NFT-gated community ARC throws annual star-studded event – attendees include Eric Chou and 9GAG’s founder

While many may have came to Singapore last week to watch the Singapore Grand Prix Formula One race, it also coincided with Asian Crypto Week, where key events such as Token2049 took place and gathered the who’s who in the crypto industry.

Many companies have hosted events during the week, and ARC is no exception. Last Friday (September 15), the NFT-gated Web3 private community held an exclusive members-only event at The Clifford Pier within the Fullerton Bay Hotel.

Following its networking party held last year in September, the event was held as a gathering for members as well as those interested in ARC. This time round, many local and foreign personalities as well as celebrities also attended the event.

American investor Jim Rogers and Singaporean billionaire Peter Lim, who is also the father of ARC’s co-founder Kiat Lim, graced the event. The star-studded list of attendees also included several Taiwanese artists, such as singer Eric Chou, actors Darren Wang and Kai Ko, as well as deejay MAI. Ray Chan, co-founder of Hong Kong online platform 9GAG also attended the event.

Taiwanese actor Chen Bolin and Singaporean socialite and entrepreneur Arissa Cheo were also spotted at the event, continuing their presence from last year’s gathering, among many other notable attendees.

Growing towards becoming Asia’s first dominant NFT brand

ARC was first founded by Elroy Cheo and Kiat Lim in January 2022, with Singaporean singer JJ Lin joining as a co-founder in July of that year.

ARC is a curated members-only community accessed via its membership NFTs and brings a diverse collective of Web3 and Web2 members to share ideas, resources and networks.

In an interview with Vulcan Post last year, co-founder Elroy shared that ARC members also “get access to exclusive events and experiences, as well as offline locations such as partner merchants or establishments owned by other members.”

ARC has secured partnerships with industry giants like Millennium Hotels and Resorts, Zouk Group, 33Club and new partners being progressively announced.

ARC’s membership extends beyond Singapore, encompassing individuals like Patrick Lee, co-founder and founding CEO of Rotten Tomatoes, Wesley Ng, co-founder and CEO of Casetify, and Bai Long, creative director of Wukong Holdings. Currently, membership applications are live and those interested can apply either through existing members’ referrals or through their website.

Featured Image Credit: JJ Lin/ARC Community Instagram

Also Read: Token2049: Bitmex co-founder Arthur Hayes predicts biggest crypto bull market in early 2024

12 interesting M’sian plant-based brands we spotted at this local vegan & vegetarian fest

On September 8 to 10, 2023, an event by the name of VEG FEST was hosted in Paradigm Mall, PJ. It was the third edition of such an event, with the two previous renditions garnering a cumulative turnout of 30,000 visitors.

Organised by VEG-HUB, a local vegan, vegetarian, and plant-based delivery platform previously known as Zesty Clickz, the event hosted close to 70 brands.

We were able to visit on the last day of the weekender event. Here were some of the interesting brands we noticed there.

1. Meamo Foods

With a factory in Rawang, Meamo Foods was one of the sponsors of the event. The brand creates plant-based meat and fish, particularly as canned foods.

Currently, it has three kinds of plant-based tuna cans available—Vegan Mayo, Spicy Vegan Mayo, and Tomato & Herbs. As for the plant-based meats, there are two options, the Tomato Bolognese and Spicy Tomato Bolognese.

Having sampled the tuna at the event, I can attest that it was delicious and tasted like the real thing. The products are available online on Lazada.

2. Thips

A brand by Metier, which is the company behind pea milk brand Snappea, Thips are tempeh chips that come in a variety of flavours, such as sea salt, spicy chilli, and seaweed.

Tempeh is an Indonesian food made from fermented soybeans through controlled fermentation. It’s regarded as a superfood that’s rich in plant-based protein and prebiotics, making them healthy for the gut.

Beyond that, the brand also has two flavours of sweet potato chips—original and BBQ. We got to try both, with the normal being mild and fragrant, while the BBQ packed a strong, flavourful punch.

The products are available online as well as in stores such as AEON, Village Grocer, 7-Eleven, myNEWS, and more.

3. Eesoy

With two stores (one in Kota Kemuning, one in Publika), Eesoy is all about soy products. Its menu features your usual soy milk and taufufa, as well as yoghurt and coffee drinks that incorporate soy.

According to its Instagram bio, the business has participated in over 70 pop-ups in Klang Valley, including the VEG FEST one.

4. VECO Burger

Offering vegan burgers using plant-based patties, VECO Burger has three outlets—one in Centrepoint Bandar Utama, one in Bug’s Paradise Farm (Puchong), and one in Kota Kemuning.

Beyond its burgers, VECO Burger also sells a range of vegan mayo. Flavours include Original, Roasted Sesame, Korean Sweet & Spicy, and Tom Yum.

Trying the Roasted Sesame flavour at VEG FEST, I was reminded of the flavours of Kewpie’s roasted sesame dressing, which uses egg and thus is not vegan. Instead of the usual egg, VECO Burger uses oat milk as a substitute.

The vegan mayo products can be purchased online via BMS Organics.

5. In The Pink Co.

In The Pink Co. is a relatively new business, based on our conversations with the co-founder of the brand at VEG FEST. It sells plant milk concentrates, which can be mixed with water to create plant milk.

Compared to your usual plant-based milks, these concentrates are easier to store and are more shelf-stable. One jar of the concentrate equals five cartons of milk. Finished jars can be returned to the business to encourage sustainability.

Three varieties of milk concentrates are available, which are Almond, Cashew, and Hazelnut.

6. SALA

Tex-Mex food, but make it vegan—that’s what SALA does. The six-year-old business has an outlet in Desa Sri Hartamas.

Tex-Mex, which refers to Texan Mexican food, is characterised by its use of cheese and meats, which is why vegan versions of the cuisine may be harder to find, not just in Malaysia but also abroad.

The founder, Fauzi Hussein, became vegan 11 years ago, and has shared about his own journey as a Malay vegan, which led him to start SALA.

7. AyoMayo

Offering a variety of vegan and Muslim-friendly spreads, AyoMayo was founded in May 2020 with the intention to support a colleague who was struggling to cover his rental expenses and sustain his livelihood.

The brand offers six flavours of almond butter—Pure, Dark Chocolate, Classic, Genmaicha, Matcha, and Espresso. Trying some of the flavours at the event, they were rich with a light sweetness, making them suitable to eat with bread, oatmeal, yoghurt, and more.

8. PurelyB

A business Vulcan Post has featured in the past (first in 2015, then in 2021), PurelyB started out as a unmonetised content platform, then a one-stop health portal, before eventually developing its own products.

One of its signature products, the Tiger Milk Mushroom, uses a unique ingredient only found in tropical rainforests such as Malaysia.

As such, founder and CEO Jesrina told us at VEG FEST that the brand now works with organisations abroad who are interested in the mushroom as well as PurelyB’s products.

Trying a sachet of the Tiger Milk Mushroom powder at the event, it was surprisingly delicious. Taste aside, it’s also supposed to help with lung healthy, immunity, and allergies.

9. Mushroom Lah

Coming in lovely pink packets, Mushroom Lah sells ready-to-eat travel packs of mushroom rendang, which can be purchased online too.

The business is run by a vegan couple, founder Aisya Jabaruddin and her husband, Akmal Hakim Ali. Aisya had been making her own plant-based rendang since 2016 with no intentions of selling it, but ended up starting Mushroom Lah during the pandemic, Options reported.

10. LinoGreen

Coming all the way from Ipoh, LinoGreen is a health brand focusing on biocosmetics and nutraceuticals.

The founder, Steven Kuek, was diagnosed with kidney disease caused by an autoimmune disorder called Systemic Lupus Erythematosus (SLE) when he was 17. At the age of 39, he underwent his first kidney transplant after a year of dialysis.

In 2016, however, he underwent an angioplasty procedure in 2016, which saw his kidney function fail immediately. Eventually, he decided to go for a second kidney transplant in 2017.

Because of his background, he now spends his time to study and research the causes of health conditions. As such, LinoGreen carries a range of health issue-specific products. Its LinoGreen® Sacha Inchi Oil are a vegan health supplement alternative to usual Omega-3 fish oil pills.

11. MamaVege

Established in 2014, Mama Vege started out as a vegetarian steamboat restaurant in Penang, but has since started selling its own products, such as self-heating steamboat packets, sauces, and most recently, an instant noodle take on Sarawak kampua mee.

Trying the Sarawak Mi Kampua at VEG FEST, it was absolutely delicious, with a QQ texture. The noodles do use eggs, so it’s vegetarian but not vegan. The brand also does a few vegan products, though, namely steamboat pastes.

12. CocoKami

At first glance, CocoKami appears to be a new brand, but it actually appears to be an extension of WellB, a company that does all things coconut, from supplying the raw fruit to doing food innovation on coconuts.

The CocoKami brand’s Fried Coconut Strips made for a really interesting snack. At VEG FEST, there were also tart-like coconut crumbles and puddings available. The products are available on WellB’s online shop.

-//-

Of course, these are just a dozen of the many businesses featured at VEG FEST. It was awesome to see plant-based foods, especially ones from local businesses, get such love and support from the community.

Since plant-based foods can be enjoyed by everyone, the event also brought in a diverse range of visitors, showcasing Malaysia’s multicultural and multiethnic landscape.

It showed the potential reception to a plant-based future as well, which seems to be hopeful and exciting, if what we saw here was of any indication.

VEG FEST 3.0 is VEG-HUB’s third such event in a year, and it seems to only be continuing to gain traction. We look forward to seeing more events that shine a light on fellow innovative local movers and shakers in the vegan and vegetarian industry.

Also Read: Here’s how M’sian SMEs can get 1,000GB of high-speed data at RM50/month to boost their biz

Are the fees fair? Grab’s timestamp feature expose truth behind its delivery fee discrepancies

A few months ago, a user of Grab’s monthly subscription plan, GrabUnlimited, shared that he was charged a higher delivery fee as opposed to regular users of the app.

Grab’s response to this, however, was that these discrepancies are actually not a result of unfair charging practices. In reality, these price fluctuations are based on factors such as the time a user clicks into the Food tile on the Grab app.

Please be assured that we do not price discriminate amongst users. Prices are always shown based on real-time market conditions, which are logged at the start of the order. There are times when the market conditions can change drastically within a short frame of time, which can result in two users seeing different fees for the same order.

– GrabFood Singapore

Grab now logs the time you start your food orders

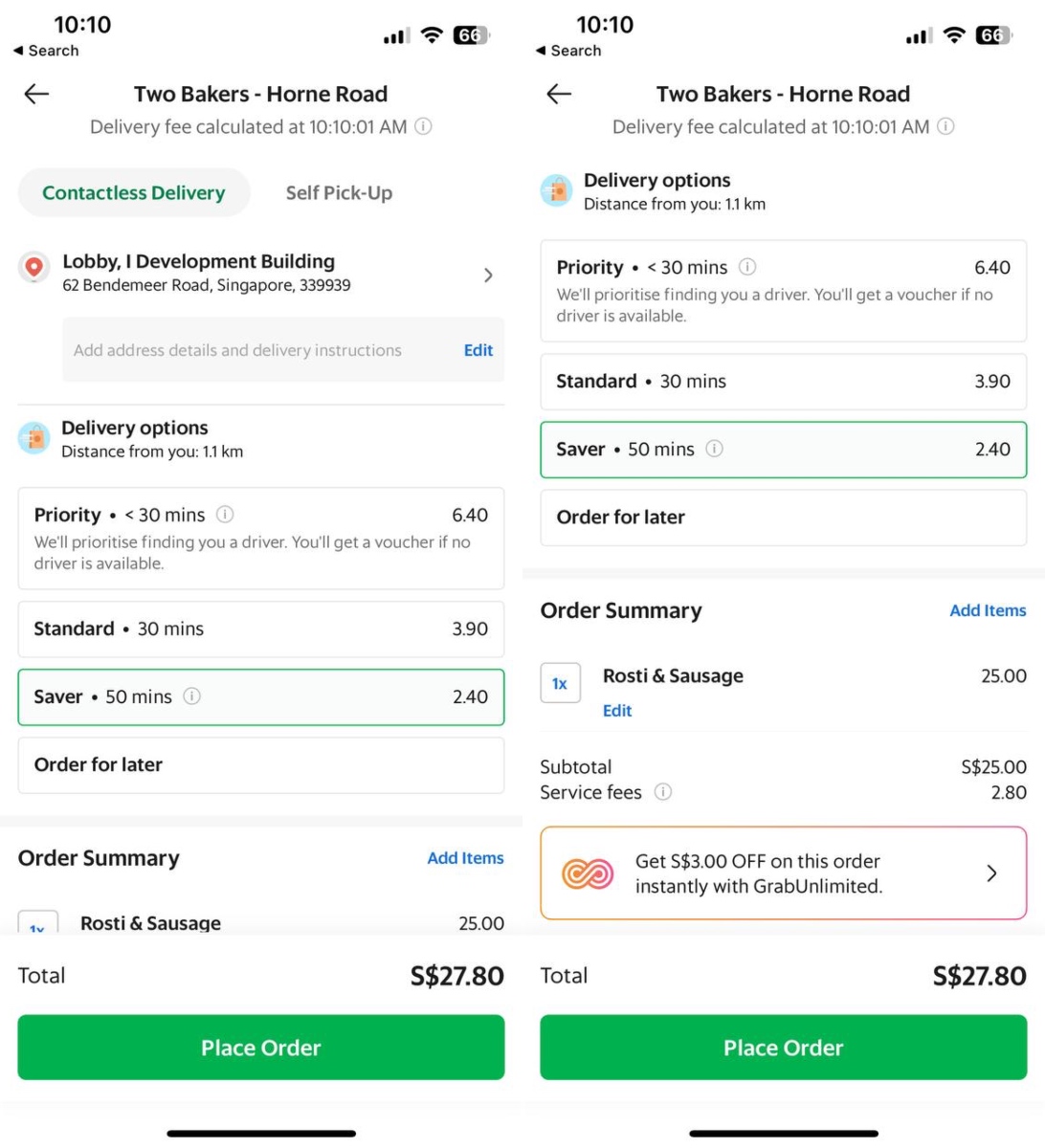

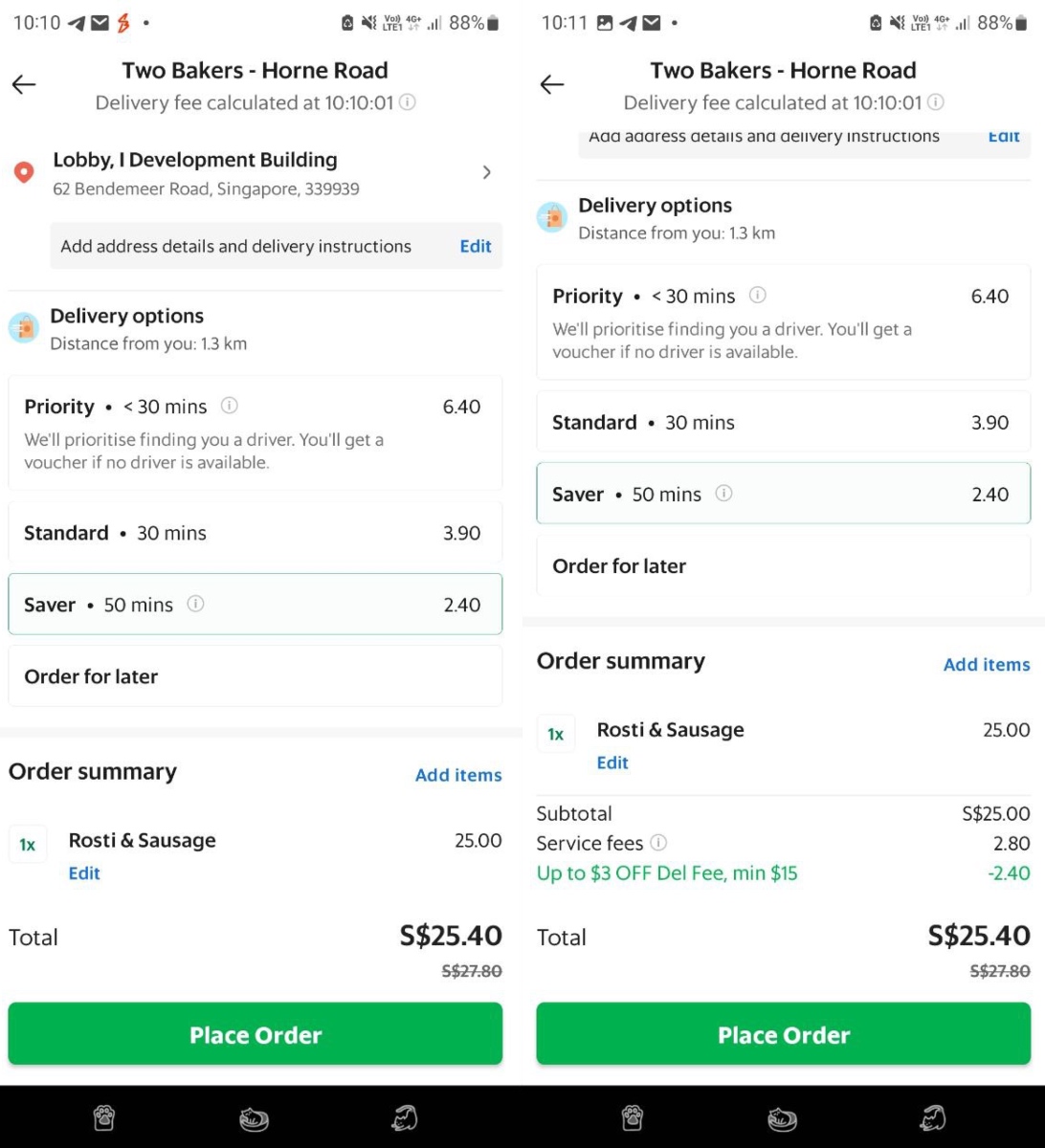

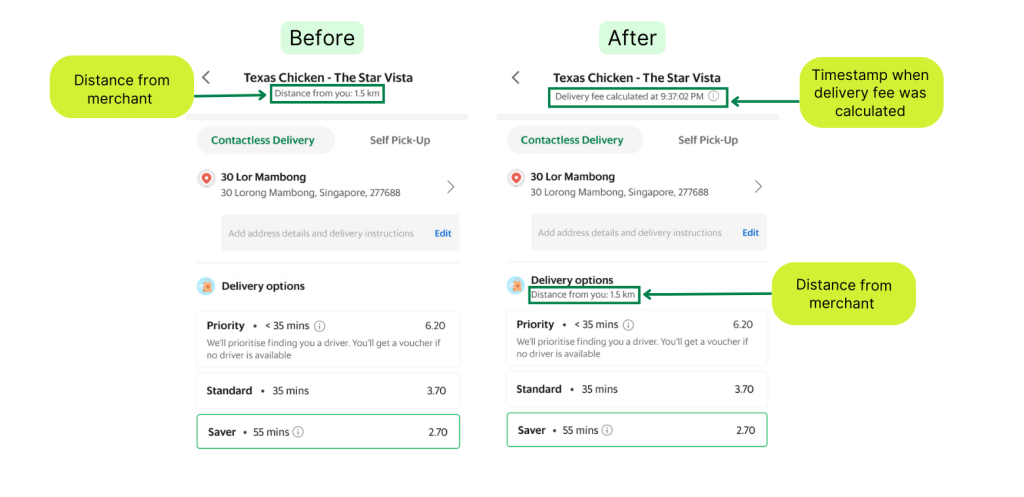

In order to address such concerns and improve transparency, Grab has rolled out a new product update that comes with a timestamp feature, which aims to provide more clarity to users as to when their delivery fee is calculated.

As users tap into the Food tile to browse their food options, the timestamp logs the start time of their order placement. This timestamp becomes crucial in determining the fees that users will be charged for their delivery.

Upon tapping the Food tile, the app holds the fee for a period of time. This ensures users have ample time to browse and place their orders at the initial fee shown to them, preventing constant fluctuations to ensure a better overall user experience.

At the crux of it, even minute differences can lead to different delivery fees. As such, if two users enter the Food tile at slightly different start times, their delivery fees may also differ accordingly.

That said, users who enter the Food tile at the exact same time can expect to be charged the same fee.

Comparing fees: GrabUnlimited vs non-GrabUnlimited

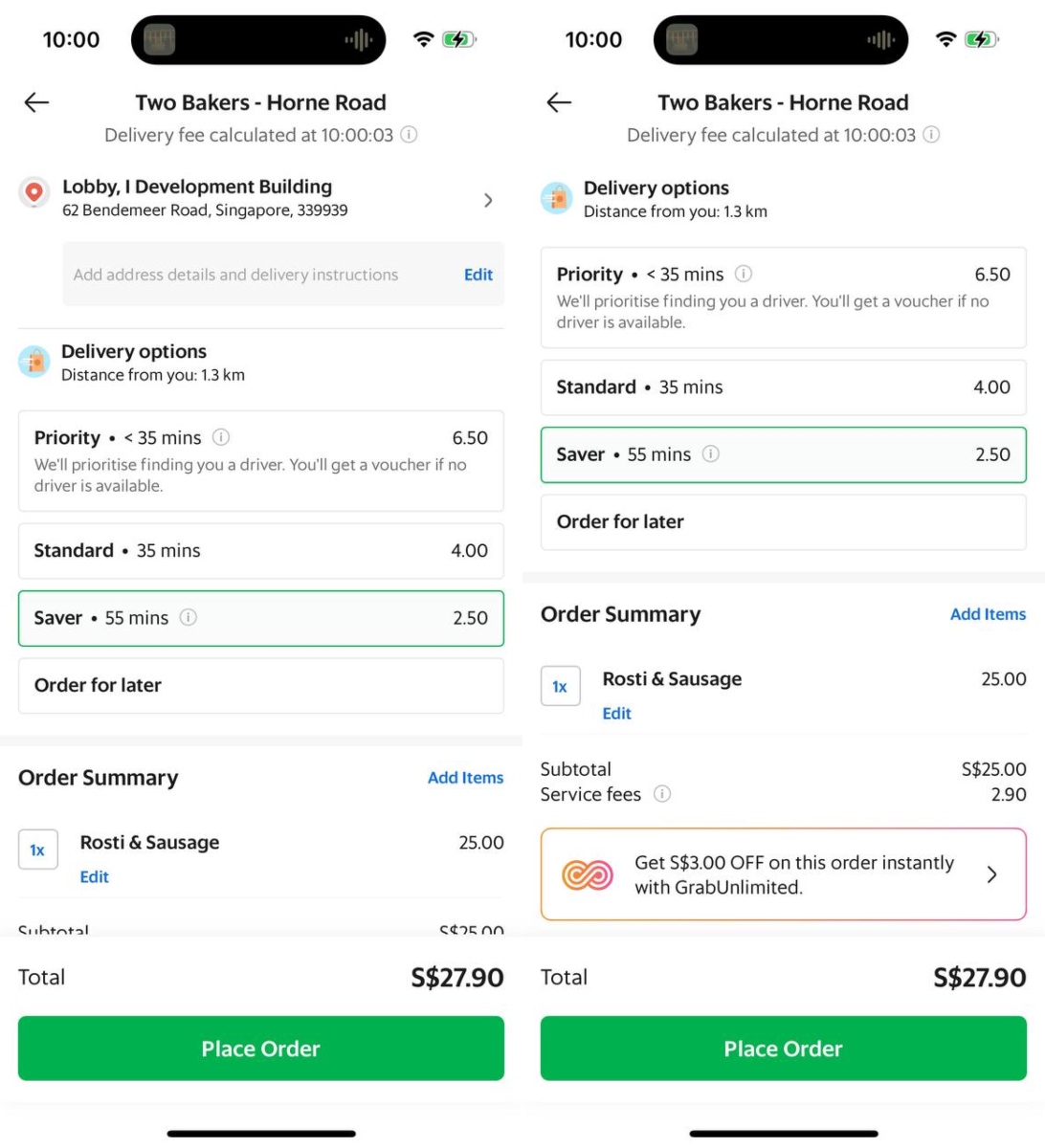

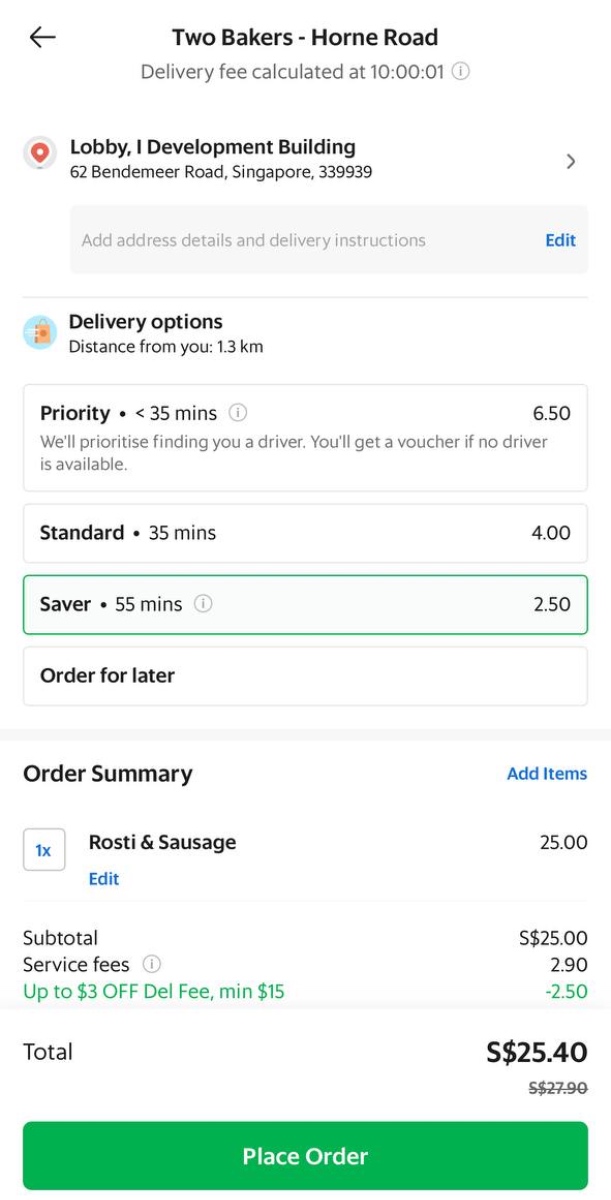

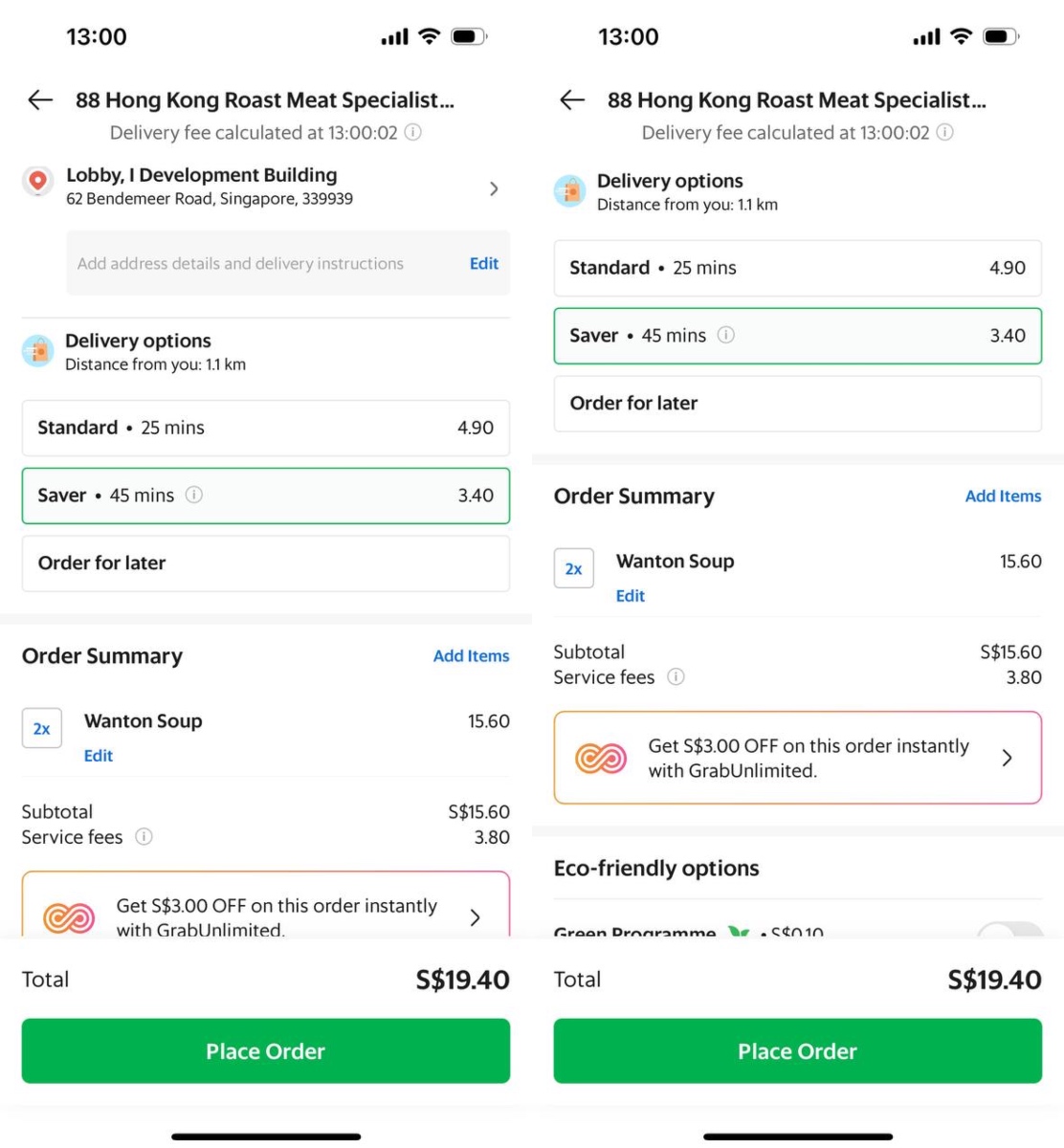

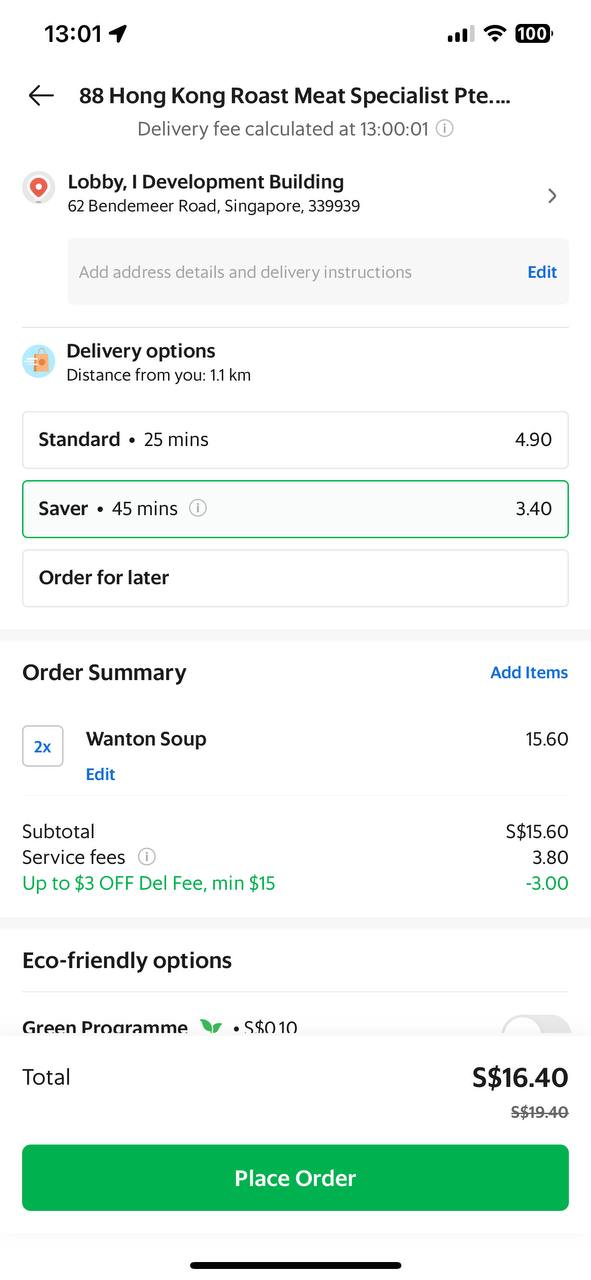

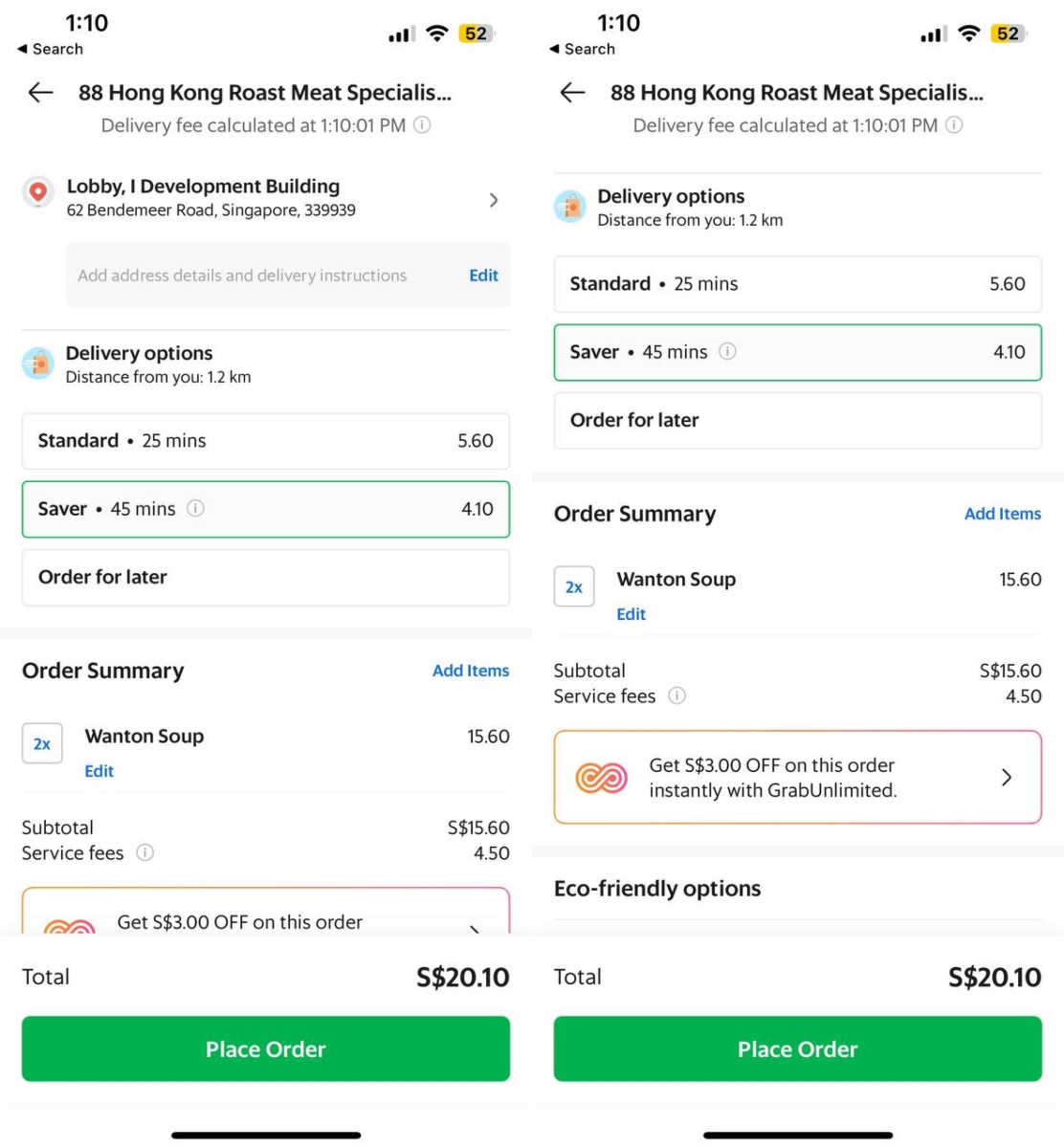

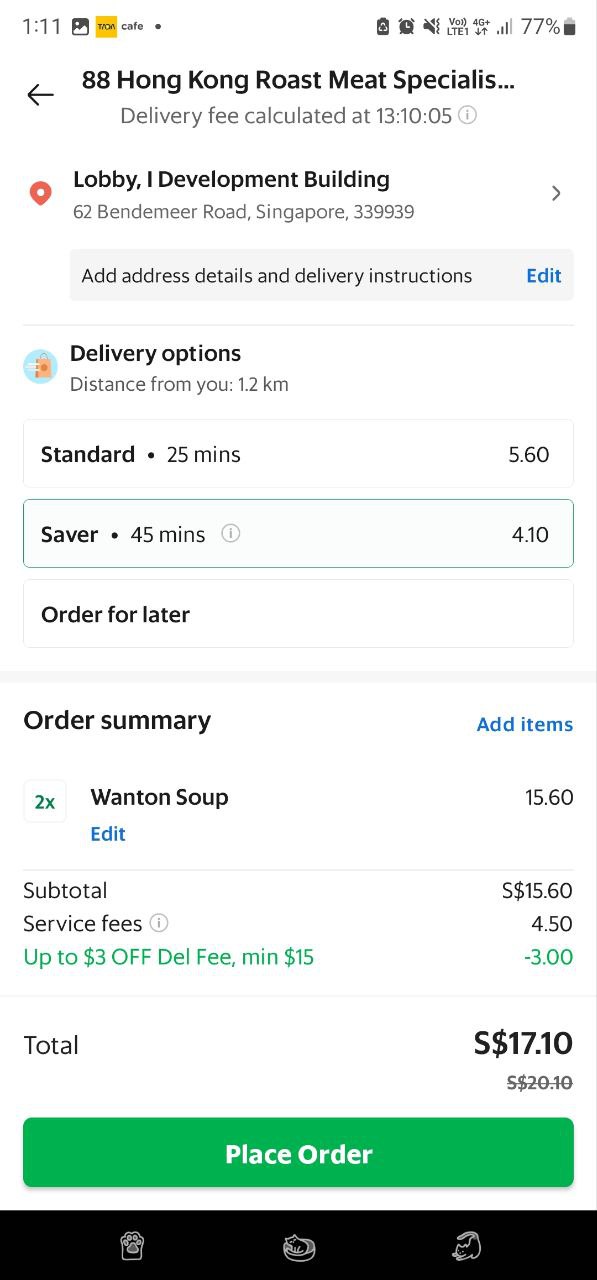

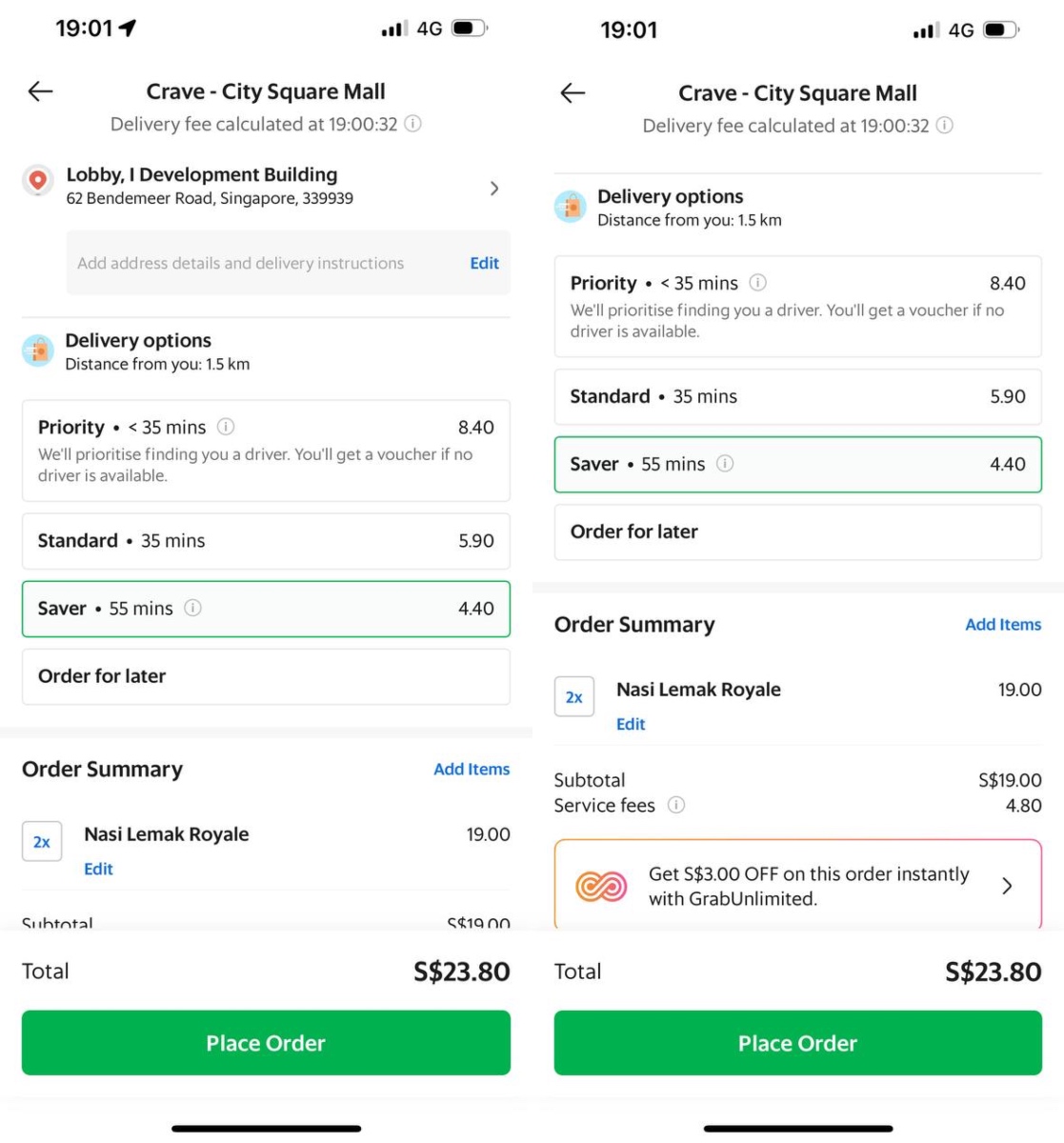

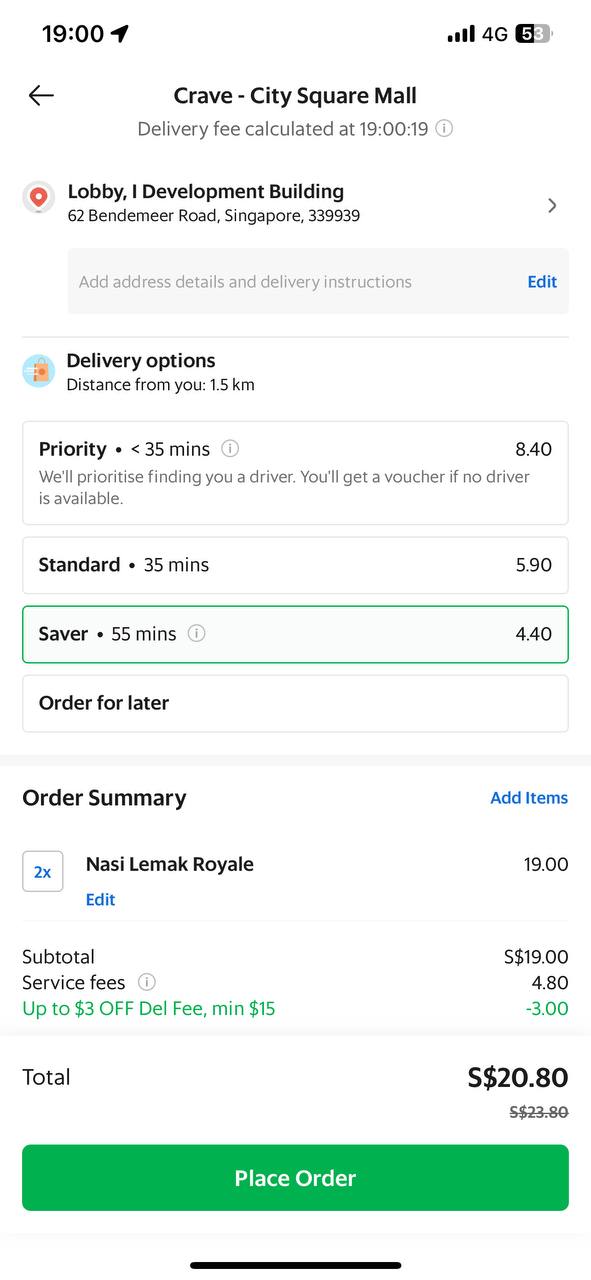

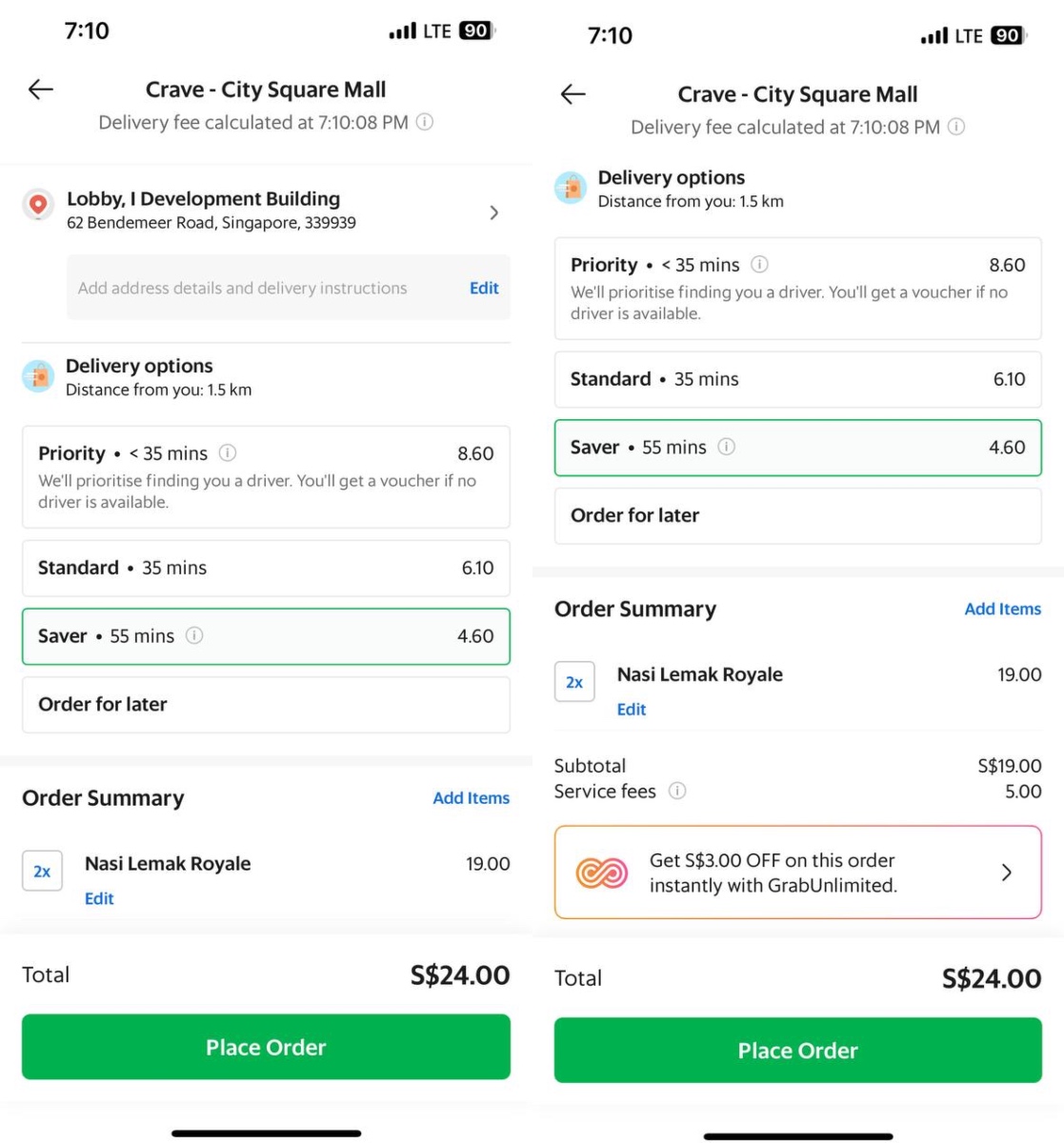

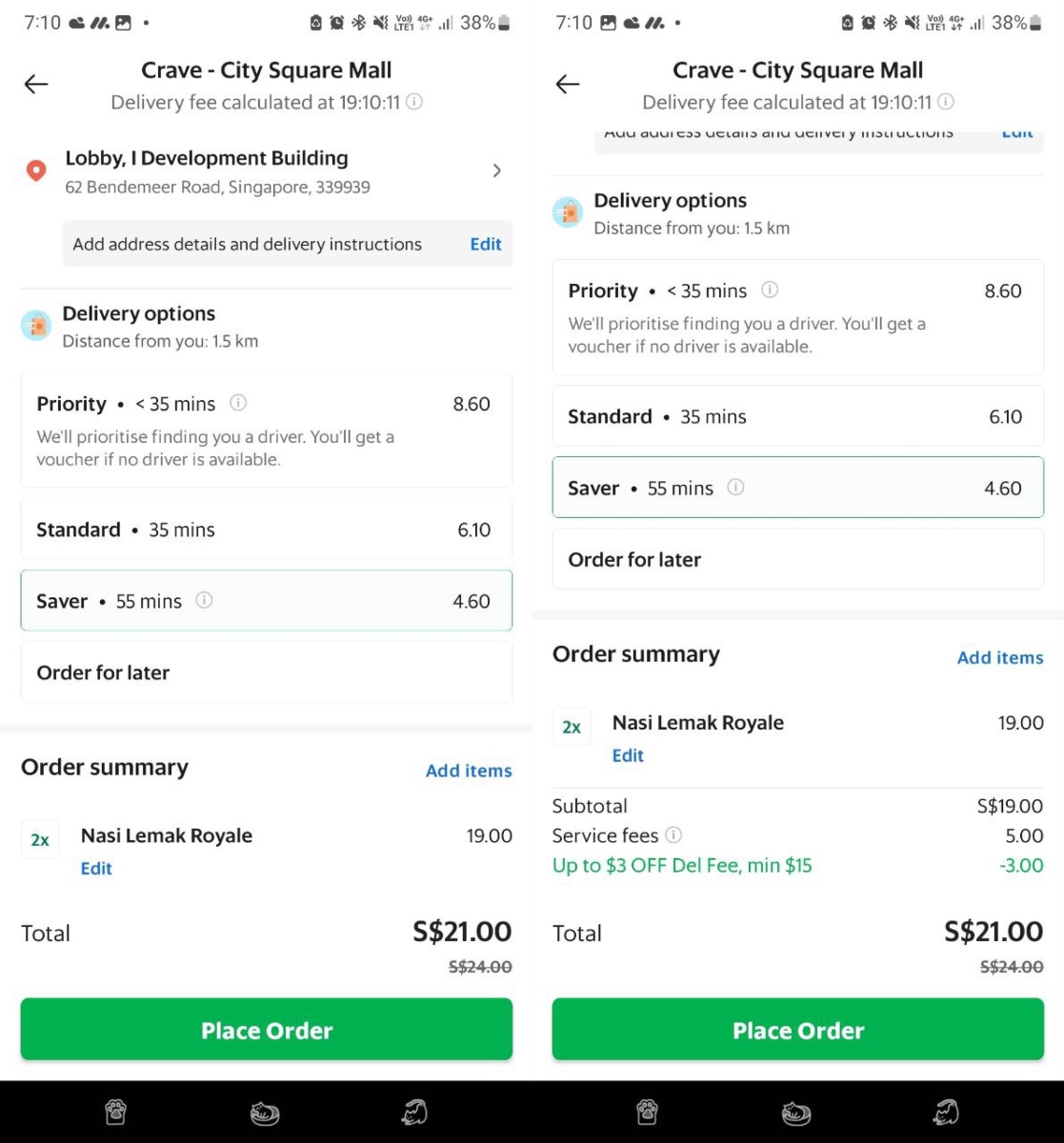

With the rollout of this new timestamp feature, the Vulcan Post team decided to conduct a test to compare delivery fee outcomes between GrabUnlimited and non-GrabUnlimited subscribers.

We ordered food from the same restaurant using two devices – one with GrabUnlimited and the other without – to check if there were any pricing differences between them. This test was repeated 10 minutes later to explore the impact of timing on delivery fees.

To provide a comprehensive overview of GrabFood’s delivery pricing, this experiment covered three timings on a weekday during breakfast, lunch and dinner hours. Each test also used Grab’s Saver option for the lowest delivery fee, and it’s worth noting that GrabUnlimited users receive up to S$3 off delivery fees as part of their S$5.99 monthly plan.

Breakfast

| Timing | Delivery fee (Non-GrabUnlimited subscriber) | Delivery fee (GrabUnlimited subscriber, before discount) | Difference in delivery fees |

| 10:00am | $2.50 | $2.50 | 0 |

| 10:10am | $2.40 | $2.40 | 0 |

Lunch

| Timing | Delivery fee (Non-GrabUnlimited subscriber) | Delivery fee (GrabUnlimited subscriber, before discount) | Difference in delivery fees |

| 1:00pm | $3.40 | $3.40 | 0 |

| 1:10pm | $4.10 | $4.10 | 0 |

Dinner

| Timing | Delivery fee (Non-GrabUnlimited subscriber) | Delivery fee (GrabUnlimited subscriber, before discount) | Difference in delivery fees |

| 7:00pm | $4.40 | $4.40 | 0 |

| 7:10pm | $4.60 | $4.60 | 0 |

The final verdict

Based on these test results, it’s clear to see that differences in delivery fees are unrelated to one’s subscription status as a GrabUnlimited subscriber.

Throughout various timings of the test, there were no price discrepancies found between the two devices, provided that we clicked into Grab’s Food tile simultaneously. Notably, disparities in pricing emerged only after a 10-minute interval, which proves that the key driver of the fee differences is based on the time at which a user enters the Food tile.

With Grab’s new timestamp feature, users can now better understand when their delivery fees are calculated.

This article was written in collaboration with Grab Singapore.

Featured Image Credit: GrabFood / Screenshots from Theng Wei Gan via Facebook

Also Read: Time is money: Which ride-hailing app in S’pore will win the test in terms of price and speed?

She used to travel 2+ hrs to get a frappe, now others do the same for her drinks in Bintulu

I’ve observed a lot of home-based businesses in Malaysia, but what drew me to Bintulu Coffeescape in Sarawak was the fact that it was one of five local brands that won at the Sarawak Shell LiveWIRE programme back in 2021. Aside from the title of “winner”, the brand also received a grant of RM15,000.

I found this to be a pretty impressive feat considering that the coffee industry is quite saturated. What could Bintulu Coffeescape have been doing that helped it get noticed?

So I reached out to its founder, Nisha Hasbi, to learn more about this Bintulu-based beverage business.

A blend of ideas and support

Speaking to Vulcan Post, Nisha shared that the idea to start Bintulu Coffeescape in 2016 actually came from her sister, Hidayah.

At the time, Nisha had been helping her parents run a restaurant for two years. But unfortunately, she shared that it wasn’t making profits while the debts and commitments were piling up.

So Hidayah suggested that Nisha start a pop-up stall in front of their house selling ice-blended drinks. The reason was that Nisha herself was a lover of Starbuck’s frappuccinos and had experience making them with her own twist.

In fact, Nisha was such a fan of Starbucks that she used to travel more than two hours to Miri just to fix her craving. During an interview with the New Sarawak Tribune, she mentioned that they didn’t have Starbucks in Bintulu at the time, so she would make the drive every month.

“I had my doubts but she (Hidayah) convinced me to start from zero and slowly sell between friends at first,” Nisha told Vulcan Post.

The brand started out by offering about 10 beverages, with Nisha reporting to the New Sarawak Tribune that they initially sold only 10 to 20 cups per day. The bulk of them was through online orders like social media and WhatsApp.

From there, the business began growing with the help of her family.

Nisha was at the helm, but every member of the Hasbi family helped out as well. She shared with Vulcan Post that even her youngest sister would assist with orders after her school ended.

Her parents served as mentors and would occasionally provide moral and physical support. “Every business decision I make, I always ask for them to review,” she elaborated. “They never interfere and always have my back when I need them.”

“They are the true pillar strengths of Bintulu Coffeescape and I can’t manage without them,” she confided.

As for Hidayah, she was not present all the time as she was still studying for her diploma and later, degree. But she helped the business in her own way as well. Nisha shared that Hidayah used to sell some of the brand’s drinks on campus while she was still a student.

Constantly brewing ideas

During Nisha’s interview with the New Sarawak Tribune in March 2022, Bintulu Coffeescape had about more than 80 items on the menu. This included offerings like frappes, milk tea, and yoghurt drinks priced from RM7.

Fast forward to August of this year, its menu has expanded to more than 130 drinks. According to Nisha, this includes seasonal beverages such as “PUDDIN” (caramel milk pudding) drink and “TAPAI”, its Gawai special offering.

“We find that most customers follow trends, and as a business, keeping updated on what’s new and trendy is good,” Nisha stated.

As such, she explained that Bintulu Coffeescape’s new menu items are not really planned. Instead, they usually happen when inspiration strikes.

Besides beverages, the brand also collaborates with fellow women entrepreneurs to retail other offerings. For example, it has partnered with local SMEs like Mariyani’s Recipe, The Sugarpiece, and tisoudelights to serve a variety of food offerings.

Another growth aspect is that the brand has officially moved away from being a home-based business and is now located at TheSpring Shopping Mall in Bintulu.

Speaking to Vulcan Post, Nisha shared that the move happened in November 2022. The shopping mall’s management approached Bintulu Coffeescape to join their Christmas event in December.

And as it was well received by customers, the brand went back again for its Chinese New Year event. But eventually, they found that moving the business back and forth between their home and the mall was tiring and time consuming.

“So we decided to stay as there were temporary [booth] slots available in the mall,” Nisha stated.

“Currently, we are operating from TheSpring and plan to do so until the end of 2023. We hope to attract more unique customers by being in one of the biggest malls in Bintulu.”

Buzzed for the future

Since the brand first launched in 2016, Nisha remarked that there has been a shift in the local beverage landscape in Bintulu. The Sarawakian town now houses big names like Tealive, Starbucks, and Chagee.

But she believes that having supportive returning customers helps sustain them, despite the brand being “just small” in the industry.

Sharing her experiences, Nisha explained that they’ve had customers who have relocated to other cities and states coming back to buy from them.

“I came across one customer from Miri that came just to have our drinks twice every month,” she said. This goes to show that brand loyalty could go a long way in driving growth.

As for its future plans, Nisha confided that the goal is to have a good team. She has had a good team, but finds that keeping them can be hard. This is because most of her ex-staff members were students.

Apart from that, Nisha also has bigger dreams for Bintulu Coffeescape. Namely, to expand and gain opportunities with potential business partners, as well as have a “super stable” customer base.

“There have been offers that came along the way, but mostly it benefits them more in terms of the rights of the shares if the business plan is to be set up,” Nisha said. So she declined their offer and decided to stay small and take baby steps in building the brand.

- Learn more about Bintulu Coffeescape here.

- Read articles we’ve written about Malaysian startups here.

Also Read: Turn your idea for a social enterprise into reality by joining this SEEd.Lab programme

Featured Image Credit: Bintulu Coffeescape

Samadhi Retreats’ carnival on Sept 30 will feature 80+ canape options & free-flow beer

[Written in partnership with Samadhi Retreats, but the editorial team had full control over the content.]

Samadhi Retreats’ annual Samadhi Carnival will be making its comeback on September 30, 2023, at Tamarind Springs in Ampang.

Regarded as a scenic food destination serving Indochinese cuisine, Tamarind Springs is a part of Samadhi Retreats’ vast portfolio that encompasses dining and hospitality brands.

From 7PM to 11PM on the day of the carnival, guests can expect to embark on a unique culinary experience, featuring a variety of wines and spirits from around the globe.

According to Natasya Falina, the head of marketing at Samadhi Retreats, the first such carnival happened nine years ago, and it started off as a Wine Fiesta event together with Straits Wine company in Singapore.

“But over the years it has evolved into something that’s more relevant with the current F&B scene with cocktail bar pop-ups and creative food presentations,” she said.

A gourmand’s heaven

Catering to the foodies, the carnival will have over 80 types of canapés from six different award-winning restaurants and retreats by Samadhi.

To go with the hors d’oeuvre, Samadhi Carnival has prepared more than 50 types of wines from around the world. Moreover, there’ll be bottomless Carlsberg beer, Somersby Cider, and Kronenbourg.

Samadhi Carnival has also teamed up with bars such as SOMA and Sanctuary 38, to create cocktails. Additionally, the carnival has exclusive partnerships with other local businesses including ice cream shop Minus 4 Degree, tuak brewer Sunborneo, and fermented tea brand Alocha Komcbucha.

While the food will be the star of the show, there will also be a variety of entertainment offerings. You can enjoy the show of contemporary Apsara dancers, or dance to the DJ’s beats yourself, get your fortune told through tarot reading, visit henna artists, and experience other traditional ethnic entertainment.

What’s included in the ticket

At RM250 per person, the ticket covers unlimited food, as well as the free flow of beer. Tickets also include four wine tastings, two cocktail tastings, and a complimentary ice cream per person.

Those visiting in a party of nine or more or more can get a discount of RM230 per person.

Natasya shared that Samadhi Carnival welcomed 360 guests last year, and plans to up that to 400 guests this year.

“We’re back with more spirits to offer basically,” Natasya said in regard to how the carnival has changed this year.

“In the previous years, we invited two cocktail bars but these were not included in the package. But this year guests will get to try two full-sized cocktails, four glasses of wines (versus three glasses last year) and some really creative ice cream creations from Minus 4 Degree.”

Tickets can be purchased online from now until September 29, 2023.

- Learn more about Samadhi Carnival here.

- Read other articles we’ve written about F&B businesses here.

Also Read: Here’s how M’sian SMEs can get 1,000GB of high-speed data at RM50/month to boost their biz

Featured Image Credit: Samadhi Retreats

“This is just the beginning”: Trust Bank CEO on becoming the world’s fastest-growing digibank

Within 12 months of its launch, Trust Bank has captured a 12 per cent market penetration in Singapore, positioning itself as the world’s fastest-growing digital bank by market share with over 600,000 customers.

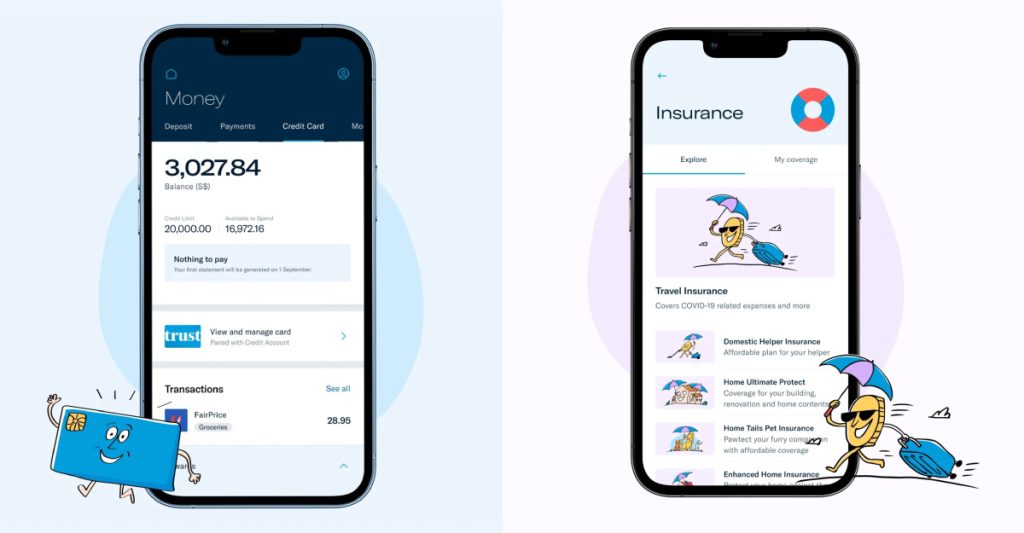

The bank first launched with three financial products — a credit card, savings account, and family personal accident insurance. Within a year, it has doubled its range of products to include a market-first fully supplementary credit card, an instant loan offering, and a financial management tool, Budget Buddies.

But what has propelled the bank to remarkable success in such a short span of time?

The partnership behind Trust Bank

Underpinning Trust Bank’s growth is the partnership behind the bank, which brings together one of the city-state’s leading consumer ecosystems, FairPrice Group, and Singapore’s longest-standing bank, Standard Chartered.

The digital bank is 60 per cent owned by Standard Chartered Bank, with the remaining 40 per cent owned by NTUC Enterprise and FairPrice Group.

The involvement of FairPrice Group in Trust Bank’s journey was of integral importance to its growth in the past year.

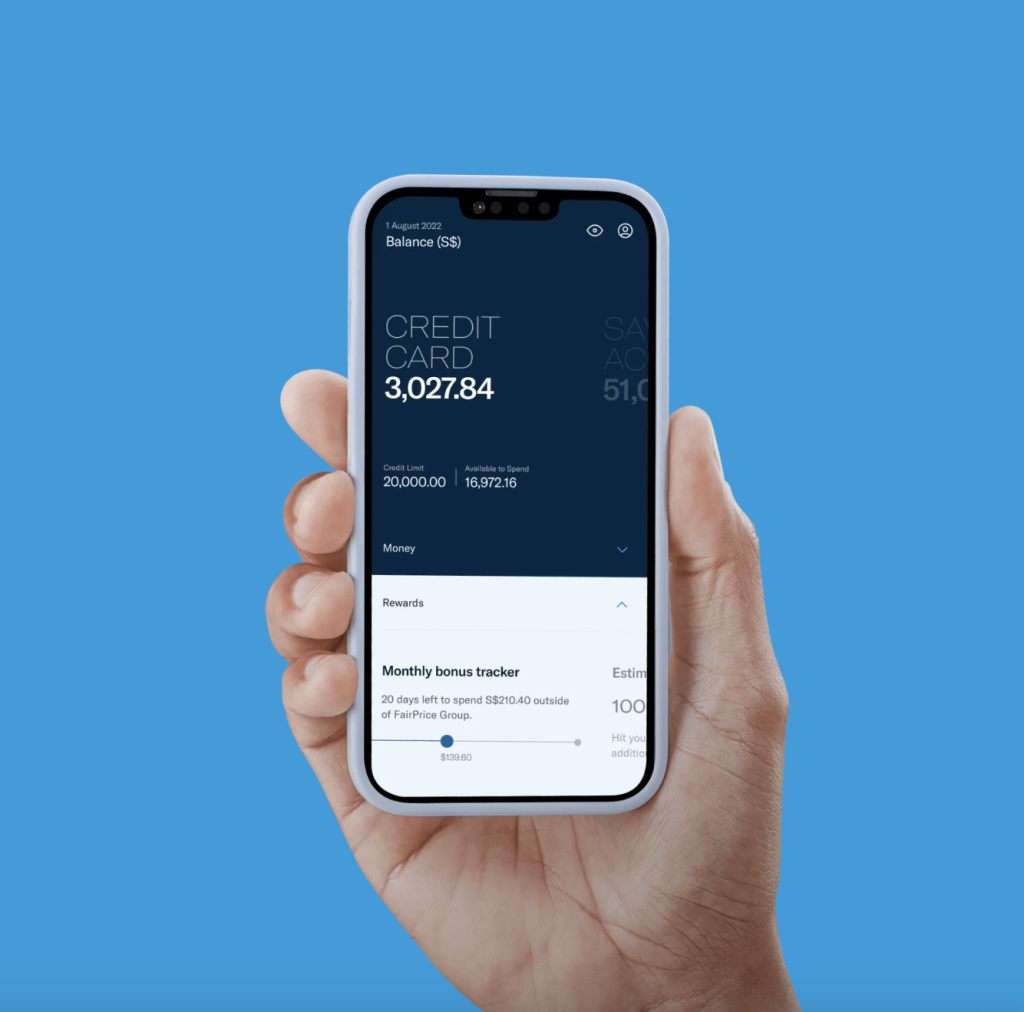

By being embedded in FairPrice Group’s ecosystem and loyalty program, Link Rewards, which serves more than a million customers every day through 570 touchpoints, the bank was able to achieve incredible rates of engagement.

In fact, Dwaipayan Sadhu, the CEO of Trust Bank, shared that its customer acquisition costs are sustainable and are around seven times lesser as compared to the usual acquisition rate in the market.

Moreover, given the fact that a Trust Bank account is the only way to accelerate savings and reward points within the FairPrice ecosystem, more Singaporeans are incentivised to sign up for the digital bank.

Meanwhile, by being backed by Standard Chartered, the digital bank was able to establish credibility easily within the Singaporean market.

Standard Chartered was one of the first international banks to secure a qualifying full bank license in the city-state back in 1999. Prior to Trust Bank, Standard Chartered was behind the launch of Hong Kong-based digital bank, Mox, in 2020.

Trust Bank has created one of the fastest onboarding processes

Beyond the partnership, Dwaipayan shared that the digital bank’s journey over the past year has been “led by a number of market-leading innovations”.

These innovations are focused on improving the user-friendliness of the digital banking platform, with the aim of making it more inclusive to attract a wider range of users across different demographics.

For instance, by leveraging automation, the bank has created one of the fastest onboarding processes globally. In fact, about 90 per cent of its users manage to open an account with the bank within just three minutes, delivering them a fuss-free experience when signing up for an account.

To further ramp up its efforts in ensuring a seamless transition to digital banking for all customers, Trust Bank has taken a significant step by establishing the Trust Experience Centre, a physical touchpoint located at VivoCity, last October.

The centre was established for our customers to get assistance in understanding Trust’s products and how to use them. The centre is staffed by our dedicated Digital Ambassadors who have been trained to guide customers through the Trust App and become more digitally-savvy.

– Dwaipayan Sadhu, CEO, Trust Bank

Customers who are accustomed to cash withdrawals can do so at a Trust ATM located at the Trust Experience Centre and at Standard Chartered ATMs islandwide.

Today, Trust Bank’s customer base consists of a wide range of ages, disproving the fallacy that digital banking is only reserved for the young.

We have a large number of young customers, but we also have many older customers. In fact, more than 10 per cent of our customers are aged 65 and above.

– Dwaipayan Sadhu, CEO, Trust Bank

Aside from providing inclusivity and an easy-to-use platform, Dwaipayan also attributes the bank’s rapid customer growth to its ground-breaking customer referral programme.

Recognising that Singaporeans prefer real-time, everyday rewards over larger, high-value items, the bank provides digital rewards such as FairPrice e-vouchers for each successful referral, which customers can instantly use for their grocery spending.

“As a result, 70 per cent of our customer base comes from referrals by friends and family,” the CEO shared.

The bank aims to achieve profitability by 2025

Looking forward, Dwaipayan views that there still are many opportunities in the Singapore retail market for the bank’s expansion.

While the digital bank has achieved substantial success thus far, Dwaipayan acknowledges that it must continue to innovate new products and services in order to stay competitive in a mature banking landscape like Singapore.

However, it is essential for these new products and services to be built around the needs of Singaporeans, which is why the bank places a strong emphasis on customer feedback.

Customer feedback drives the development of our products and features and every single customer feedback is made transparent to all employees via our internal communications channel. This then feeds into our product development cycle and allows us to tap on every team’s diverse expertise, collectively ideating solutions to contribute to a customer’s user experience.

– Dwaipayan Sadhu, CEO, Trust Bank

Through this feedback loop, the bank is not only able to create new products, but also improve existing features that meet the needs of customers.

The CEO further shared that the bank has several new products on its roadmap, which will be rolled out in the next couple of months. As with all of its products, the upcoming products will be focused on bringing its customers an “experience that is easy, transparent, and rewarding”.

He added that the bank aspires to become Singapore’s fourth-largest retail bank by 2024 and achieve profitability by 2025.

This is just the beginning for us, and we will continue to improve so that our customers benefit from being with Trust and continue to enjoy an innovative and delightful experience.

– Dwaipayan Sadhu, CEO, Trust Bank

Featured Image Credit: Trust Bank

Also Read: Trust Bank launches new insurance service – digibank’s CEO says it aims to break even in 2025

Some insurtech startups failed, but Planner Bee is confident in its “recession-proof” model

Financial planning is a concept that is familiar to all of us, with many financial plans available on offer. However, many people avoid financial planning due to the lack of awareness and clarity, as well as the stigma associated with financial advisors being seen as “hard-sellers”.

Seeing a gap in the fintech industry for an avenue providing independent and neutral financial advice, Cherie Wang co-founded Planner Bee together with her younger brother, Kenneth Wang. Their aim was to employ an omnichannel approach to make financial planning less intimidating.

User feedback has always been a key pillar of Planner Bee, so the siblings spent a year conducting market research and focus sessions to better address the pain points of their users.

They discovered that people struggled to select the right financial products for their needs, with many users lacking a clear understanding of which financial products to choose. Consolidating financial data typically took an average of four hours, accompanied by significant friction.

“When we first ideated the product, we really thought that our target audience would like to also budget their money – look at everything in one place, down to the cent where they would say ‘I’ve spent ‘x’ amount on dining, ‘y’ amount on transportation’ and be more neurotic about it,” said Cherie.

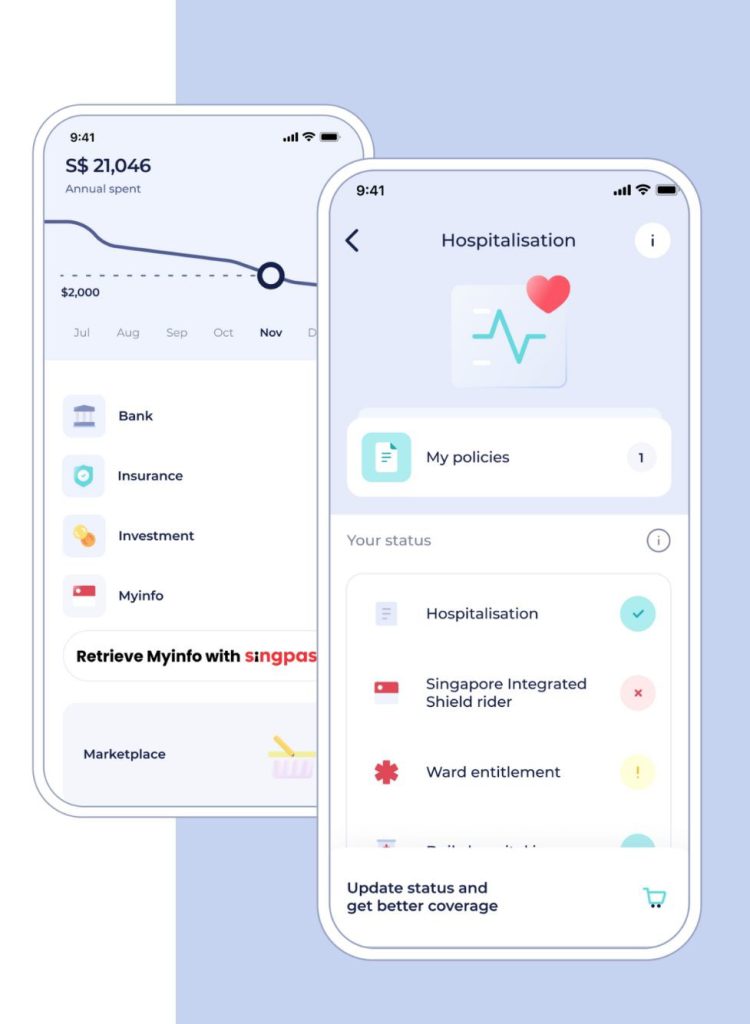

With the data and feedback gathered, Planner Bee was founded in 2019. It subsequently launched a mobile app and website in 2020 with the goal of assisting users in comparing different financial plans and providing advice based on their financial needs.

The mobile app allows users to synchronise their bank, insurance, and investment data into a unified platform, offering them a comprehensive overview of their health and life insurance plans.

Meanwhile, the website serves as a neutral marketplace where users can compare insurance options and seek advice. Additionally, through their blog posts, they educate users on what to consider when purchasing financial products.

They launched Planner Bee during the Circuit Breaker

The COVID-19 pandemic has brought a lot of uncertainty to the global economy, impacting both the operational and fundraising landscape. Consequently, some insurtech startups, such as GoBear, have been forced to cease operations due to insufficient funds to sustain operations.

Despite the high risks and the uncertain nature of the pandemic, Planner Bee’s mobile application and website launched in 2020, coinciding with the Circuit Breaker period.

Cherie observed that more people have become more receptive to seeking financial advice online which encouraged her to invest US$1 million into the launch, which was jointly funded by her family and friends.

Unlike GoBear which focused on travel insurance, Cherie stressed that Planner Bee focuses on a different area of financial planning.

For us, our main focus is on long-term insurance planning, where we help people secure their Life and Health Insurance, Term Insurance [and] Maternity [Plans]. It is a little bit more recession proof, because these are products that people need regardless of the economy.

– Cherie Wang, co-founder, Planner Bee

She added that Planner Bee initially acquired users through the launch of their app, with app development spearheaded by Kenneth, who is an Artificial Intelligence (AI) engineer.

Users were also acquired through their blog posts, which helped to boost their SEO (search engine optimisation) and long-tail marketing efforts. Cherie further leveraged her network, which she had cultivated over her 13 years as a financial advisor.

Catering to different financial needs

While Planner Bee has maintained its main objective of providing a platform offering neutral financial advice, its business operations have evolved to better meet the needs of its audience.

When the duo launched their mobile app and website in July 2020, they initially envisioned the app becoming their primary source of traffic. To their surprise, the website has garnered 10 times more engagement since its launch.

Additionally, Planner Bee monetised its online marketplace in the previous year, allowing users to request personalised comparison quotes upon viewing the online product listings and make online purchases through an independent advisor. This strategy has enabled Planner Bee to achieve a 40 per cent month-on-month growth since 2022.

When asked if they would shift to a paid subscription model, Cherie shared that there are no plans to charge customers any fees. Instead, they generate revenue through referral fees from partnering financial providers.

From the outset, the founders understood that, much like many Asians who are willing to view ads in exchange for privacy, they generally prefer not to subscribe to paid services. They believed that the same behaviour extended to paying for financial advice.

We don’t think that we’re big or strong enough to change that behaviour, [so] we went along with it. We tell our customers that we rank our products according to facts – we’re not biassed towards any insurer [because] we don’t represent them. We get fees for each purchase, and it’s clearly stated when people buy through us. [The price is not] affected by how much they pay us because the data is all ranked by the technology.

– Cherie Wang, co-founder, Planner Bee

Cherie also shared that while Planner Bee initially aimed to cater to a younger audience between the ages of 21 and 35, specifically fresh graduates interested in early financial planning, they have observed that a significant portion of their users falls within the 25 to 45 age range.

Users in this age group tend to have higher average incomes and are more financially literate, with many holding professions such as lawyers, software engineers, bankers, and middle management roles. Consequently, they are more inclined to purchase financial plans and products.

However, this shift in user demographics does not mean they have lost focus on the younger demographic. Educating users remains a key pillar of Planner Bee’s business.

We’ve always insisted that education is the key to awareness. Hence, we produce original content on our blog thrice a week. Our topics are catered mostly to new insurance buyers that are slightly more financially literate through lifestyle topics that help to bring out the importance of financial planning and importance of insurance. 95 per cent of our base are between 21 and 45 [years old], with a very gender neutral split.

– Cherie Wang, co-founder, Planner Bee

More tech advancements ahead

In February last year, Planner Bee added an automated insurance recommendation engine to its mobile app. Currently, Planner Bee compares insurance products from more than 20 insurers for their customers and consolidates data from 43 financial insurers for its users.

With the digitisation of financial services, the convenience of accessing our finances at our fingertips has increased significantly. However, this convenience has also led to a surge in online scams and incidents of user data leaks in recent years.

To safeguard users’ data and privacy, all user data is fully encrypted and stored on Singapore-based cloud services. Access to specific pieces of data is restricted to a need-to-know basis only.

Cherie also emphasised that maintaining relationships with a large number of financial providers is no easy feat. Furthermore, the team has to constantly fine-tune their technology to keep the data presented on their apps and website up-to-date, especially when there are new product and price updates in the financial sector.

She admitted that working with such a large number of providers is never easy. It’s akin to managing a supermarket with a vast array of stock-keeping units (SKUs) to keep track of, and that presents its challenges.

These challenges become even more pronounced when the providers offer a wide variety of products in different shapes and sizes. As a result, they are constantly fine-tuning their technology to adapt to the frequent changes that occur across all these providers.

Whenever there is a product or price update, that trickles down to our quotation team, and accuracy is key when it comes to money. So these changes are actually quite hard to manage even until today, simply because insurers do find it hard to streamline their data to us.

– Cherie Wang, co-founder, Planner Bee

Planner Bee has since made significant strides in automation, with 90 per cent of their systems now automated. This effort is aimed at providing users with timely and accurate quotations and data. Additionally, providers provide the team with advanced notice of new updates, which are embargoed until the specified release date.

While the fintech scene in Singapore is rapidly expanding, the insurtech space has been growing at a slower pace compared to other areas within fintech. However, Cherie noted that the insurance sector is experiencing some real changes.

“A lot more providers are looking to support the insurance [sector] to become faster, reduce costs, compliance, claims and stuff like that, [but] that’s not our expertise,” said Cherie.

Due to their strong understanding of end consumers, they have chosen to address the consumer side of the problem, which is that purchasing insurance and dealing with claims can be a daunting process for many. She acknowledged there are not many businesses providing these services, highlighting an existing gap that has yet to be filled.

To date, Planner Bee offers S$1.5 billion of insurance offerings for their mobile app users, and it continues to strive for an enhanced user experience.

Despite the gradual growth of the insurtech industry, Planner Bee remains committed to advancing its technology and offerings to users. In the coming months, users can anticipate an improved version of their mobile app, which will enable them to access data from their Central Provident Fund (CPF), including House Development Board (HDB) loans and CPF balances.

The company is also working on allowing users to synchronise their Singpass data to streamline their personal data. Furthermore, users can also expect a redesigned app by next month based on the feedback received.

Featured Image Credit: Planner Bee

Also Read: S’pore sneaker startup Novelship raises US$9.5M – looks to enter female market as users double