has gained can also work in your favour.

So overall, keep it very simple and focus more on what you built and what has been achieved, and less around the history, the market — there are a lot of unnecessary facts.

– Markus Bruderer, Partner, Antler

Early-stage startups should focus on the “who’s” and the “why’s”

The stage of the startup also plays a role in shaping the pitch. In the early pre-seed stage, where the emphasis is primarily on the founders, it is vital to highlight their chemistry, determination, and relevant experience, along with some validation.

Jeffrey Seah, a general partner at MSW Ventures, shares the same viewpoint — the “who’s” and the “why’s” of starting up a venture are extremely vital. The investor recounted a couple of instances where founders approached him, solely emphasising the potential returns on investment that he could reap from the startup.

I think [their] mindset was that I’m interested in making money, so [they were] telling me what I could get. But the journey [of starting up a business] is very long, [which is why] I want to hear more about yourself and why you’re doing what you’re doing.

– Jeffrey Seah, General Partner, MSW Ventures

As a startup progresses to the seed stage, demonstrating product-market fit becomes crucial, including showcasing revenue, engagement metrics, as well as active user numbers, among others.

This stage requires showcasing that the business’ product resonates with customers and that it is ready for further scaling, as well as the potential for breaking even, Markus explains.

Additionally, Jeffrey adds that a crucial aspect that most startups tend to miss out in their pitch is quality revenue. Quality revenue focuses on sustainable growth, where customers not only continue to support the company, but also refer others and expand their own engagement with the product or service.

As your company gets bigger, [factors like] why people stick with you, why people give you more money each time, why your customers invite their friends to use you as well, why they upsize a contract with you every year — that’s quality revenue.

– Jeffrey Seah, General Partner, MSW Ventures

With quality revenue, entrepreneurs can give the confidence to investors that they are on the road to self-sustainability.

Distilling impactful data is the key to secure investments

That said, once your startup has gained traction — it’s important to share the data that matters.

The best traction revolves around what drives revenue, profit, and EBITDA margins, as well as paying customers. These tangible metrics demonstrate the financial success and sustainability of your business.

On the other hand, vanity metrics such as monthly active visitors, downloads, or website visits — while they may have their place — do not provide a comprehensive picture of your startup’s performance.

For B2B startups, showcasing reputable clients and partnerships can be significant. However, Ee Ling warns that this may not be sufficient.

These work if you’re early stage and don’t have revenue yet. However, if you put all these logos and you have 20 proof of concepts (PoCs) and [generate] no revenue — that’s going to be a big question mark [for investors].

– Lim Ee-Ling, Executive Director, Market Launch, 500 Global

Hence, when crafting your pitch deck, it’s essential to distill and understand your current position and highlight the most compelling aspects of your business. By focusing on the most impactful data, you can present a persuasive case for investment and demonstrate the potential for long-term success.

Is it important to have the right connections before seeking funding?

A common perception that most entrepreneurs may have is that they’d need personal connections or a warm introduction to access investment opportunities.

For Jeffrey, while a warm introduction is a great way to secure investments, a genuine and compelling conversation starter can also do the trick.

When I look back at my 10 best angel investments, seven of them were actually cold calls. In one instance, a guy followed me to the washroom and tried to make conversation while he took up the cubicle next to me. I did one round of investment with him, and two rounds later.

– Jeffrey Seah, General Partner, MSW Ventures

Markus shared that while early stagers looking to start from the beginning can apply for investment opportunities via Antler’s website, those from different networks or are new to the startup ecosystem can also drop him a LinkedIn request.

One thing you can try is to simply throw up a LinkedIn request, and include maybe a 100-word blurb, (somewhat similar to a thirty-second pitch).

– Markus Bruderer, Partner, Antler

Besides that, he also advises entrepreneurs to gain some visibility through social media channels such as LinkedIn. Sharing their venture’s achievements and discussing their journey as startup founders, among other content, can attract the attention of VCs and other investors.

Connection or no connection, it ultimately boils down to your elevator pitch — is it good enough to capture the attention of investors?

Featured Image Credit: Vulcan Post

Also Read: Startups to unicorns: VCs and execs of S’pore firms share how IP can be a key driver of growth

SM Tharman confirms candidacy for S’pore’s upcoming presidential elections

Singapore is gearing up for a significant milestone in its democratic process as the nation prepares for the upcoming presidential elections.

Amidst mounting anticipation, former Deputy Prime Minister Tharman Shanmugaratnam has officially declared his candidacy, making him a formidable contender in the race for the nation’s highest office.

In a letter addressed to Prime Minister Lee Hsien Loong today (June 8), Mr Tharman announced his decision to participate as a candidate in the upcoming presidential election. As a result, he expressed his intention to retire from politics and resign from all his government positions.

Mr Tharman, 66, stated his plan to relinquish his membership in the People’s Action Party (PAP) and step down from his roles as Senior Minister and Coordinating Minister for Social Policies on July 7, which is a month from the day of the letter.

He explained that this timing allows him to fulfil his existing commitments both domestically and internationally, while also ensuring that proper arrangements are made to ensure the continued welfare of his constituents in Jurong GRC for the remainder of the electoral term.

This announcement comes after President Halimah Yacob said on May 29 that she would not be running for a second term.

Tharman was first elected in Parliament in 2001

Known for his astute leadership and extensive experience in public service, Tharman brings a wealth of knowledge and expertise to the table.

He has a notable political career, beginning with his election into Parliament in Jurong GRC in November 2001. Since then, he has been successfully re-elected four times.

Currently, Mr Tharman holds several prominent positions, including Senior Minister since 2019, Coordinating Minister for Social Policies since 2015, and chairman of the Monetary Authority of Singapore (MAS) since 2011. He also serves as the deputy chairman of the Government of Singapore Investment Corporation (GIC) since 2019 and chairs its Investment Strategies Committee.

In his previous roles, he has served as Deputy Prime Minister, Finance Minister, and Education Minister, showcasing his diverse expertise in various sectors.

Before entering politics, Mr Tharman spent the majority of his professional career at the MAS, gaining valuable experience in the financial sector.

Tharman’s decision to run for the presidency has not come as a surprise to many. Over the years, he has garnered widespread support and admiration from Singaporeans across all walks of life. His commitment to social welfare, economic development, and inclusivity has resonated with citizens, making him a popular figure among voters.

With the presidential elections now less than three months away, Singaporeans are eagerly anticipating an engaging and substantive campaign. The position of the President in Singapore is largely ceremonial but holds significant symbolic importance. The President plays a crucial role in upholding the integrity of Singapore’s democratic institutions, acting as a unifying figure and safeguarding the nation’s stability.

The Elections Department will oversee the smooth running of the electoral process, ensuring transparency, fairness, and adherence to the highest standards of democracy. Singaporeans are encouraged to actively participate in the elections, exercise their right to vote, and play a crucial role in shaping the future of their nation.

Mr Tharman’s decision to run for the presidency adds a new dimension to the electoral race, and his candidacy promises to stimulate healthy debate and generate fresh perspectives. The nation eagerly awaits the campaign trail and the eventual election results, as Singapore charts a course towards a future under the stewardship of its next President.

Featured Image Credit: Munshi Ahmed | Bloomberg | Getty Images

Also Read: S’pore’s eighth president Halimah Yacob announces decision not to stand for re-election

Cash flooding S’pore forced DBS to lend MAS S$30 billion as banks run out of investment ideas

Disclaimer: Opinions expressed below belong solely to the author.

Here’s some good news for borrowers. According to the latest report by Bloomberg, banks in Singapore are so flushed with cash from deposits pouring into the city-state that they no longer know what to do with it.

This forced the country’s largest bank, DBS, to offload S$30 billion to the Monetary Authority of Singapore (MAS), as admitted by CEO Piyush Gupta during an analyst call (transcript here) last month.

We are not finding enough opportunities to put the money to work and instead have lent S$30 billion to MAS.

– Piyush Gupta, CEO, DBS

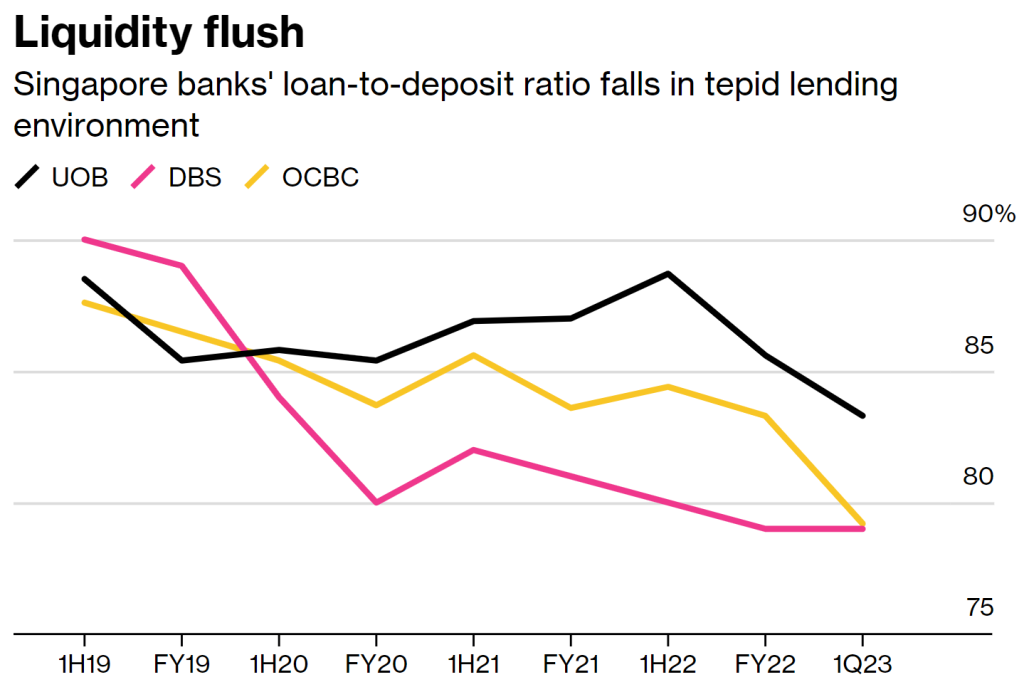

DBS isn’t the only bank afflicted by this “curse of abundance”, as loan-to-deposit ratios have fallen precipitously for all local banks, down from nearly 90 per cent prior to the pandemic, to barely 80 per cent in 2023, driven mainly by international capital and wealthy individuals fleeing to the safety Lion City offers.

Image Credit: Bloomberg

The basic mode of operation of a bank is to take in deposits — in exchange for interest rate payments made to the depositor — and then lend the money out at a higher rate and collect the difference as profit (roughly speaking).

Aside from a small fraction kept in cash for anybody willing to take theirs out, most of the money banks have on their balance sheets is employed somewhere, doing something, yielding a return.

If it doesn’t, it becomes deadweight that earns zero — and zeros in finance are only accepted when they come in a long line, following a positive number at the front.

That’s why “lending” to the central bank by using many of its financial instruments is still a better deal in comparison, though some distance from annual 3+ per cent on mortgages to as much as 27 per cent banks charge credit card holders.

Borrowers rejoice! (sort of)

DBS declined to provide more details about the conditions of the “loan” to MAS when queried by Bloomberg News, but it is clearly a tool of last resort, as more money is made by lending to businesses and individuals.

What it does mean for you, however, is that Singapore is, relatively speaking, one of the best places to get a loan anywhere in the world right now.

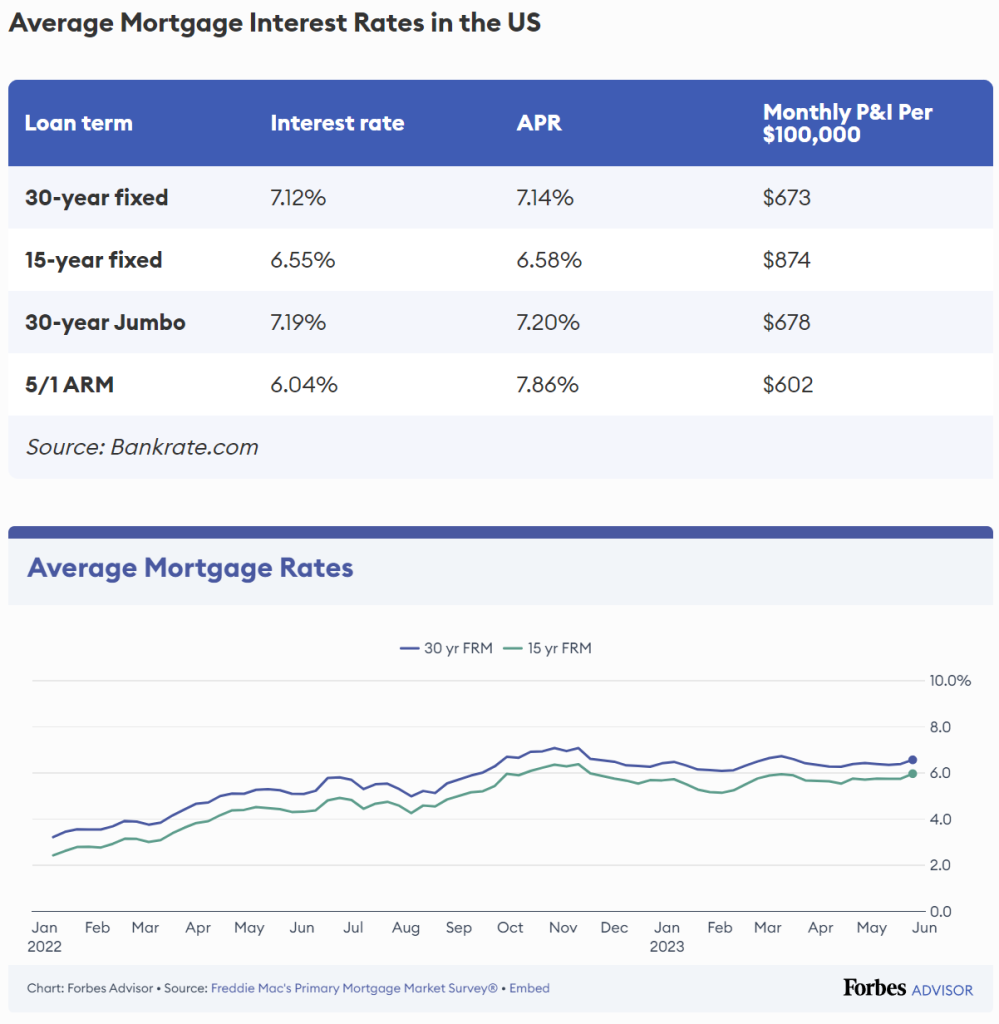

With interest rates on mortgages roughly around 3.5 per cent, the city-state compares favourably to most developed countries.

Of course, it’s a far cry from cheap lending of the pre-pandemic era, when global rates were hovering close to zero — and you could buy a property with financing costing you just around one per cent per annum.

That time may not come back soon, though, and three per cent (with some change) still looks mighty attractive compared to about six per cent in Australia and the UK, or over seven per cent in the USA.

Why aren’t loans even cheaper?

If it’s so difficult to put money to work, then you might be wondering why loans aren’t even cheaper.

If banks were able to do as little as one per cent per year as recently as 2021, why can’t they drop their rates now, when they’re struggling to make any return?

There are a few reasons for that, of course:

- The main one is that interest rates in Singapore are not set by MAS, but rather by the free market which is, in turn, dependent on the prevailing interest rate tendencies abroad. That’s why even central bank’s facilities are priced according to those rates, which takes us to the second point…

- Risk. Housing loans are generally more risky than interbank trades or central bank’s facilities (ie. it’s far more likely that a homeowner runs into trouble paying off his debts). So, his loan has to be priced accordingly, above the rates used in the safest transactions. And his ability to repay his obligations is adversely impacted by…

- Inflation – which is really a double whammy. Firstly, it erodes the value of money, that the bank must try to compensate for (each dollar you borrow will be worth less with each year of high inflation). Secondly, it makes the risk of the borrower defaulting on his debt higher (rising prices eat into incomes).

Paradoxically, then, unless we have to endure another period of meagre economic activity, akin to that following the meltdown of 2008/09 (which had kept interest rates very low for over a decade), then we can’t really hope for borrowing to be as cheap as it was then.

It was a great time for Singaporeans, as the country had been doing very well compared to the rest of the world — while reaping the added benefit of cheap borrowing, given how low interest rates were everywhere else.

Now, despite the change for the worse, the Lion City is still in a better situation than almost everybody else is — so much so, that money keeps flooding its shores, overwhelming local financiers who simply don’t know where to put it to profitable use.

And as problems go, this is a good one to have.

Featured Image Credit: Reuters

Also Read: Singapore attracted S$140 billion from abroad thanks to its successful handling of COVID-19

This Johorian engineer has created a local version of Tide Pods that’s also eco-friendlier

When I was studying abroad and living in college dorms, Tide Pods were my saviour. Its compact and 3-in-1 nature meant that I didn’t have to lug bottles of detergent and softener when doing my laundry in the basement.

For those who have never heard of it, Tide Pods are a brand of 3-in-1 laundry capsules that you can easily toss into laundry machines alongside your clothes.

While Tide Pods don’t seem to be readily available in Malaysian supermarkets, other brands of such capsules have made their way onto our shelves, whether that be physical ones or online.

One local brand that’s pursuing this idea is The Laundry Pods.

Spinning into entrepreneurship

It was started by Johorean Kim Loom Low who used to travel to Singapore for his engineering job.

The idea for The Laundry Pods came to him last year when the borders reopened and he was able to return to JB.

Having studied in Melbourne and lived in Singapore, he had grown familiar with laundry pods and sheets. Yet, when he moved back to Malaysia, he found out that there weren’t many choices for such products.

Moreover, the products available lacked a sustainable edge, something that laundry capsule brands overseas have already been pursuing.

Seeing a gap in the market, Kim jumped on the opportunity to work on it on top of his full-time job as an engineer.

Although he shared that it can be very time-consuming and tiring, he believes in the idea enough to continue pursuing it.

Developing the perfect pod

Going into this, Kim wanted to do two things—provide a new way of doing laundry while delivering it in a sustainable way.

Addressing the first point, he looked at a few categories of detergent products—tablets, laundry sheets, and pods.

“I chose the one I’m more familiar with, which are pods,” he said.

Whilst researching the market, Kim looked at competitors such as Clean Conscience and Method, which are Singaporean brands. He also looked at big brands like Tide Pods.

Eventually, he determined the three-chamber pods work the best in most conditions, not just in terms of pricing but also from a marketing perspective.

One chamber would include detergent and fragrance. Another would contain the softener. Finally, the last chamber would contain the stain remover and the surfactant, which is where the bio-enzyme comes in.

“Natural bio-enzymes are the special ingredient found in premium detergents like Dropps. It costs a lot more,” Kim explained.

A load of advantages

Compared to traditional detergents, Kim argues that pods come with a few advantages. First is the convenience, of course.

“Imagine if you are a college student and must go down the laundromat downstairs to wash your clothes, but you have to carry huge bottles, and not one, but two—detergent and softener,” he said. Yeah, I’d be doing laundry once in a blue moon then.

Convenience aside, there’s also the fact that the capsules contain pre-measured amounts of detergent and softener used. This means users aren’t over- or under-pouring the amount of detergent, which would affect clothing in the long term.

Kim was also particular about the selection of the scents. His brand offers unique scents such as Pink Sakura (peach), Blue Ocean (woody), Green Botanica (herbal), and Golden Petals (floral).

The Laundry Pods is supposed to be eight times more powerful compared to normal detergent, something that Kim claims has been tested by a third-party lab.

He shared that using one capsule of The Laundry Pods, which contains about 5ml of detergent, can have the same cleaning power as 40ml of normal liquid detergent.

Other than these pods, he also plans to roll out other solutions such as subscription plans.

All in on sustainability

Another thing that The Laundry Pods wanted to address is sustainability. This doesn’t just mean the core product should be biodegradable, but also that the packaging should be environmentally friendly.

Kim’s criteria were that the products must be in bulk containers with no plastic packaging during transportation. Secondly, these 3-in-1 pods must be bio-degradable.

Those who are familiar with laundry pods will know it typically comes in plastic containers because of the fragile nature of the pods. Manufacturers typically opt for this so they won’t have to bear the responsibility of the pods bursting during shipping.

Thus, finding a manufacturer was the most difficult part for Kim. Packaging aside, he shared that manufacturers in Malaysia currently do not have the capacity to produce triple-chamber pods.

Plus, most ingredient suppliers are focusing on synthetic chemicals rather than the bio-enzymes he’s looking for.

“So, I have no choice but to go to the global manufacture hub, China,” Kim said.

He eventually found a trustworthy manufacturer that produces OEM products for numerous global brands, including sustainable ones. It was more expensive, but it was a price he was willing to pay.

For packaging, he settled on non-plastic laminated art card boxes which are rigid and recyclable, and for the brand’s starter packs, reusable canvas bags are used.

“We are currently working on other packaging options with reusable purposes like glass or cloth bags, so stay tuned,” he added.

Kim has also ensured that the brand uses courier bags made from oxo-biodegradable materials which can break down safely and naturally after usage.

Is Malaysia ready for this?

While writing this, I recalled a local brand of laundry pods I encountered in the past called Podla. Searching it up again, it seems to be inactive, at least on social media.

This begs the question, are Malaysians ready to switch from the kinds of detergents they’re familiar with, be it liquid or powder, to opt for the pod option?

Looking at the United States, Tide Pods were originally launched in the 70s. But, it was only in the 2010s that its sales picked up again.

This history is something Kim is familiar with, too.

“Part of the reason is their marketing strategy,” he deduced. “Just like air fryers nowadays, which is starting to become one of the must-have items in the kitchen.”

Since The Laundry Pods is targeting Millennial and Gen Z consumers, who are typically more open to new, innovative ideas, he thinks it shouldn’t be an issue.

“Most of my customers belong to this group of people,” Kim said. “In some years, they will become mums and dads in a family and can pass on the valuable message of laundry pods to the next generation and expand the market coverage and awareness.”

Yet, laundry pods are not cheap. When compared to conventional detergents, these pods are more expensive by the load.

Kim agreed, acknowledging that pods are certainly more expensive than other forms of detergent. However, everything comes with a price tag.

“If the pods can out-perform or bring more benefit to the consumer compared to other forms of products, I believe that consumers will see the value in it,” he said.

- Learn more about The Laundry Pods here.

- Read other articles we’ve written about Malaysian startups here.

Also Read: Role-play as Friends characters & gossip over endless coffee at this coworking pop-up in KL

Featured Image Credit: The Laundry Pods / Vulcan Post

How Econsave grew from a sundry shop to a nationwide chain that rivals names like Mydin

When talking about neighbourhood grocery stores, there are usually a few stores that come to my mind, such as 99 Speedmart, Giant, and Lotus’s.

But in the list is another established yet lesser talked about store that was made for the people—Econsave.

A quick look at its start

Before there was Econsave, there was Rong Long, the sundry shop.

According to CPP Wealth, the wooden store set up in Port Klang was less than 200 sq ft, but it was through this humble shop that the Lai siblings (four brothers and a sister) got their first taste for business.

They grew up helping their father, Lai Poh Thian, with the grocery shop he opened in 1955. It took 14 years of saving up on a labourman’s salary to set up the business.

Their determination to expand the local mum-and-pop shop led them to pursue a tertiary education in business abroad.

While in Australia, the supermarkets there left a deep impression on the brothers. So they planned to bring the modernised concept home and apply it to Rong Long.

On October 8, 1993, Econsave’s first store opened in Pekan Kapar, Klang, and it’s still standing tall today, Econsave’s website showed.

The brand’s name is actually a portmanteau, combining the words “economical” and “(providing) savings” together. Their tagline, “bandingkan harga kami (compare our pricing)” is their way of promising low prices to consumers.

With that as its USP, one company that Malaysians might (and have, which we’ll get to later) put in the same box as Econsave is Mydin.

Cut from the same cloth

Mydin is a local brand that has a similar origin story to Econsave.

They both began as small wooden shops, were an expansion of an old family business, and more importantly, are known for their affordability.

And unlike bigger retail supermarkets, the two brands are focused on making it easier for local communities to shop, regardless of one’s income bracket.

This can be seen from the strategic areas where their stores are located. Both Econsave and Mydin’s outlets are largely in townships, though the former occupies more real estate.

Econsave has 88 outlets as of July 2022 throughout Malaysia, while Mydin has 39 outlets and is only available in Peninsular Malaysia.

This isn’t to say Econsave or Mydin is not available in cities. But for the most part, I believe they serve a crowd that’s looking for an inexpensive shopping experience.

So the target demographic is quite similar and makes them business competitors.

From my observations, it seems like you won’t usually find a Mydin and Econsave outlet in the same areas.

Based on what I see on their sites, the range of items being sold at both stores is also similar, with everyday necessities all under one roof—food produce, health and hygiene products, as well as casual wear.

But not quite two peas in a pod

However, some key differences are I’ve noted between the two brands.

For instance, Mydin is much more focused on its aesthetic appeal compared to Econsave. I find its signage looks more polished and its outlets appear to have better upkeep. Overall, its appearance seems neater.

On the other hand, Econsave seems more approachable and retains its mum-and-pop shop look. To me, it’s like your local kedai runcit in the form of a larger supermarket. It’s reliable, cosy, and the prices hardly disappoint.

Plus, while it may lack a strong online presence, I argue that it makes up for it with its number of visible outlets, which some might argue is even better for sales conversion.

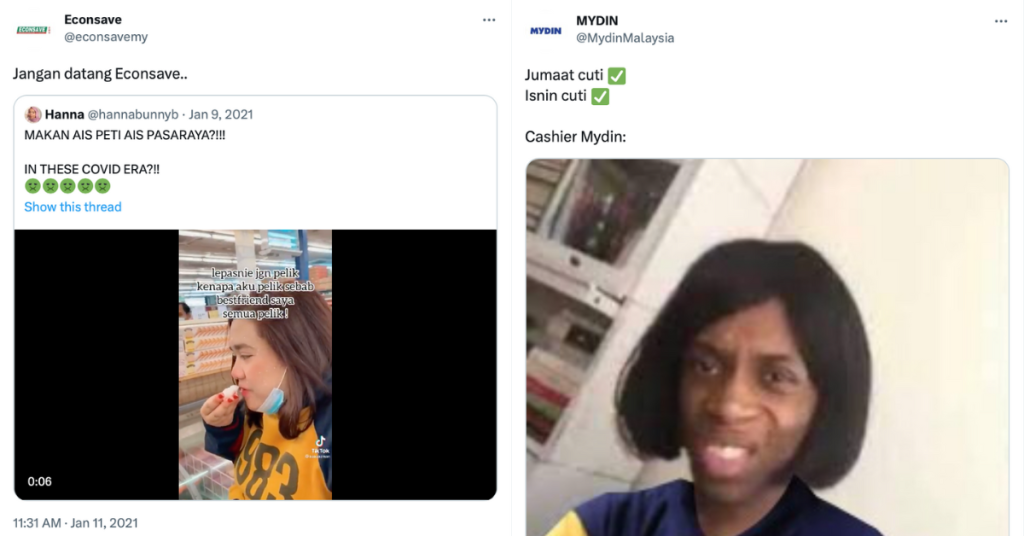

While the two stores are targetting similar crowds, there are still contrasting niches. Taking a look at each brand’s online presence, I would say that Mydin targets a more tech-savvy crowd.

Mydin is more active online and frequently creates content by hopping onto the latest trends. In fact, its social media pages (usually Twitter) have gone viral a couple of times due to its relatability.

Not only does its marketing strategies involve social media, but the brand also provides an online grocer.

Conversely, Econsave seems to use more brochures to entice consumers to visit their physical stores. In-store promotions are frequently updated on its social media pages and distributed through physical catalogues.

The brand has tried to create a sassy personality for its Twitter channel, but it’s never popped off the way Mydin’s has.

Is there a “better” brand?

The similarities and differences between these two brands have long been a discussion among Malaysian households.

Last year, a netizen brought his observations and experiences online, which actually garnered a reply from Mydin’s CEO.

The tweet mentioned that Econsave’s items were cheaper than Mydin. The Managing Director of Mydin then replied with an explanation of how Mydin ensures its prices remain competitive, which includes checking out Econsave’s prices too.

Seeing that both brands have enjoyed quite a long lifespan thus far, I think that they are able to co-exist as rivals, serving hyperlocal communities.

With groceries being a basic necessity for everyone, I believe there is ample market share for Econsave and Mydin.

Also Read: When not cooking at a Michelin-starred spot, this M’sian is designing Japanese chef knives

Featured Image Credit: Econsave

ZUS Coffee’s COO spills the beans on how the local chain expanded to 225 outlets in 4 yrs

For many of us including myself, coffee has turned from a luxury to an everyday necessity.

In my teenage years, a decent cup of coffee could only be found at either a big international coffee chain or at one of your favourite neighbourhood cafes.

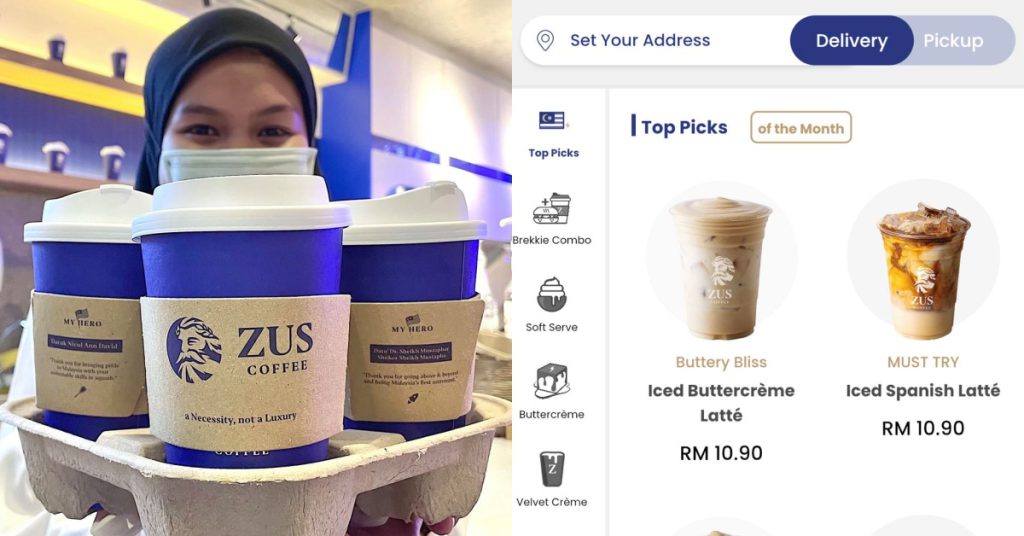

However, in recent times, local chains have exploded onto the scene, and have replaced overseas brands as Malaysians’ favourite coffee spots. One prime example is ZUS Coffee, which now has over 225 outlets across Malaysia.

To find out more on how the brand has managed to achieve such rapid expansion, we reached out to ZUS Coffee’s chief operating officer, Venon Tian.

Turning a luxury into a necessity

In an interview with Vulcan Post, Venon shared that the founding team behind ZUS Coffee is a group of eight co-founders, each with a unique background and range of experiences.

“Their collective wisdom reflects a broad spectrum of expertise in coffee, e-commerce, finance, and marketing,” he said.

Prior to the start of ZUS Coffee, the founders had careers in a range of industries but despite their diverse backgrounds, they found common ground in their passion for coffee and entrepreneurship.

“They believe in the value of quality coffee and were motivated by the idea of making it more accessible to everyday people. They saw the cost of a good cup of coffee as ludicrous and saw a clear opportunity to make a difference in the market,” said Venon.

The founders, who relied heavily on coffee to fuel their everyday hustle, were often frustrated by the constraints of price, location, and time associated with getting a decent cup of coffee.

They also believed that high-quality coffee available elsewhere often carried a hefty price tag, while more reasonably priced options were typically instant or canned varieties that didn’t quite do the trick.

“Recognising this gap, the hands-on entrepreneurs decided to fill it themselves by creating a brand that offered good coffee at an accessible price point and at various locations.”

The local coffee scene has long been dominated by international coffee brands like Starbucks and Coffee Bean, but Venon stated that ZUS Coffee’s objective isn’t quite the same.

“Our mission with ZUS Coffee was always distinct—we wanted to make specialty coffee accessible to everyone. While they provide a ‘third place’ for customers, ZUS Coffee focuses on treating coffee as a daily necessity,” he added.

One way of doing that was by…

Infusing technology and coffee

The cofounders didn’t just want to make it just an ordinary cafe chain, instead, they used their expertise in tech to create the ZUS app first, which allowed customers to place their orders with ease.

The ZUS app proved to be a gamechanger which they discovered upon opening their first outlet in Binjai, KL back in 2019.

“The app, which offered delivery and pickup options from day one, became a hit among the coffee lovers in the office areas nearby.”

As such, ZUS Coffee brands itself as a tech-driven coffee chain which is meant to reflect how they have integrated technology into its operations.

To date, Venon shares that the ZUS app has facilitated and delivered over 36 million cups of coffee so far and allowed them to better understand their customers’ behaviours and taste preferences.

“With this data, we can be exactly where coffee drinkers need us, serve what they prefer, and reward them in ways they appreciate through our loyalty programme.”

Moreover, he believes that being tech-driven reflects their willingness to embrace technology in finding superior and faster solutions to problems.

Currently, they’re exploring AI solutions within the app to enhance customer service and to achieve instantaneous response times for their customers or baristas who need assistance.

Venon also stated that their infusion with technology is also their distinguishing factor when it comes to comparisons with other coffee chains such as Gigi Coffee and Bask Bear Coffee.

“(Particularly in) the depth of our understanding of our customers,” he added. “The technology we employ enables us to get much closer to our customers, which aids in product innovation, and determining the most convenient purchasing channels for our customers.”

Understandably though, not everyone would like to have a separate app just for enjoying a coffee, and that would be where other local coffee brands come in to serve them.

Coffee runs through their veins

The initial menu featured staple coffee-based drinks alongside a few signature flavours such as ZUS Gula Melaka Latté and Thunder, both of which remain customer favourites until today.

“These options were designed to ease the entry for those who appreciated coffee but found its bitterness a barrier,” explained Venon.

Co-founder Terence Ho, who is also ZUS Coffee’s Head of Barista, brought his experiences in cafe management as both a barista and a cafe owner to perfect the art and science of coffee-making.

“From the opening of our first outlet in 2019, he worked hand-in-hand with the other founders to understand the nuances of operating a café chain.”

Keeping it brewing

Reflecting on ZUS Coffee’s growth so far, Venon expressed his disbelief.

“Honestly, we never anticipated such rapid expansion. However, within our first year of operations, we realised we had tapped into a pressing need among coffee drinkers.”

As a testament to their rapid growth, Venon shared that ZUS Coffee achieved 7.5x and 3x revenue growth for the years 2021 and 2022 respectively and consistently served between 200-400 cups of coffee in each ZUS Coffee outlet every day.

Despite the already impressive expansion, the brand has no plans of stopping and aims to have 350 outlets by the end of the year.

This, coupled with the fact that a few months ago, Philippine’s billionaire Frank Lao invested in ZUS Coffee with the aim of introducing the chain to the Philippines market, certainly proves that the brand has yet to reach its peak.

“We will keep going until we become the go-to neighbourhood coffee brand, offering affordable, accessible coffee to every community,” concluded Venon.

Also Read: This M’sian brand has sustained itself with just one fizzy honey beverage for 6 years

Featured Image Credit: ZUS Coffee